MO MO-C 2025-2026 free printable template

Get, Create, Make and Sign MO MO-C

How to edit MO MO-C online

Uncompromising security for your PDF editing and eSignature needs

MO MO-C Form Versions

How to fill out MO MO-C

How to fill out form mo-c - 2022

Who needs form mo-c - 2022?

Form MO- - 2022 Form: A Comprehensive How-to Guide

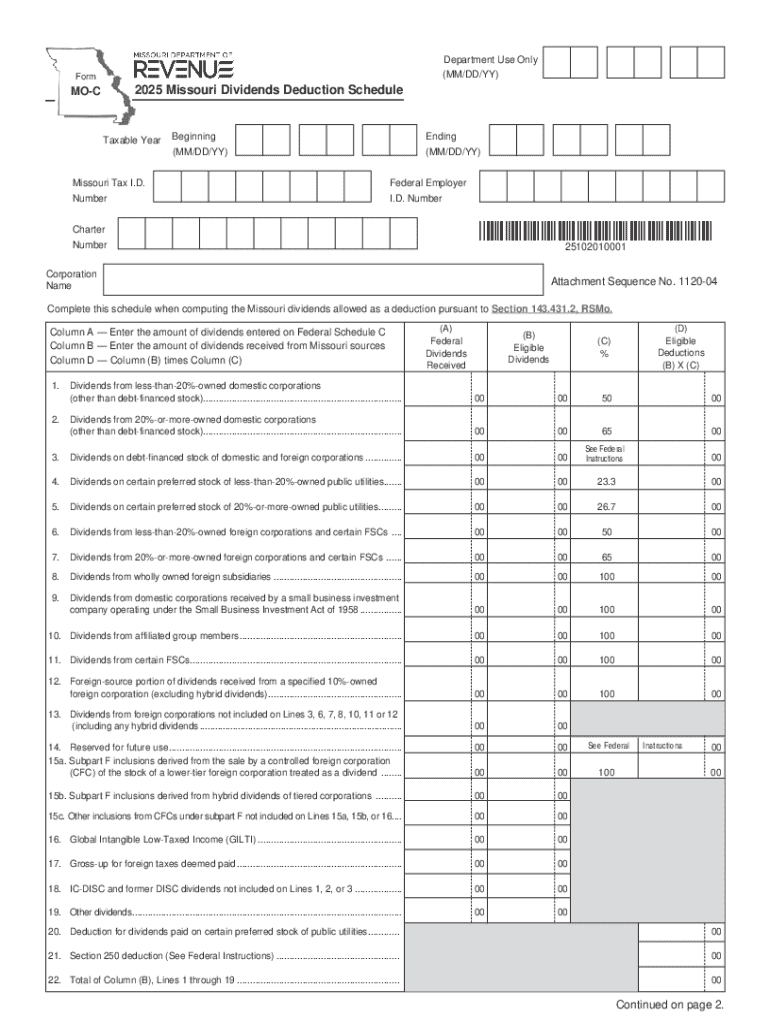

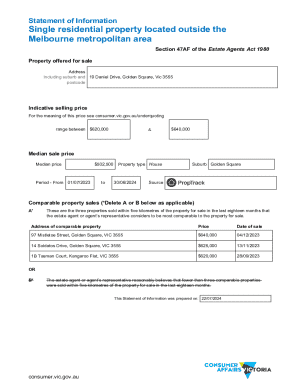

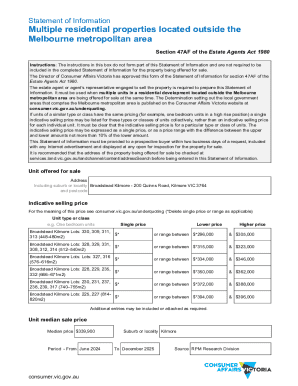

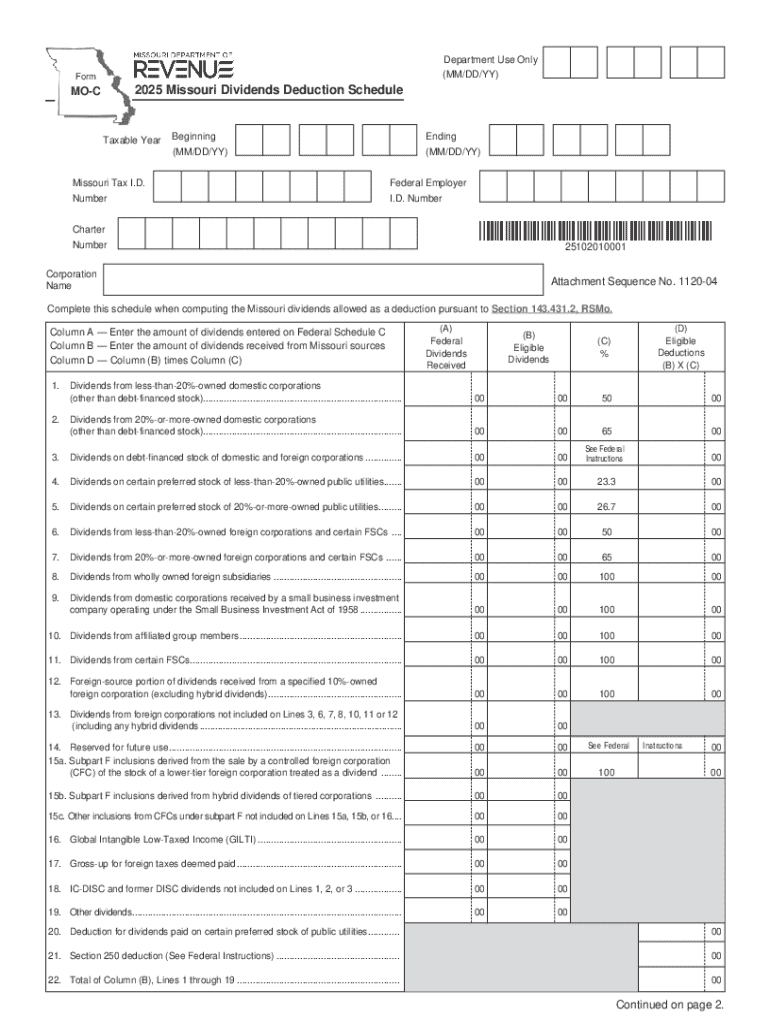

Overview of Form MO- - 2022

Form MO-C is a crucial document used within Missouri tax procedures, specifically designed for individuals and teams to report income derived from various sources. The form acts as a supplemental income document for residents needing accountability in their financial disclosures. It plays a significant role in accurately computing state taxes owed or refunds eligible due to various income scenarios.

This form is pivotal for individuals who have multiple income streams or claim specific credits and deductions that require detailed reporting. For example, freelancers, part-time workers, or individuals with rental properties often find this form integral for organizing their financial information related to state taxes.

Key features of Form MO- - 2022

What distinguishes Form MO-C from other Missouri tax forms is its emphasis on supplementary income reporting. While other forms might focus solely on primary wage income, Form MO-C delves into additional income sources, ensuring taxpayers account for everything comprehensively. This distinctiveness is vital for maintaining compliance with state tax laws, as failure to report secondary income could lead to discrepancies and potential penalties.

This form often encompasses credits available to taxpayers based on their unique financial situations, allowing for optimal tax savings and compliance. A thorough understanding of Form MO-C ensures that taxpayers remain within legal bounds while maximizing their entitled tax benefits.

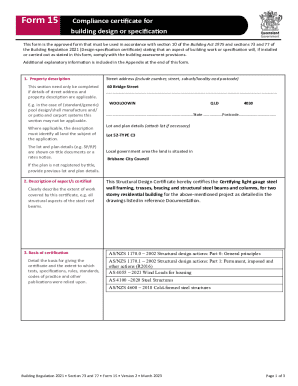

Preparing to complete Form MO- - 2022

Before diving into filling out Form MO-C, it’s crucial to gather the necessary documentation. Essential items include income statements from various sources, documentation of all applicable deductions, and past tax return records. Having all pertinent information organized in one place accelerates the completion process and reduces the likelihood of errors.

Eligibility to use Form MO-C typically extends to individuals who receive income that must be reported in addition to traditional wages. This includes freelancers, contractors, or anyone who earns money from side businesses. Recognizing eligibility ensures that taxpayers use the correct forms and maintain compliance with tax regulations.

Step-by-step instructions for filling out Form MO- - 2022

Completing Form MO-C can seem daunting, but it can be manageable by breaking it down section-by-section. Below are detailed instructions for filling out each area of the form.

Common mistakes to avoid

When filling out Form MO-C, certain areas are commonly overlooked. For example, taxpayers often forget to report all income sources or miscalculate their deductions. Such mistakes might seem minor but can lead to significant tax discrepancies.

To double-check entries, it's wise to have another set of eyes review the completed form before submission. Engaging a friend or colleague to look over the details can help catch errors or omissions you might have missed during the stress of filing.

Tips for efficient form completion

To enhance the efficiency of completing Form MO-C, consider utilizing pdfFiller’s interactive tools. This platform allows for easy editing, form-filling, and tracking within a user-friendly interface, making it straightforward to navigate through the details required on the form.

Collaboration within teams is also facilitated through pdfFiller, enabling multiple users to work on shared documents seamlessly. This collaborative aspect ensures that input from various team members contributes to a more thorough completion of the form.

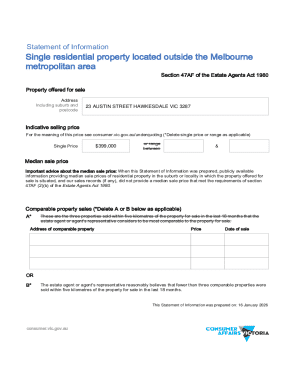

Submitting Form MO- - 2022

Form MO-C can be submitted conveniently online through pdfFiller or via traditional mail. Choosing the online route typically expedites the processing time significantly, providing immediate confirmation of submission.

It is essential to be aware of the important deadlines for submission to avoid any penalties or late fees. The final date for submitting this form aligns with Missouri’s overall tax deadline, generally in mid-April of each year.

Post-submission steps

Tracking your submission after filing Form MO-C is also an essential step. Keeping a record of submitted documents and any confirmations received can minimize anxiety while waiting for approval from the tax authority.

If issues arise after submission, it's advisable to contact the tax department promptly. Understanding potential repercussions and knowing how to rectify any discrepancies is vital for maintaining compliance.

Using pdfFiller for ongoing document management

Leveraging a cloud-based platform like pdfFiller for document management offers numerous benefits. The platform allows users to store and retrieve forms easily, maintain a history of changes, and ensure compliance all year round, not just during tax season.

Additionally, features for eSigning and collaboration enhance the document management experience. Users can collaborate on documents in real time, enabling teams to pull together efforts on tax filings and ensuring accuracy and efficiency.

FAQs about Form MO- - 2022

To assist users in navigating Form MO-C, here are some frequently asked questions that address common concerns around the form.

Enhancing your document management skills

Further, exploring the resources available through pdfFiller can greatly benefit document management skills. The various tools and courses provide valuable insights into effective document handling, enhancing proficiency.

Interactive tutorials and webinars can also give users direct experience in utilizing the platform efficiently while mastering best practices in document creation and management, ensuring you're always prepared.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify MO MO-C without leaving Google Drive?

Can I sign the MO MO-C electronically in Chrome?

How do I complete MO MO-C on an iOS device?

What is form mo-c - 2022?

Who is required to file form mo-c - 2022?

How to fill out form mo-c - 2022?

What is the purpose of form mo-c - 2022?

What information must be reported on form mo-c - 2022?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.