Get the free Form 990 Schedule A - Public Charity Status Guide, Tests ...

Get, Create, Make and Sign form 990 schedule a

Editing form 990 schedule a online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 990 schedule a

How to fill out form 990 schedule a

Who needs form 990 schedule a?

Form 990 Schedule A: A Comprehensive Guide

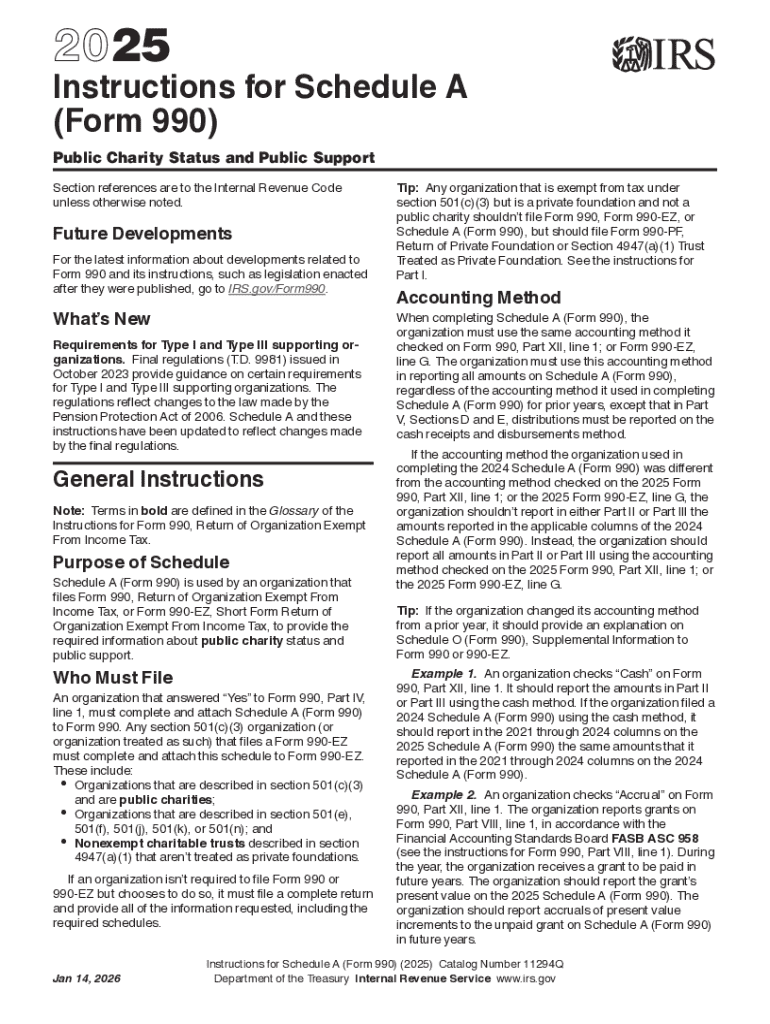

Understanding Form 990 Schedule A

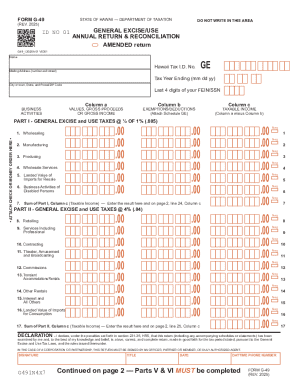

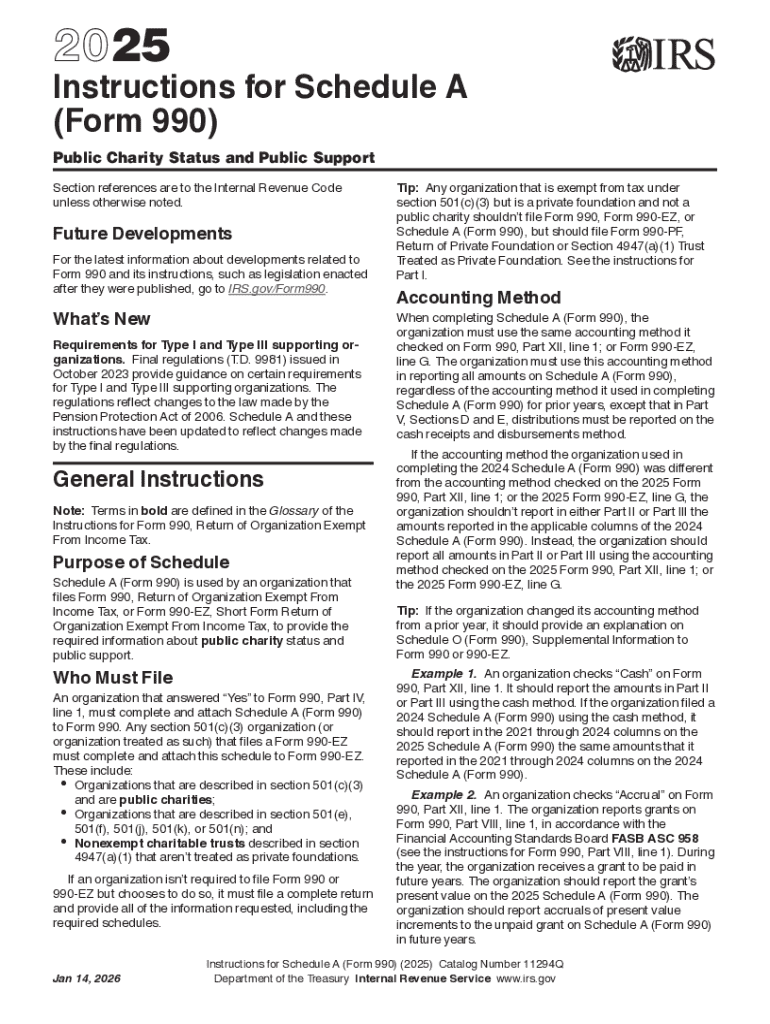

Form 990 Schedule A is an essential component of the IRS Form 990, which organizations must file annually to maintain their tax-exempt status. Schedule A specifically focuses on the organization's public charity status by providing detailed information about support and contributions received. This form is critical because it helps the IRS determine whether an organization qualifies as a public charity rather than a private foundation, which comes with different tax implications and reporting requirements.

The primary purpose of Schedule A is to ensure compliance with tax regulations governing non-profit organizations. By accurately completing this form, non-profits can demonstrate their adherence to the public support test, which measures the level of public financial support received. Compliance is necessary not only for tax exemptions but also for retaining donor trust and credibility within the community.

Who needs to file Form 990 Schedule A?

Non-profit organizations that qualify for tax-exempt status under sections 501(c)(3) and similar classifications are required to file Form 990 Schedule A. These include a variety of entities, such as charities, educational institutions, and religious organizations. Particularly, any non-profit entity that falls under the public charity category—meaning they rely primarily on a diverse range of public contributions—must submit this schedule to provide a clear picture of their funding sources.

However, there are exceptions. Some organizations, like congregations, qualified governmental entities, and certain trusts, may not be required to file this form. Determining your specific filing obligations can be complex; organizations should assess their classification carefully to avoid penalties or loss of status.

Key components of Schedule A

Schedule A is structured into several essential parts that collectively provide a comprehensive overview of the organization's support and funding. Each section requires meticulous attention to ensure accurate reporting, as discrepancies can lead to various compliance issues. The key sections are:

Understanding the difference between a public charity and a private foundation is also crucial, as these entities face different fundraising limitations and regulatory oversight. A public charity, typically supported by donations from the general public or government entities, enjoys a different tax treatment compared to a private foundation that primarily relies on a single source of funding.

Detailed instructions for completing Schedule A

Completing Form 990 Schedule A may seem daunting, but with a clear approach, organizations can efficiently gather the necessary data. Here is a step-by-step guide on how to complete each part of the form:

Many organizations stumble when reporting contributions, particularly in distinguishing between qualifying donations and those that do not count towards public support. Accurate calculations and attention to IRS guidelines are paramount to avoid misunderstandings that could jeopardize tax-exempt status.

Editing and managing your completed Schedule A

Once you have filled out Form 990 Schedule A, the next crucial step is managing and editing the document efficiently. pdfFiller's tools provide a seamless solution for editing, eSigning, and collaborating on your completed form. The platform allows you to upload your form, make necessary adjustments, and share it securely with team members or advisors who may need to review it.

Best practices for storing and accessing your completed form play a vital role in maintaining compliance. Secure cloud storage solutions enable organizations to access their forms from anywhere, allowing collaborative efforts even when team members are not physically present in the office. Management of different versions of the form can also be crucial in keeping track of any procedural changes or regulatory updates.

Interactive tools for simplifying the process

pdfFiller provides interactive tools specifically designed to simplify the filing process for Form 990 Schedule A. Leveraging templates that are readily available on the platform can expedite future filings and help ensure consistency across documents. These tools not only enhance document management but also empower organizations to remain organized and compliant.

Additionally, pdfFiller offers various resources tailored for non-profits that can further assist in navigating tax compliance challenges. From instructional guides to community platform access, users can find the help they need, fostering an environment conducive to clarity and efficiency.

FAQs regarding Form 990 Schedule A

As organizations prepare to fill out Form 990 Schedule A, they often have several questions regarding its obligations and ramifications. Here are some of the most frequently asked questions:

Expert answers and insights can provide clarity. Consulting with a tax advisor can also preemptively resolve potential questions related to compliance and financial disclosures.

Staying updated on regulatory changes

Navigating the compliance landscape requires organizations to monitor regulations closely. The IRS frequently updates its guidelines, and staying informed is crucial for non-profit leadership. Organizations should make it a practice to regularly review IRS updates, as well as possible changes that could affect their reporting obligations.

Resources for ongoing compliance are readily available on various platforms, including pdfFiller, which can assist in tracking necessary changes and updates pertinent to Form 990 Schedule A. Utilizing such tools enables organizations to maintain adherence to regulations without falling behind on essential compliance tasks.

Engaging with advisors and resources for non-profits

Understanding when to seek professional guidance is important for non-profit organizations tackling the complexities of tax forms such as Schedule A. Organizations can connect with tax advisors directly through platforms like pdfFiller, enhancing their support network.

Moreover, engaging with community resources and online platforms dedicated to non-profit needs can provide additional support. Tapping into this network not only enriches knowledge but also establishes a collaborative environment, increasing the organization's overall operational efficiency.

Summary of key takeaways

Filing Form 990 Schedule A is a critical obligation for non-profit organizations aiming to comply with IRS regulations. It is essential to understand the structure of the form, the importance of accurate reporting, and the role of tools like pdfFiller to enhance document management. Effective filing is not just a regulatory compliance measure; it serves as a testament to organizational transparency and accountability.

By leveraging the resources available through pdfFiller, non-profits can streamline their processes while maintaining meticulous records. Regularly reviewing and updating Form 990 Schedule A ensures compliance and fosters trust among stakeholders, which are vital for sustainable operations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my form 990 schedule a in Gmail?

Where do I find form 990 schedule a?

How do I edit form 990 schedule a in Chrome?

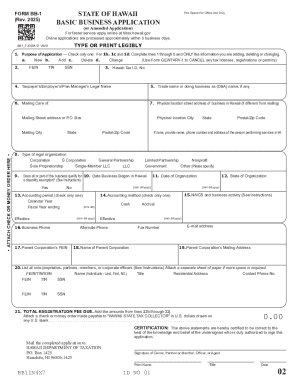

What is form 990 schedule a?

Who is required to file form 990 schedule a?

How to fill out form 990 schedule a?

What is the purpose of form 990 schedule a?

What information must be reported on form 990 schedule a?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.