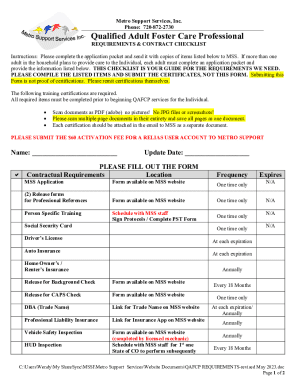

Get the free Instructions for Form 1120F, U.S. income tax return of a foreign ...

Get, Create, Make and Sign instructions for form 1120f

How to edit instructions for form 1120f online

Uncompromising security for your PDF editing and eSignature needs

How to fill out instructions for form 1120f

How to fill out instructions for form 1120f

Who needs instructions for form 1120f?

Instructions for Form 1120-F: A Comprehensive Guide

Understanding Form 1120-F: The Basics

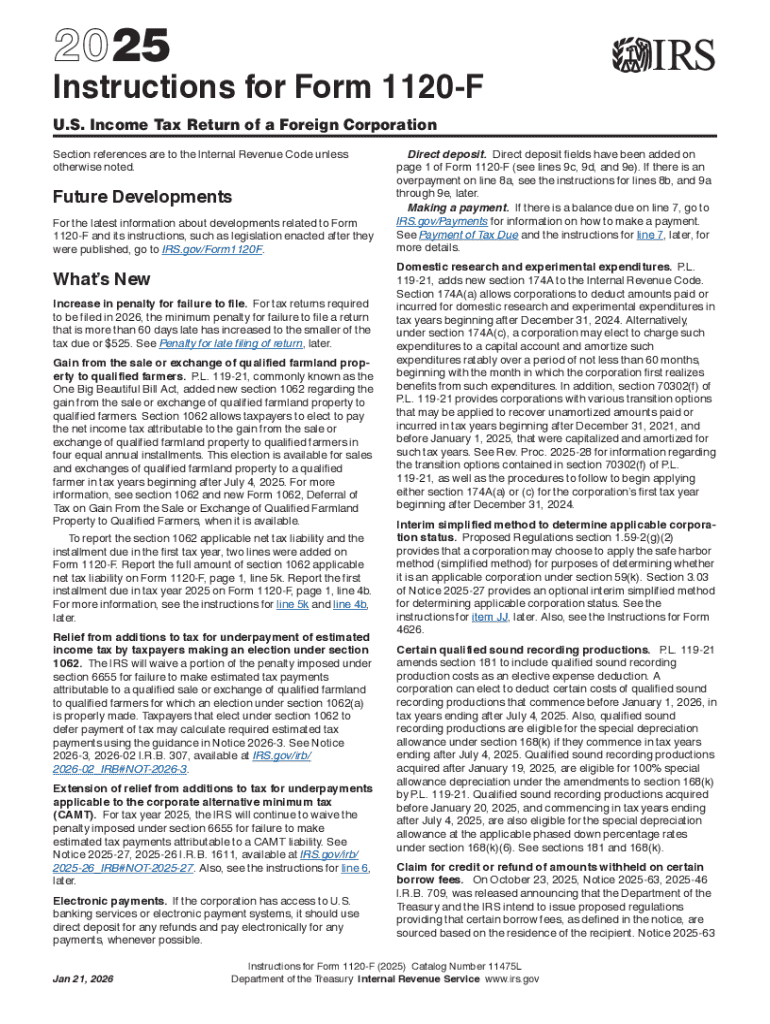

Form 1120-F is the U.S. Income Tax Return for a Foreign Corporation. This form must be filed by foreign corporations that engage in business activities within the United States or derive income from U.S. sources. The purpose of this form is to report various types of income, deductions, and tax liabilities associated with that income, ensuring compliance with U.S. tax laws and regulations.

One notable difference between Form 1120 and Form 1120-F is that Form 1120 is for domestic corporations while Form 1120-F is specifically designed for foreign entities. Furthermore, Form 1120-F includes sections that cater to non-resident tax obligations, detailing how foreign corporations should report their U.S. tax liabilities.

Who needs to file Form 1120-F?

Foreign corporations are required to file Form 1120-F if they engage in trade or business activities in the United States, have income that is effectively connected to that trade or business, or have U.S.-source income. Factors determining this necessity include the nature of the business and the residency of its investors.

Exceptions exist for specific income types, such as portfolio interest or income from certain foreign investments, which do not typically require a Form 1120-F filing. Moreover, statutory provisions may apply, offering different requirements for corporations operating in various jurisdictions.

Preparing to complete Form 1120-F

To successfully prepare for filing Form 1120-F, foreign corporations must gather essential documents such as financial statements, tax identification numbers, and supporting legal documents. Comprehensive records of gross income, deduction calculations, and any necessary adjustments must be accounted for to ensure accurate reporting.

Common mistakes occur in areas like reporting income types or forgetting to include specific schedules. Utilizing tools for document management, like pdfFiller, can streamline the preparation process, enabling corporations to create, edit, and store forms efficiently.

A step-by-step guide to filling out Form 1120-F

Filing out Form 1120-F requires attention to several distinct sections, starting with Page 1, where basic entity details such as name, address, and reason for filing are documented. Accurate input of these foundational details lays the groundwork for the rest of the form.

Continuing to Page 2, corporations must report income, gains, and losses, focusing on U.S. source income while applying deductions accordingly. Page 3 covers tax liabilities, detailing applicable tax rates and available credits, providing clear guidelines on estimating taxes owed.

Filing methods for Form 1120-F

Filing Form 1120-F can generally be accomplished either through paper filing or e-filing, with each method possessing distinct advantages. E-filing, particularly with platforms like pdfFiller, enhances efficiency by allowing immediate submission and confirmation, which is vital for meeting IRS deadlines.

Moreover, e-filing reduces the risks associated with paper documentation, such as misplacement or errors during manual data entry, and also typically leads to faster processing and refunds.

Protecting your interests: Understanding protective returns

A protective return serves as a safeguard for foreign corporations while they clarify their tax obligations. Filing a protective return is advisable in cases where the corporation is unsure about the extent of its income or connections to the U.S. business activities.

The benefits of filing such returns include avoiding penalties for late filing and protecting the corporation's rights concerning potential deductions or refunds that may arise from future clarification of its tax status.

Consequences of failing to file Form 1120-F

Failing to file Form 1120-F can result in significant penalties, including late filing fees and interest accumulation on unpaid taxes. Foreign corporations that neglect their filing obligations not only face financial consequences but also legal ramifications due to non-compliance with U.S. tax laws.

It’s crucial for corporations to understand the potential impact of these penalties on their business operations and to take timely action to remedy any late filings. Remedies for late filers may include submitting the return as soon as possible and discussing mitigation options with tax professionals.

Frequently asked questions about Form 1120-F

Common misunderstandings about Form 1120-F often arise due to the complexities surrounding foreign tax obligations. For example, many foreign corporations mistakenly assume that all U.S. income is exempt from reporting, overlooking vital docuements that could affect their tax liabilities.

Addressing these misconceptions is essential to avoid penalties and ensure compliance. It is also advisable to seek assistance from tax professionals familiar with international taxation.

Leveraging pdfFiller for efficient form management

pdfFiller provides an array of features that cater specifically to the needs of foreign corporations filing Form 1120-F. With its document editing capabilities, users can easily input necessary data, add signatures electronically, and collaborate with team members—all from a secure, cloud-based platform.

Utilizing pdfFiller enables companies to stay organized, ensuring all tax documents are readily accessible and securely stored. Customer testimonials highlight the effectiveness of this platform in simplifying the filing and management process, promoting better compliance with U.S. tax regulations.

Key takeaways for successfully filing Form 1120-F

Successfully filing Form 1120-F hinges on understanding the key steps involved—from preparing the necessary documents to accurately completing and submitting the form. Awareness of deadlines and maintaining compliance with U.S. tax regulations is fundamental for foreign corporations engaged in business in the United States.

Leveraging tools like pdfFiller can enhance this process, providing corporations with the means to efficiently manage their documents while ensuring accuracy and compliance. Digital filing capabilities not only streamline the process but also reduce potential errors associated with paper-based submissions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit instructions for form 1120f from Google Drive?

Can I create an electronic signature for the instructions for form 1120f in Chrome?

How do I fill out instructions for form 1120f on an Android device?

What is instructions for form 1120f?

Who is required to file instructions for form 1120f?

How to fill out instructions for form 1120f?

What is the purpose of instructions for form 1120f?

What information must be reported on instructions for form 1120f?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.