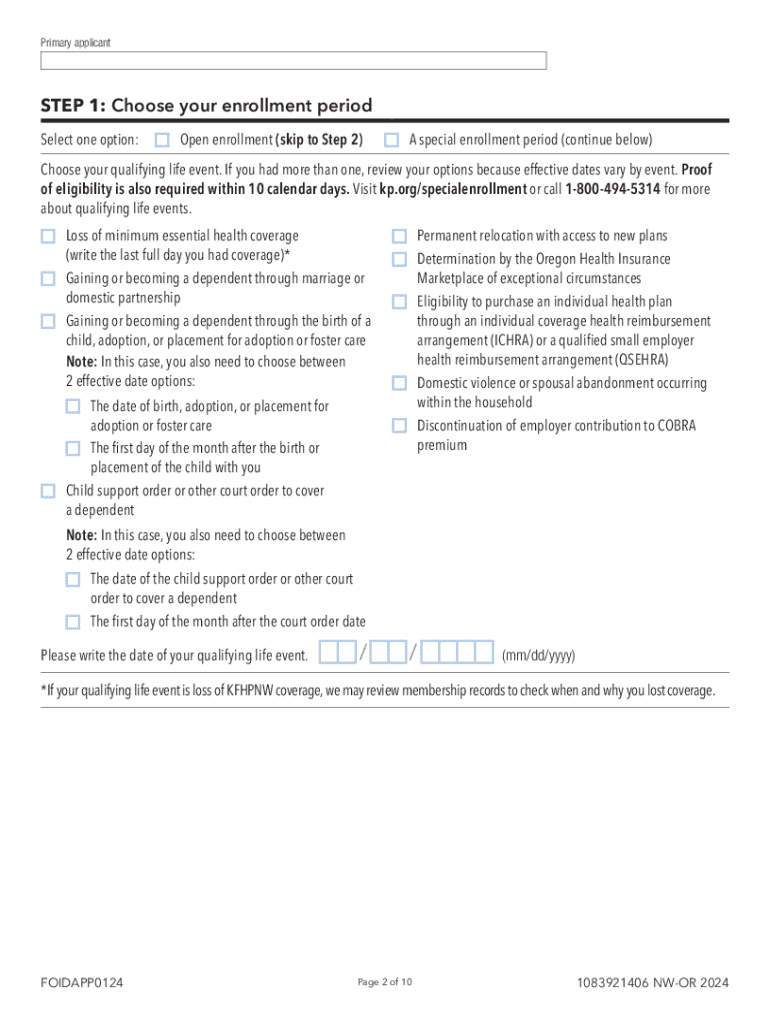

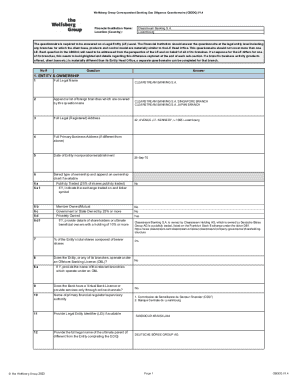

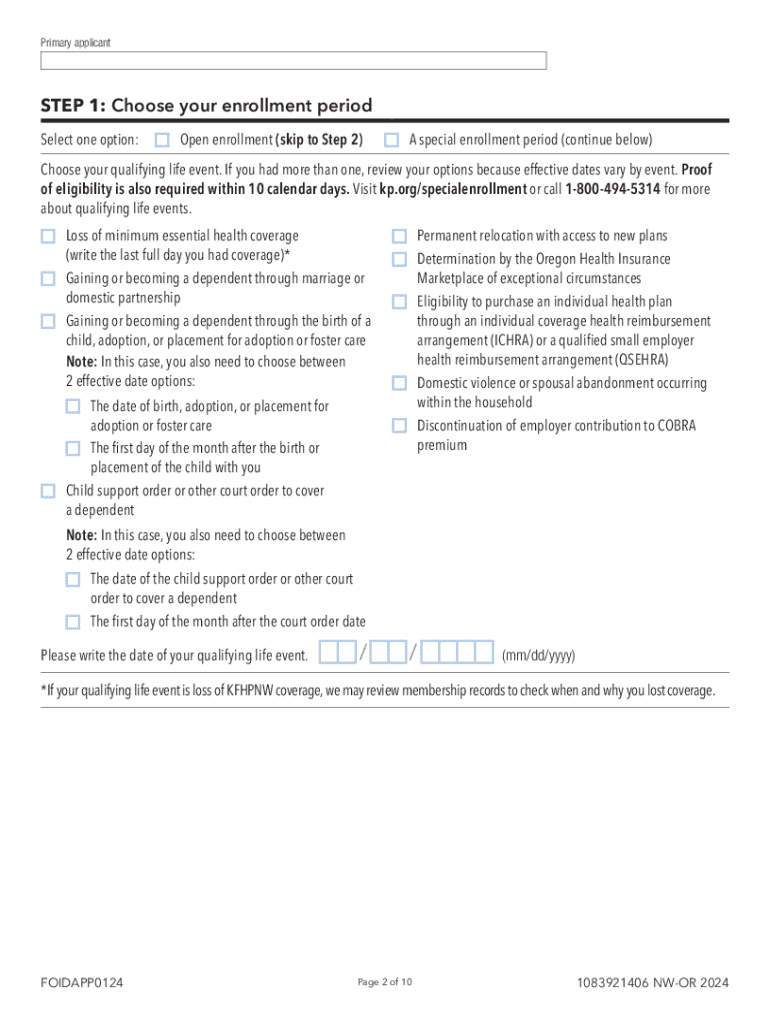

Get the free If you want coverage for your family on the same KFHPNW plan, please fill out one ap...

Get, Create, Make and Sign if you want coverage

Editing if you want coverage online

Uncompromising security for your PDF editing and eSignature needs

How to fill out if you want coverage

How to fill out if you want coverage

Who needs if you want coverage?

If You Want Coverage Form: A Comprehensive How-to Guide

Understanding coverage options

Coverage forms are essential documents that help individuals secure various types of insurance, safeguarding them against unexpected financial burdens. These forms vary widely depending on the type of coverage you seek—be it health, auto, or homeowners insurance. Understanding the significance of each coverage form ensures you choose the right protection that aligns with your specific needs.

Different types of coverage include health insurance, which covers medical expenses; auto insurance, which protects against vehicle-related incidents; and homeowners’ insurance, which safeguards properties against damage or theft. Each type of coverage form requires specific information, tailored to the needs of the issuer and the insured.

Why you need a coverage form

Proper documentation is critical when obtaining coverage. A coverage form serves as a formal request for insurance, compiling necessary personal and policy information for review. This ensures both the insurer and the insured have a clear understanding of the coverage being requested.

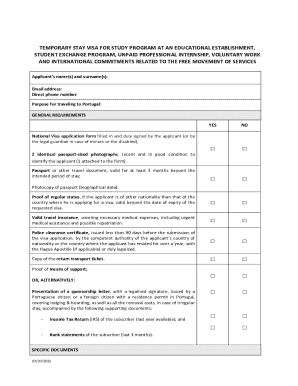

Common scenarios requiring a coverage form include acquiring a new health plan, registering a vehicle, or securing rental insurance before moving into a new residence. Each scenario demands thorough documentation to reduce risks and ambiguities during the underwriting process.

Types of coverage forms

Understanding the different types of coverage forms is vital for effective insurance management. Here are some common categories:

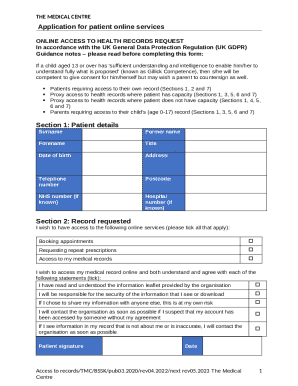

Filling out the coverage form

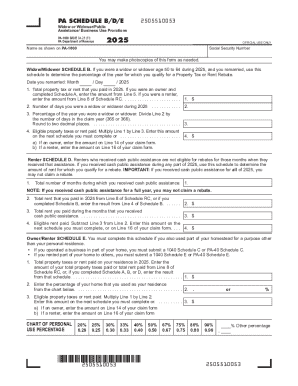

Completing your coverage form involves several steps, each designed to capture specific information relevant to the type of coverage required. Generally, your form will include the following sections:

To ensure accuracy, double-check that you have completed every section thoroughly to avoid processing delays.

Common mistakes to avoid

When filling out your coverage form, some common mistakes can hinder the approval process. Frequently overlooked information includes missing signatures or incorrect identification numbers. Always ensure that you verify important details.

Moreover, choose the correct coverage types and amounts; mismatched details can result in delays and complications. Take the time to read your form carefully, verifying that all sections are completely filled.

Interactive tools for form completion

pdfFiller provides tools that simplify filling out forms, offering user-friendly interfaces for editing and adding information to your coverage forms. With pdfFiller, you can effortlessly upload your form and use interactive options to navigate the completion process.

For example, you can directly click on required fields to enter text, add or remove existing elements, and save your changes seamlessly. Here’s a simple step-by-step usage guide for pdfFiller:

Editing and signing your coverage form

Once your form is completed, ensure that it is properly edited. pdfFiller allows you to make any changes necessary and add your signature safely. The platform's easy-to-use features enable you to highlight text, change fonts, and create annotations.

Utilize electronic signatures (eSignatures) to sign your document digitally. eSignatures are legally recognized and provide a convenient alternative to traditional handwritten signatures. It’s essential to complete the signature section of your form to affirm your commitment and ensure compliance.

Managing your coverage form after submission

Understanding what happens after you submit your coverage form is crucial for managing your insurance needs. The review process typically includes verification of your details and the type of coverage requested. Review periods can vary; however, expect feedback within a few weeks.

To stay updated on your application status, pdfFiller provides tracking tools that allow you to monitor the progress of your submitted forms. You can easily check for any communications from your insurer, ensuring you are informed every step of the way.

Updating your coverage information

Life changes, such as moving, marriage, or significant income changes, often require updates to your coverage. To revise your insurance information, access your original coverage form through pdfFiller and make the necessary adjustments. Keep in mind that certain changes may also need to be documented and submitted for review.

When considering changes, be aware of your policy renewal dates and any potential impact on your coverage rates. Timely updates will help ensure you maintain optimal coverage, avoiding lapses that could lead to financial risk.

FAQs on coverage forms

Frequent questions regarding coverage forms often center around errors or disputes during the application process. Here are some common inquiries:

To facilitate your insurance journey, direct links to essential coverage resources and forms are available on pdfFiller, helping you navigate the documentation process seamlessly.

Final thoughts on coverage forms

Navigating the intricacies of insurance coverage forms can feel overwhelming, but with the right tools and knowledge, the process becomes manageable. Throughout this guide, we’ve outlined essential steps and best practices to ensure a smooth experience.

Utilizing pdfFiller to manage your forms will ease the daunting task of documentation, allowing you to focus more on enjoying peace of mind that comes with the right insurance coverages. Remember, proper care in handling your coverage forms directly impacts your security and comfort in uncertain times.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my if you want coverage directly from Gmail?

How do I make changes in if you want coverage?

How do I complete if you want coverage on an Android device?

What is if you want coverage?

Who is required to file if you want coverage?

How to fill out if you want coverage?

What is the purpose of if you want coverage?

What information must be reported on if you want coverage?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.