Get the free Addressing Financial Literacy Gaps in Ireland

Get, Create, Make and Sign addressing financial literacy gaps

How to edit addressing financial literacy gaps online

Uncompromising security for your PDF editing and eSignature needs

How to fill out addressing financial literacy gaps

How to fill out addressing financial literacy gaps

Who needs addressing financial literacy gaps?

Addressing financial literacy gaps form: A comprehensive guide

Understanding financial literacy

Financial literacy is fundamentally the ability to understand and apply various financial skills effectively. This includes budgeting, saving, investing, and comprehending financial products. In today's economy, mastering these skills is crucial for managing life goals such as retirement planning, home ownership, and wealth accumulation. Without adequate financial knowledge, individuals may make poor financial choices that have long-term adverse effects.

Currently, financial literacy rates are alarmingly low in many demographics. According to research by the National Endowment for Financial Education, only 24% of Americans can answer basic financial literacy questions accurately. Low-income populations, young adults, and underserved communities face unique challenges—ranging from lack of access to education, limited resources, to cultural barriers—that exacerbate these knowledge gaps.

A well-informed public leads to empowered individuals who can navigate the complexities of personal finances. Financial literacy contributes to better decision-making, improved monetary management skills, and enhanced community resources. By bridging these gaps, communities can collectively uplift their economic status.

Identifying gaps in financial literacy

Several major gaps exist in the realm of financial knowledge. Key areas where knowledge is lacking include budgeting, saving, investing, and understanding credit. Many individuals struggle to create and stick to a budget, leading to overspending and debt accumulation. Furthermore, misconceptions about investing often deter people from taking advantage of valuable wealth-building opportunities.

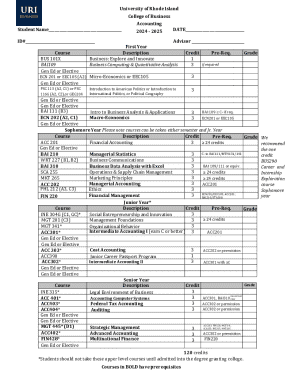

Specific demographics are disproportionately affected by these gaps. For instance, low-income populations often have limited exposure to financial education and resources for effective money management. Young adults and students, particularly those who are first-generation college attendees, frequently lack the foundational knowledge necessary for financial success. Similarly, underserved communities face additional systemic challenges that hinder their access to financial literacy.

Innovative approaches to address financial literacy gaps

Leveraging technology has emerged as an effective way to enhance financial literacy. Online resources, such as financial management apps and virtual learning platforms, provide interactive tools that can engage learners of all ages. For instance, budgeting apps can facilitate better tracking of spending patterns, leading to improved money management skills.

Community programs and workshops also play a crucial role in addressing financial literacy. Successful case studies, like those initiated by local libraries and non-profits, have demonstrated that group learning encourages knowledge sharing and peer support. Furthermore, collaboration with public institutions can bridge the gap through regular workshops and seminars aimed at educating families on financial matters.

Developing tailored financial literacy programs

Every community has unique financial education needs. Assessing these needs through surveys or community discussions can help stakeholders create tailored programs that resonate with specific demographics. By understanding what populations lack, organizations can focus on providing relevant content effectively.

Creating inclusive program content is essential for success. Using culturally relevant materials not only enhances engagement but also ensures that individuals can relate personally to the information shared. Additionally, measuring success and impact can be done through various key performance indicators (KPIs), such as participant feedback and post-program surveys to gauge knowledge retention.

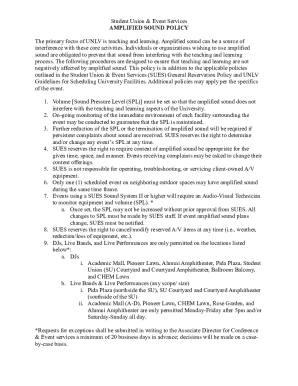

Practical steps to fill out and utilize financial literacy resources

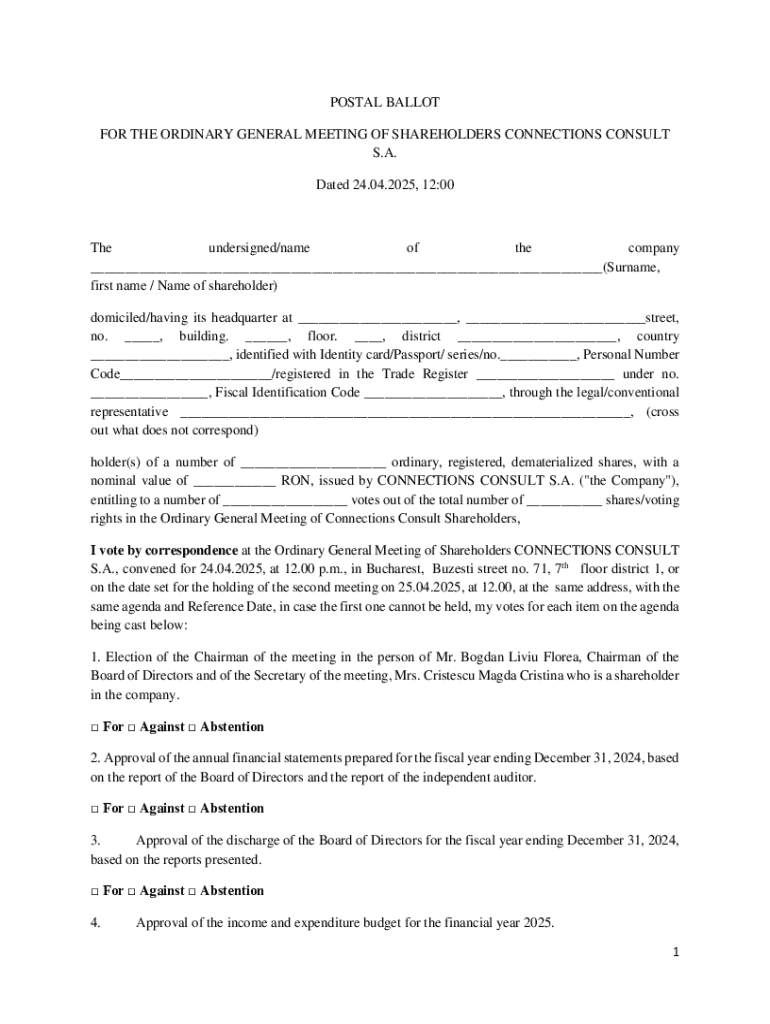

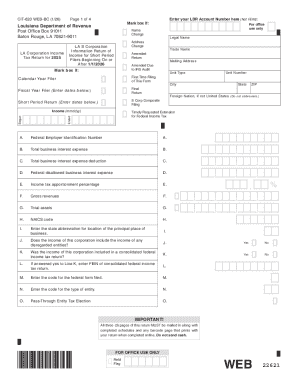

The 'Addressing Financial Literacy Gaps Form' is designed to streamline the identification and resolution of financial literacy issues within communities. This form serves as a key tool for capturing valuable insights regarding the gaps in financial education.

Filling out the form effectively involves several steps. First, gather all necessary documentation detailing your community’s demographics and financial education resources available. Then, use clear and concise language to articulate specific gaps and any relevant statistics that support your claims. Utilizing online platforms like pdfFiller can simplify the process further, enabling users to edit, sign, and submit their forms seamlessly.

Enhancing financial literacy through collaboration

Building community partnerships is essential for amplifying the message and reach of financial literacy initiatives. Collaboration among schools, non-profits, and local businesses creates a networked approach that fosters a supportive environment for financial education. For example, partnership programs where financial institutions sponsor financial literacy modules at local schools have yielded positive results.

Encouraging community involvement can significantly enhance the financial wellbeing of families and individuals. Initiatives like community workshops, informative seminars, and peer-led programs can effectively facilitate discussions around finances. Success stories from such collaborative efforts showcase how community-driven change can lead to improved financial literacy.

Navigating potential barriers to success

Addressing resistance to financial education is vital for the successful implementation of literacy programs. Common misconceptions about personal finance, such as 'financial literacy is only for the wealthy,' can impede progress. To tackle this, it’s crucial to provide relatable examples and foster an open dialogue around the importance of financial literacy for all socioeconomic backgrounds.

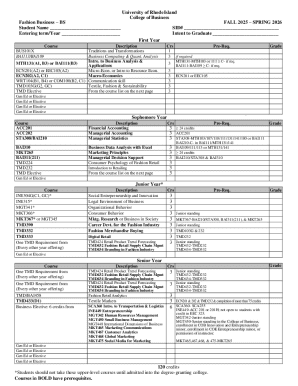

Securing funding and resources also presents a challenge. Developing sustainable funding models through grants, community support, and corporate partnerships can provide much-needed financial backing for ongoing literacy programs. By demystifying the financial education process and sustaining community engagement, organizations can navigate these barriers effectively.

Future trends in financial literacy

The financial literacy landscape will continue to evolve, especially as new technologies reshape how individuals manage their finances. The incorporation of artificial intelligence and blockchain may revolutionize access to financial knowledge by introducing innovative tools that instantly provide analysis and tailored advice, thus attracting a wider audience.

Community-driven initiatives will play a pivotal role in influencing national efforts to elevate financial literacy standards. Local organizations are uniquely positioned to identify and address specific needs, impacting broader discussions on financial education. By championing grassroots movements, communities can drive significant change and promote a culture of financial knowledge sharing.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in addressing financial literacy gaps without leaving Chrome?

How can I edit addressing financial literacy gaps on a smartphone?

How can I fill out addressing financial literacy gaps on an iOS device?

What is addressing financial literacy gaps?

Who is required to file addressing financial literacy gaps?

How to fill out addressing financial literacy gaps?

What is the purpose of addressing financial literacy gaps?

What information must be reported on addressing financial literacy gaps?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.