Get the free California's Transfer on Death deed - Avoid probate

Get, Create, Make and Sign california039s transfer on death

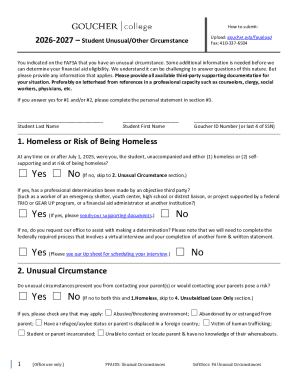

Editing california039s transfer on death online

Uncompromising security for your PDF editing and eSignature needs

How to fill out california039s transfer on death

How to fill out california039s transfer on death

Who needs california039s transfer on death?

California's Transfer on Death Form: A Comprehensive Guide

Understanding California's Transfer on Death Form

The California Transfer on Death Form is an effective estate planning tool that allows property owners to designate beneficiaries who will inherit their property upon their death, without the need for probate. This form bypasses the lengthy and often costly probate process, making the transfer of assets more straightforward and efficient.

In California, probate can be a complicated and expensive process, where the value of an estate is assessed and the distribution of assets is managed by the court system. This form allows individuals to control their asset distribution directly, simplifying the procedure for their beneficiaries.

Key features of the Transfer on Death Form

The Transfer on Death Form is characterized by several key features that make it a popular choice among individuals preparing their estate plans. It is a straightforward document that does not require a living trust or will, but rather offers a simple way to transfer real estate. Understanding its eligibility requirements and limitations is crucial for effective use.

Anyone who owns real property in California can use the form, but there are some limitations. For example, a person may only transfer property they own individually, not property owned jointly or as part of a business.

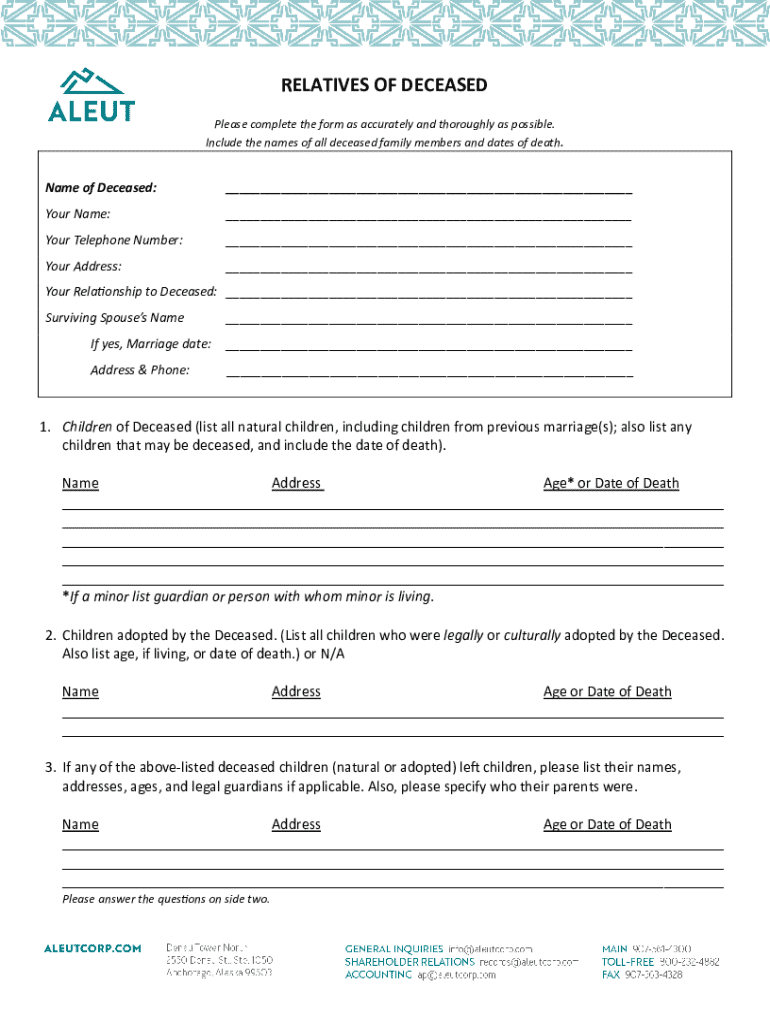

Step-by-step guide to completing the California Transfer on Death Form

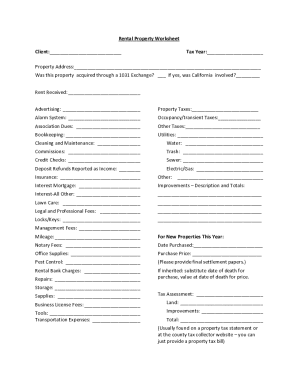

Filling out the Transfer on Death Form may initially seem daunting, but following a systematic approach can facilitate this process. Begin by gathering necessary personal and property information, including the names and details of all parties involved.

Next, you will fill out the form section by section, making sure to accurately provide the required information. Pay attention to common mistakes such as misspellings or missing signatures, which can jeopardize the effectiveness of the form.

Editing and modifying the Transfer on Death Form

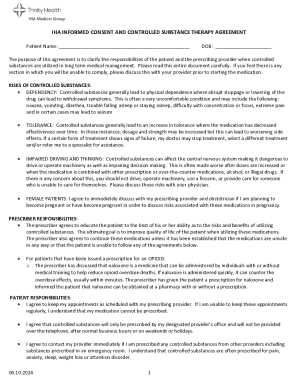

After completing the Transfer on Death Form, you may find it necessary to edit or modify it. pdfFiller makes it convenient to manage your documents digitally. You can upload your form to the platform and use editing tools to make any necessary changes.

Collaboration is also a key feature, enabling you to share the form with family or legal advisors for feedback. This ensures that all stakeholders are aligned, and allows for smoother transitions in estate planning.

eSigning and finalizing the Transfer on Death Form

Finalizing the Transfer on Death Form requires an electronic signature, which simplifies the document management process. eSignatures are legally valid in California, reinforcing the authenticity of your document without the need for physical presence.

To eSign your form, navigate to the pdfFiller platform where clear instructions guide you through the process. This not only saves time but provides peace of mind knowing that your form is securely executed.

Managing your Transfer on Death Form

Once your Transfer on Death Form is completed and signed, managing it properly is crucial. pdfFiller allows you to store your documents securely, ensuring retrieval is easy whenever needed. This balance of security and accessibility is vital in estate planning.

Alongside secure storage, you should also periodically assess if your Transfer on Death Form needs updating. Events such as marriage, divorce, or the addition of new beneficiaries necessitate revisions to this essential document.

Common questions about California's Transfer on Death Form

Prospective users often have questions about the implications of using the Transfer on Death Form. For instance, many ask what happens if they neglect to use the form. Without it, their property may be subjected to the lengthy probate process. Alternatively, individuals sometimes wonder whether they can transfer property while still alive, which is indeed allowed through this form.

Changing your mind after filling out the form is also common. Fortunately, as the property owner, you retain the right to alter or revoke the Transfer on Death designation at any time before your passing.

Contacting legal professionals for guidance

When navigating estate planning and specific forms like the Transfer on Death Form, seeking legal advice can help clarify complexities. In particular, individuals may benefit from consulting with an attorney specializing in estate planning to ensure their wishes are accurately reflected.

The right legal professional can offer insights into how best to utilize the Transfer on Death Form alongside other estate planning instruments. Additionally, utilizing pdfFiller can simplify the process, making collaboration with legal advisors more efficient.

Related topics and resources

Understanding California's Transfer on Death Form is but one facet of comprehensive estate planning. Exploring other estate planning forms, such as wills, living trusts, and health care powers can provide a complete strategy for asset management. It's also worthwhile to review how other states manage property transfers upon death.

In addition, links to relevant articles and studies on estate management can provide further insights into the various methods of protecting your legacy and ensuring your wishes are fulfilled efficiently.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send california039s transfer on death for eSignature?

How do I make changes in california039s transfer on death?

How do I edit california039s transfer on death on an iOS device?

What is California's transfer on death?

Who is required to file California's transfer on death?

How to fill out California's transfer on death?

What is the purpose of California's transfer on death?

What information must be reported on California's transfer on death?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.