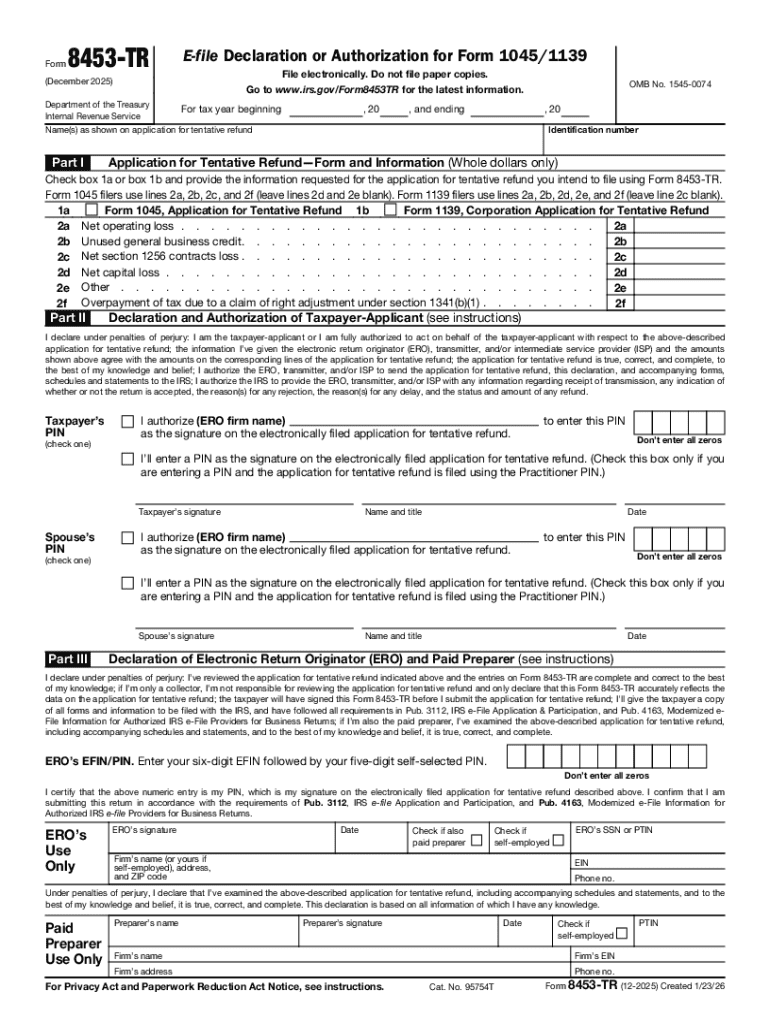

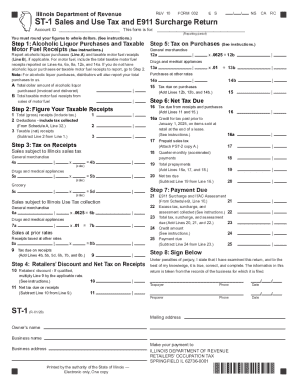

Get the free Form 8453-TR (December 2025). E-file Declaration or Authorization for Form 1045/1139

Get, Create, Make and Sign form 8453-tr december 2025

How to edit form 8453-tr december 2025 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 8453-tr december 2025

How to fill out form 8453-tr december 2025

Who needs form 8453-tr december 2025?

Form 8453-TR December 2025 Form: A Complete Guide for Tax Filers

Overview of Form 8453-TR

Form 8453-TR is an essential document used by taxpayers and tax professionals for electronic filing of tax returns. This form serves as an authorization for the Electronic Return Originator (ERO) to file a tax return on behalf of the taxpayer. As e-filing becomes increasingly prevalent, the December 2025 edition introduces adjustments aimed at streamlining the submission process, improving clarity, and ensuring compliance with IRS standards.

One of the key changes to the December 2025 edition is the enhancement of the e-signature process, which aligns with the evolving technology in digital transactions. Form 8453-TR is not just a formality; it plays a crucial role in acknowledging the taxpayer's agreement with the filed return, thereby protecting both the taxpayer and the ERO.

Understanding the tax implications

Filing Form 8453-TR comes with particular tax obligations. It applies to both individuals and businesses that wish to authorize electronic preparation and submission of their tax returns. Notably, eligibility depends on the type of return being filed and the arrangements made with the ERO submitting the return. For instance, taxpayers who have a complex financial situation, including multiple income sources or deductions, will often necessitate this form for accurate filings.

Common scenarios necessitating the use of Form 8453-TR include situations where a tax return is filed by a third party, such as a tax preparer, and instances involving specific tax credits or claims that require electronic documentation. It is crucial to ensure that your financial circumstances match the eligibility criteria, as improper submissions may lead to potential legal complications or increased scrutiny from the IRS.

Instructions for completing Form 8453-TR

To accurately complete Form 8453-TR, follow these detailed steps. First, gather all necessary information and documents, including your prior year’s return, W-2s, 1099s, and any other pertinent tax documents. The accuracy at this stage can significantly impact your filing process.

Next, fill out your personal and business details in the first section, ensuring that all names, addresses, and identification numbers are confirmed as correct. Tax information should be entered in the designated fields, reflecting your actual income, deductions, and any credits claimed. Mistakes made here can lead to delays or rejection of your return.

Finally, verify all the information for authenticity; cross-reference it against the documents you’ve gathered. Errors or inconsistent data can complicate your tax outcome, so double-checking is essential.

Common mistakes to avoid

When completing Form 8453-TR, common mistakes often arise from careless data entry. Taxpayers might enter wrong Social Security numbers, misspell names, or miscalculate figures, leading to potential problems. These inaccuracies can result not only in a rejection of your tax filing but also cause delays in refunds or result in penalties.

It’s crucial to pay close attention while filling out the form as these small errors, while seemingly trivial, can cause major headaches down the line. Furthermore, inaccuracies could provoke additional scrutiny from the IRS, resulting in audits or queries for more information.

Editing and signing the form

After completing your Form 8453-TR, you may need to edit it for errors or adjustments. Utilizing PDF editing tools allows for easy modification of the form without hassle. It is important to ensure any changes maintain clarity and do not adversely affect the form’s layout, which could confuse the IRS review process.

For signing, choose an eSignature solution that complies with IRS standards. Options include typing your name, drawing your signature on the screen, or using a secure digital certificate. It's essential to select a method that validates your identity adequately, ensuring that your consent for filing your tax return is legitimately documented.

Submitting Form 8453-TR

To submit Form 8453-TR, utilize a reliable e-filing platform like pdfFiller, which offers a cloud-based service designed for convenience and efficiency. While submitting the form, it’s essential to be aware of the methods available; these typically include direct submission via your tax software or uploading the form manually, depending on the service being used.

Check for any associated fees for electronic filing and ensure you adhere to the submission deadline set by the IRS. Missing the deadline may lead to penalties or interest on taxes owed, underscoring the importance of timely filing.

Tracking your submission

After submitting your Form 8453-TR, tracking its status is crucial to confirm receipt by the IRS. Various methods exist to verify submission, often depending on the e-filing platform used. Tools provided by pdfFiller allow users to monitor their submission and receive updates on the status of their filed forms.

Once your submission is processed, you may receive notifications indicating its acceptance or if the IRS requires additional information. This alerts you to promptly address any issues, ensuring a smooth continuation in your tax filing experience.

FAQs about Form 8453-TR

One of the most crucial aspects of tax filing is knowing how to amend your submission if necessary. If you realize post-submission that there are inaccuracies, the proper course of action includes submitting an amended return along with a new Form 8453-TR, clearly indicating that it’s a correction. If your submission is rejected, the IRS will typically provide guidance on the appropriate steps to rectify the problem.

Additionally, familiarizing yourself with resources for support can ease the tax filing process. Both the IRS website and various tax services can provide clarification or instruction regarding any specific questions you might have about Form 8453-TR.

Advantages of using pdfFiller for Form 8453-TR

Choosing pdfFiller as your platform for managing Form 8453-TR offers numerous advantages. Users gain access to a suite of features that facilitate not only form completion but also comprehensive document management. From easy editing and eSigning to seamless collaboration among team members, pdfFiller empowers individuals and businesses alike.

The cloud-based nature of pdfFiller allows users to access their documents from anywhere, ensuring flexibility and convenience for those who work remotely or on the go. Plus, testimonials from satisfied customers demonstrate the efficacy and reliability of the service in streamlining the tax filing process.

Relevant forms and documents

Form 8453-TR relates closely to many other tax forms and documents used in the e-filing process. Common related documents include Form 1040 for individual income tax returns, as well as various schedules that detail income, credits, and deductions. Knowing these forms is essential for thorough tax management.

For comprehensive tax management, familiarize yourself with links to other key IRS documents. Understanding forms that interact with Form 8453-TR can better prepare you for all eventualities during tax season, enhancing your preparedness and compliance with IRS requirements.

Future considerations for taxpayers

As tax laws evolve, it's vital to stay ahead of changes that may affect your filing practices and documentation requirements. Anticipating updates in tax law will help prepare taxpayers for changes in Form 8453-TR and its submission processes, including any shifts in e-file signature authorization.

Taxpayers should regularly engage with trusted resources, such as the IRS website or tax consultation services, to ensure they remain informed and compliant with evolving regulations. Preparing for upcoming updates and understanding how they impact your tax responsibilities can provide peace of mind and reduce the potential for errors.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send form 8453-tr december 2025 to be eSigned by others?

Can I create an electronic signature for the form 8453-tr december 2025 in Chrome?

How do I complete form 8453-tr december 2025 on an Android device?

What is form 8453-tr December 2025?

Who is required to file form 8453-tr December 2025?

How to fill out form 8453-tr December 2025?

What is the purpose of form 8453-tr December 2025?

What information must be reported on form 8453-tr December 2025?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.