Get the free Loan Product Advisor (LPA) Feedback Message Updates

Get, Create, Make and Sign loan product advisor lpa

Editing loan product advisor lpa online

Uncompromising security for your PDF editing and eSignature needs

How to fill out loan product advisor lpa

How to fill out loan product advisor lpa

Who needs loan product advisor lpa?

Loan Product Advisor (LPA) Form - How-to Guide

Understanding the Loan Product Advisor (LPA) Form

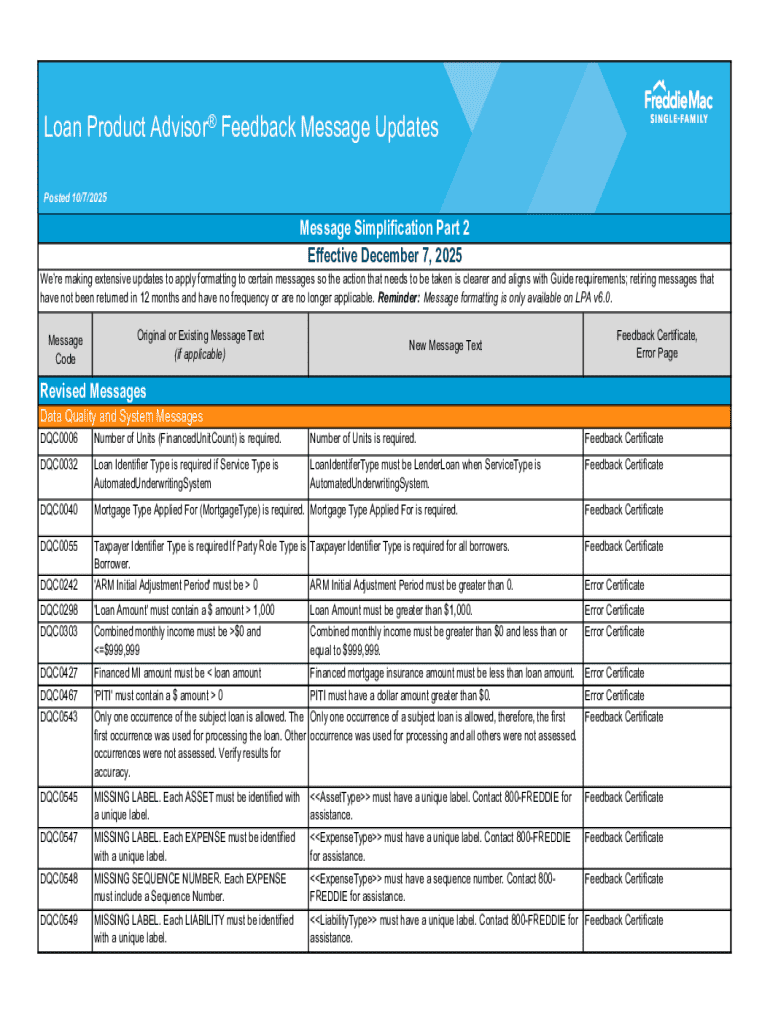

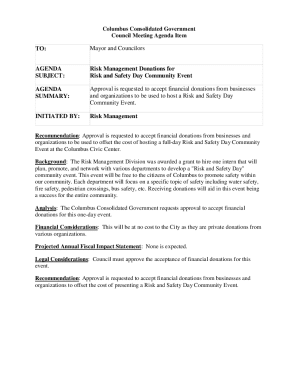

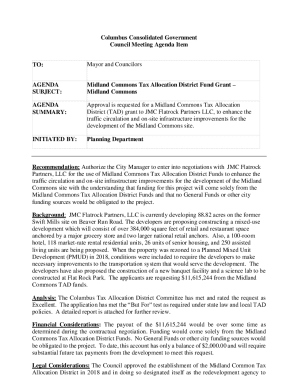

The Loan Product Advisor (LPA) Form is a pivotal document within the mortgage approval framework, utilized by lenders to assess loan applications efficiently. This form aids financial institutions in making informed decisions by analyzing the creditworthiness of the borrower and the eligibility of the loan. Additionally, it provides insight into the risk levels associated with various loan products, ensuring that lenders have the necessary information before committing to a loan.

The importance of the LPA in the loan process cannot be overstated; it serves as a comprehensive guide for both lenders and borrowers by streamlining communication and expectations. Ensuring that all required fields are completed correctly can significantly enhance the likelihood of gaining approval. Key features of the LPA form include its standardized format, which facilitates easier data sharing and integration with other financial systems.

Step-by-step guide to completing the LPA form

Completing the Loan Product Advisor (LPA) Form requires careful attention to detail. Here's a structured approach to ensure efficiency and accuracy.

Pre-submission requirements

Before filling out the LPA form, it's crucial to gather all necessary documentation. This typically includes pay stubs, proof of employment, tax returns, and details about existing loans. Information needed from borrowers encompasses personal identification, income statements, and property information necessary for the loan application.

Filling out the LPA form

When filling out the form, you’ll encounter multiple sections designed to capture essential borrower information. Key sections to focus on include:

To ensure accurate data entry, double-check each section and confirm the information aligns with official documentation.

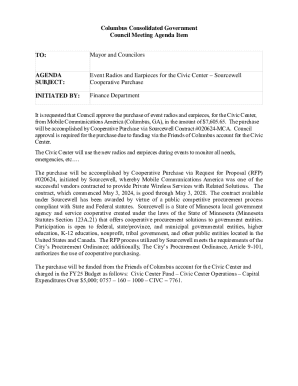

Submitting the LPA form

After filling out the form, the submission process involves reviewing the completed document, ensuring all fields are filled, and that there are no typos. Common submission mistakes include overlooking certain signature fields or providing inaccurate loan information. A meticulous review can help avoid common pitfalls.

Editing and managing the LPA form

After submission, it’s essential to manage the LPA form effectively. Utilizing tools like pdfFiller can greatly enhance the ease of editing your document, allowing you to update information as required by market changes or borrower feedback.

Utilizing pdfFiller’s editing tools

pdfFiller provides versatile options for editing PDF documents effortlessly. Users can add annotations, comments, or updates directly within the form, ensuring all necessary changes can be made without starting from scratch. With easy PDF editing capabilities, communication with other team members becomes straightforward, improving collaborative efforts.

Saving and storing the LPA form

Once the LPA form is edited, it’s crucial to save and store it efficiently. Organizing completed forms in a designated folder helps maintain quick access for future reference. Implementing version control best practices ensures that the most recent updates are kept while older versions are archived to maintain a clear record.

E-signing the LPA form

E-signing the LPA form has revolutionized how documents are executed in the loan process, providing a seamless and efficient signing experience. At pdfFiller, the advantages of e-signature include reduced processing times and improved document security.

Step-by-step e-signing process

To e-sign the LPA form, follow these simple steps:

Additionally, it’s crucial to ensure compliance with e-signature laws, which are established to guarantee the legality and recognition of e-signatures throughout the process.

Collaborative features with pdfFiller

pdfFiller's platform emphasizes collaboration, especially when managing the LPA form. Teams can easily share forms, allowing for collective input and faster approvals. Sharing features enable secure distribution of the LPA form to necessary stakeholders.

Using pdfFiller for team reviews and approvals

By using pdfFiller for team reviews, users can provide feedback on proposed changes in real-time. This functionality allows for a more streamlined approval process, enhancing team communication and decision-making efficiency. Role management features also ensure that team members have appropriate access, enhancing security while enabling necessary collaboration on loan products.

Automating your LPA submission process

Integrating automation into your LPA submission process can deliver significant efficiencies. Tools like pdfFiller offer automation capabilities that lessen administrative overhead and increase accuracy.

Leveraging pdfFiller's automation tools

By leveraging automation tools provided by pdfFiller, teams can streamline the LPA submission process, ensuring roles are clearly defined and deadlines are met. Automated workflows can minimize manual data entry errors while providing real-time updates on the submission status.

Case studies: success stories of automation

Many organizations have experienced remarkable success through automation in their loan processes. By transitioning to a digital approach, firms have reported enhanced operational efficiency, reduced turnaround times, and improved borrower satisfaction. These case studies serve as powerful testimonials to the transformative impact of integrating automation into the LPA processing workflow.

Troubleshooting common issues with the LPA form

Navigating common issues when completing the LPA form can simplify the entire loan application experience. Identifying potential errors, whether related to incorrect data entry or missing documentation, is essential for smooth processing.

FAQ section: addressing user concerns

It’s normal for users to have questions or concerns regarding the LPA form. Common queries may include inquiries about eligibility requirements or specific loan eligibility criteria. Establishing an FAQ section can be a valuable resource to clarify these issues, while also encouraging users to seek professional help when necessary.

Best practices for using the Loan Product Advisor (LPA) form

Employing best practices when using the LPA form can optimize the loan process considerably. Here are a few tips that can aid in this regard:

By consistently applying these best practices, lenders can enhance their borrower experience while ensuring compliance and accuracy.

Success metrics for using the LPA form

Measuring the impact of accurately completing the LPA form is essential for assessing operational effectiveness. Tracking various key performance indicators (KPIs) related to loan approvals, processing times, and borrower satisfaction can provide valuable insights.

Key performance indicators (KPIs) to track

Relevant KPIs may include the average turnaround time for approvals, the percentage of applications that require resubmission due to errors, and borrower satisfaction ratings. Monitoring these metrics can guide lenders to identify areas for improvement and measure overall process efficiency.

Conclusion: maximizing the benefits of the LPA form with pdfFiller

Integrating the use of the Loan Product Advisor (LPA) Form into daily operations is crucial for lenders aiming to streamline their processes. Utilizing pdfFiller's robust features not only enhances document management but also lays the groundwork for continuous learning and improvement.

The evolving landscape of loans necessitates that lenders remain agile and innovative. Adopting such advanced tools can lead to greater certainty in the loan process while ultimately driving success for businesses engaged in mortgage lending.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my loan product advisor lpa directly from Gmail?

Can I sign the loan product advisor lpa electronically in Chrome?

How do I complete loan product advisor lpa on an iOS device?

What is loan product advisor lpa?

Who is required to file loan product advisor lpa?

How to fill out loan product advisor lpa?

What is the purpose of loan product advisor lpa?

What information must be reported on loan product advisor lpa?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.