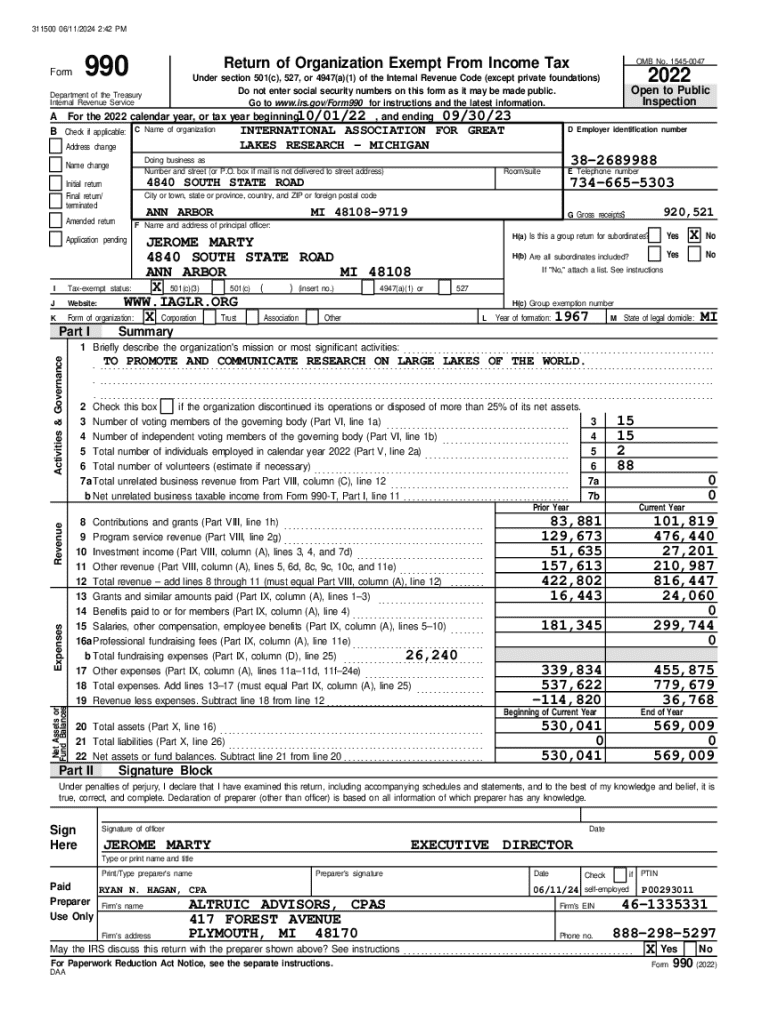

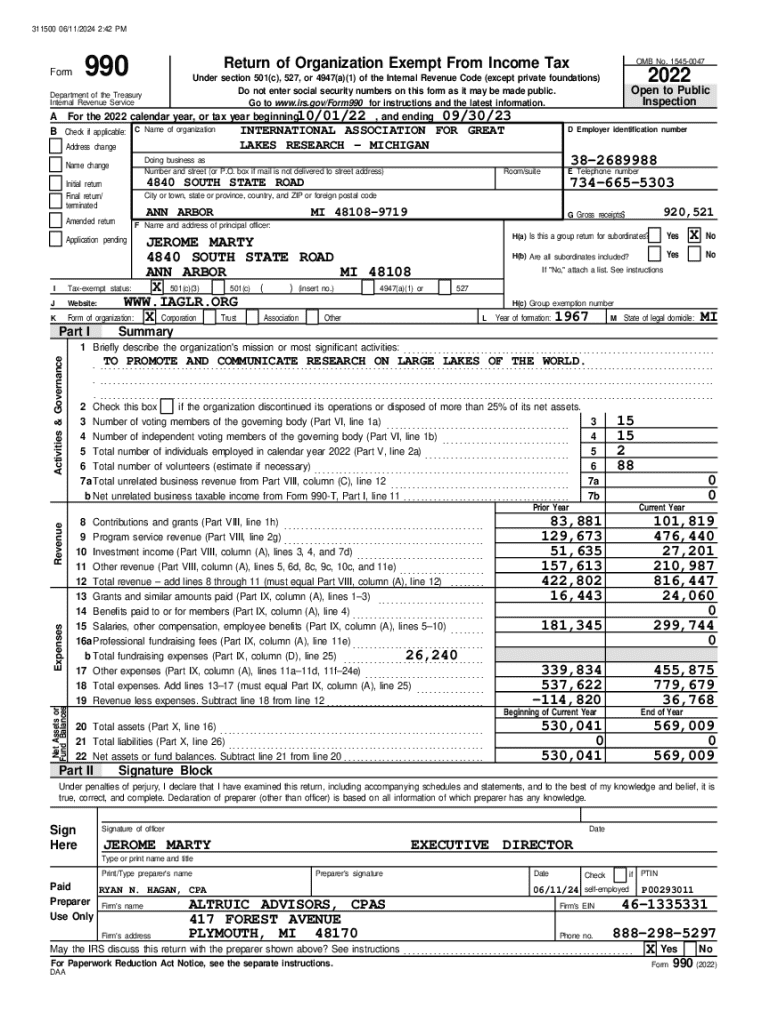

Get the free A For the 2022 calendar year, or tax year beginning10/01/22 , and ending 09/30/23

Get, Create, Make and Sign a for form 2022

How to edit a for form 2022 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out a for form 2022

How to fill out a for form 2022

Who needs a for form 2022?

A comprehensive guide to filling out the 2022 Form A

Understanding the 2022 Form A

The 2022 Form A plays a critical role in the tax filing process, serving as a template for reporting various types of income, deductions, and credits. This form is essential for individuals and various taxpayer groups to complete their annual income tax return accurately. It encompasses important details that can impact refund eligibility and tax liabilities.

In 2022, this form gained increased relevance due to several legislative changes affecting tax policies and regulations. Taxpayers are encouraged to familiarize themselves with these changes to ensure compliance and maximize their potential refunds. Notably, changes to allowable deductions and income thresholds have reshaped how we approach tax filings this year.

Compared to previous years, 2022’s Form A includes important modifications focused on improving clarity and efficiency for taxpayers. These changes not only streamline the filing process but also enhance accessibility for those filing online.

Eligibility requirements for filing Form A

Understanding who should use Form A is pivotal in the filing process. Generally, individuals whose gross income falls under a certain threshold and meets specific criteria will be required to file this form. Often, a first-time filer or someone remedially filing due to non-compliance in earlier years may encounter unique circumstances that necessitate this form.

To qualify for using Form A, individuals must be U.S. citizens or resident aliens, have a valid Social Security Number (SSN), and ensure that their income aligns with the stipulated limits. Special considerations apply to various taxpayer groups, such as students, retirees, and low-income earners, each of which may have distinct requirements for eligibility.

Step-by-step instructions for completing Form A

Step 1: Gather necessary documents

Before starting with Form A, it’s crucial to gather the necessary documents. These typically include your W-2 forms, 1099 forms, last year's tax return, and any receipts for deductible expenses. Missing documentation can lead to confusion and inaccurate filings.

Common mistakes while gathering documents include overlooking certain income types and failing to secure all W-2 forms from multiple employers. It's important to create a checklist to ensure you don't miss anything essential.

Step 2: Understand the sections of Form A

Form A is divided into several sections, each addressing specific reporting requirements. There’s a section for personal information, income sources, adjustments, and deductions. It’s vital to understand each section thoroughly to fill your form accurately.

Key terms in this context include 'AGI' (Adjusted Gross Income), which is pivotal in determining taxable income, and 'deductions,' which can reduce taxable income. Familiarizing yourself with terminology will help you navigate the form with confidence.

Step 3: Filling out the form

Begin filling out Form A line-by-line, carefully writing down your information as it appears on your documents. Ensure that any numerical figures are accurate, as even small errors can lead to processing delays or incorrect refunds.

Using tools like pdfFiller can significantly streamline this process. They offer features that allow you to edit, fill out, and eSign your Form A directly, making it easier to manage your documents effectively.

Step 4: Review and confirm accuracy

Once you’ve completed the form, thoroughly review it for accuracy. Create a checklist to verify that all personal information is correct, income figures are accurately reported, and deductions are appropriately claimed. This step is vital to prevent issues after submission.

Double-checking information, especially social security numbers and numerical values, can save you from headaches down the line. Remember, the smallest mistakes can lead to unintended delays or complications.

Submitting your 2022 Form A

Once Form A is meticulously filled out, the next step is to decide how you’ll submit it. There are several submission methods available. Online submission is generally quicker and provides instant confirmation of receipt, making it a popular choice among taxpayers.

If you opt for mail, ensure you send your form to the correct address and consider using a signed-for delivery service to track your submission. Be mindful of submission deadlines to avoid any unnecessary penalties or complications.

Managing your Form A post-submission

After submission, it’s important to track the status of your Form A. Many tax authorities provide online tracking options, making it easy to check if your form has been processed. Utilize resources available through pdfFiller to manage and archive your form for future reference.

Should you realize that a mistake was made after submission, you can amend your Form A. This is typically done using a specific amendment form or process designated by the tax authorities. PdfFiller also features tools that facilitate easy amendments.

Resources for assistance

If you find yourself needing assistance while navigating Form A, a wealth of resources is available at your disposal. Tax assistance hotlines and online tools can provide timely advice and guidance. Don't hesitate to reach out if you need help.

Online platforms like pdfFiller offer dedicated resources, including templates, FAQs, and expert advice on how to handle your tax forms efficiently. Take advantage of these tools to ensure a smoother filing experience.

Additional tips for a smooth filing experience

To maximize efficiency when completing Form A, consider planning your filing schedule in advance. Allocate sufficient time to gather documents, complete the form, and review it critically for any errors. Utilize pdfFiller's intuitive editing options to enhance your workflow.

Best practices for document security and privacy include using strong passwords on online platforms, encrypting sensitive information in documents, and ensuring that digitally submitted forms are securely managed. Being proactive about your data security is crucial.

Frequently asked questions

Clarifications on Form A often center around eligibility, the specifics of filing statuses, and changes in current tax law. Tax implications are also common inquiries, particularly regarding refunds and what to expect post-filing. Make sure you’re informed about the processes that affect your tax situation in 2022.

Keep up with updates on tax law changes by reviewing official resources or consulting with tax professionals. Understanding these influences on Form A ensures that your filings will be as accurate as possible, mitigating unwanted surprises down the road.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find a for form 2022?

How do I fill out a for form 2022 using my mobile device?

How do I edit a for form 2022 on an Android device?

What is a for form 2022?

Who is required to file a for form 2022?

How to fill out a for form 2022?

What is the purpose of a for form 2022?

What information must be reported on a for form 2022?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.