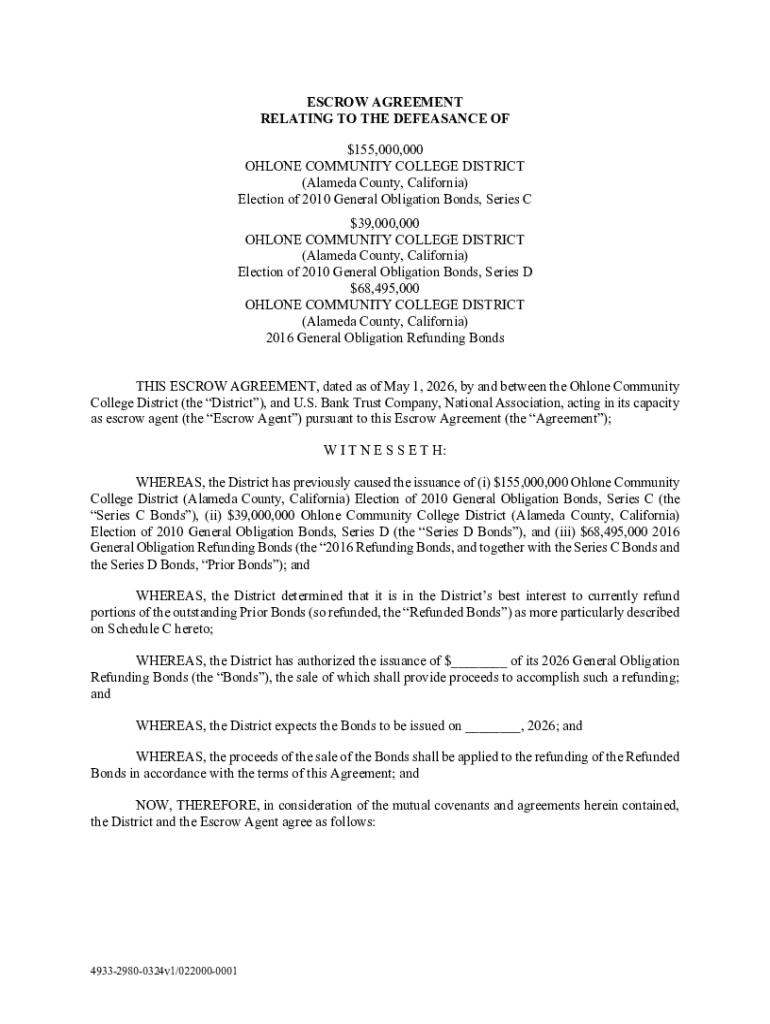

Get the free Escrow Agreement GO Refunding Bonds

Get, Create, Make and Sign escrow agreement go refunding

Editing escrow agreement go refunding online

Uncompromising security for your PDF editing and eSignature needs

How to fill out escrow agreement go refunding

How to fill out escrow agreement go refunding

Who needs escrow agreement go refunding?

Escrow Agreement Go Refunding Form: How-to Guide

Understanding the escrow agreement

An escrow agreement is a legally binding document that facilitates a secure transaction between parties by appointing a third-party escrow agent, who holds funds or assets until specific conditions are met. This arrangement ensures that the buyer receives their purchase while the seller receives payment, protecting both parties' interests. In many cases, escrow agreements are crucial in real estate transactions, online sales, and other significant financial dealings.

The importance of escrow agreements lies in their ability to mitigate risk. They help maintain trust between buyers and sellers, especially in high-stakes deals where large sums of money are involved. Each party works with the escrow agent to clearly outline the terms of the agreement, which can include timelines, contingencies, and conditions for release of funds.

Parties involved in an escrow agreement

The main parties involved in an escrow agreement include the buyer, the seller, and the escrow agent. The buyer is the individual or entity purchasing a product or service, while the seller is the one providing the product or service. The escrow agent, usually a financial institution or a trusted individual, manages the transaction and holds the funds until all conditions of the agreement are satisfied.

Clear communication among these parties is vital to the smooth execution of the agreement. Disputes can arise if any party misinterprets the terms, highlighting the need for concise documentation and understanding. Each party should have access to the exact details of the agreement to ensure a seamless transaction.

Purpose of the escrow agreement go refunding form

The Go Refunding Form is an essential document in the escrow process that facilitates the request for a refund. The form enables individuals involved in transactions to reclaim funds held in escrow, under specific conditions outlined in the original escrow agreement. Understanding when to utilize this form is crucial in ensuring a smooth transaction process.

There are several scenarios that necessitate the use of the Go Refunding Form. Common cases include failed transactions, mutual agreement between the buyer and seller to terminate the deal, or situations where conditions were not met. To proceed with a refund request, it's important to adhere to the stipulations set forth in the original escrow agreement.

Step-by-step guide to completing the go refunding form

Before you begin filling out the Go Refunding Form, gather all necessary information to streamline the process. Key documents might include the original escrow agreement, identification, and supporting evidence to justify the refund request. Organizing your data beforehand can help you avoid delays.

Filling out the form: a detailed walkthrough

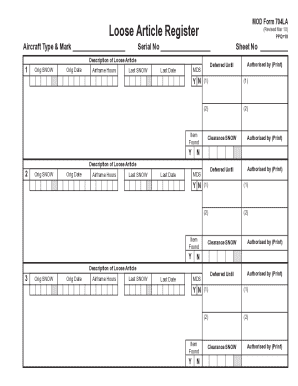

When filling out the Go Refunding Form, pay close attention to accuracy and completeness. This section details the specific areas of the form that require your input.

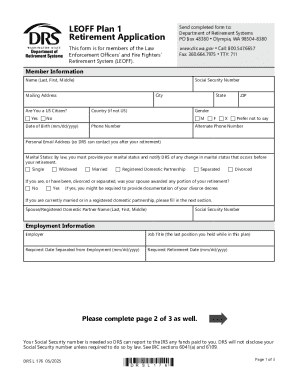

Section 1: Personal information

In this section, you’ll need to provide your name, address, and contact information. Ensure that all details are accurate, as this information will be used to process your request and reach you with any updates. A minor error can lead to delays in your refund.

Section 2: Escrow details

You'll need to supply information from your original escrow agreement, including the escrow account number, names of all parties involved, and transaction details. Look through your agreement carefully to find these details, as they are crucial for matching your request with the correct transaction.

Section 3: Reason for refund request

This section requires you to clearly articulate the reason for your request. Keep your explanation concise but detailed enough to justify the refund. Acceptable reasons might include an unsuccessful transaction or failure to meet conditions. Providing supporting documentation can strengthen your case.

Section 4: Signatures and dates

The final step involves signing and dating the form. Ensure that you have authorized representatives sign if required. In the digital age, many forms can be completed with electronic signatures, which must comply with legal standards, so ensure you're following best practices for security and validation.

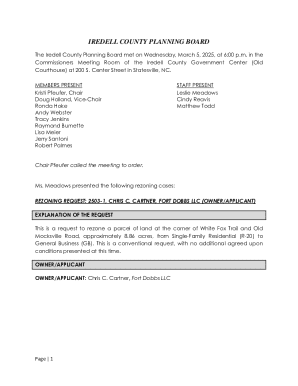

Managing the submission process

Once you've completed the Go Refunding Form, it's time to submit it. Understanding the best delivery options is crucial for timely processing. You can submit the form electronically through email or a secure online portal. Each option has its pros and cons.

After submission, it's essential to follow up on your request. Tracking the status can prevent unnecessary stress. Communicate with your escrow agent or institution professionally, referencing your submitted form and keeping a record of all correspondence.

Troubleshooting common issues

Denied refund requests can be disheartening. Several reasons might contribute to a denial, including incomplete documentation, failure to meet conditions outlined in the escrow agreement, or timing of the request. If your request is denied, carefully review the reasons and address any discrepancies. You may be able to correct the issues and resubmit.

Additionally, be prepared for possible delays in processing your request. Understanding that factors like administrative backlogs or missing documents can cause holdups is essential. To help expedite your submission, ensure you have provided all required documentation and follow up regularly with clear, polite communication.

Best practices for future transactions

To prevent disputes in future transactions, it's vital to establish clear escrow terms. Well-worded agreements outline expectations and conditions, reducing the likelihood of complications. Thoroughly define all contingencies and procedures within the escrow agreement to improve overall outcomes.

Effective communication among all parties involved is equally critical. Regular check-ins and updates can foster cooperation, ensuring everyone stays informed throughout the transaction. Using professional communication templates for updates and queries can also streamline dialogue.

Interactive tools and resources

Digital tools can significantly streamline the management of escrow transactions. pdfFiller offers functionalities designed specifically for managing documents, including filling, editing, and signing PDFs online. Utilizing these tools can transform the way you handle your Go Refunding Form, making the process more efficient and user-friendly.

For those seeking additional guidance, video tutorials on using the Go Refunding Form are available. These tutorials break down the process step by step, providing visual aids that can enhance understanding. Frequently asked questions (FAQs) regarding escrow agreements can also address concerns and clarify common ambiguities.

Continuous education and updates

Staying informed about evolving escrow regulations is critical to ensuring compliance and protection in transactions. Regularly updating yourself on laws affecting escrow processes can empower you to make educated decisions throughout future dealings. Relying on trustworthy resources for ongoing learning can make a significant difference.

Encouraging users to share their experiences regarding escrow transactions can foster a sense of community. Engaging in discussions can provide valuable insights and allow for peer-to-peer learning, enriching the knowledge base about effective escrow practices.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find escrow agreement go refunding?

How do I make edits in escrow agreement go refunding without leaving Chrome?

How do I fill out escrow agreement go refunding on an Android device?

What is escrow agreement go refunding?

Who is required to file escrow agreement go refunding?

How to fill out escrow agreement go refunding?

What is the purpose of escrow agreement go refunding?

What information must be reported on escrow agreement go refunding?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.