Get the free Form 53-C - Consumer's Use Tax Return - dor mo

Get, Create, Make and Sign form 53-c - consumeramp039s

Editing form 53-c - consumeramp039s online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 53-c - consumeramp039s

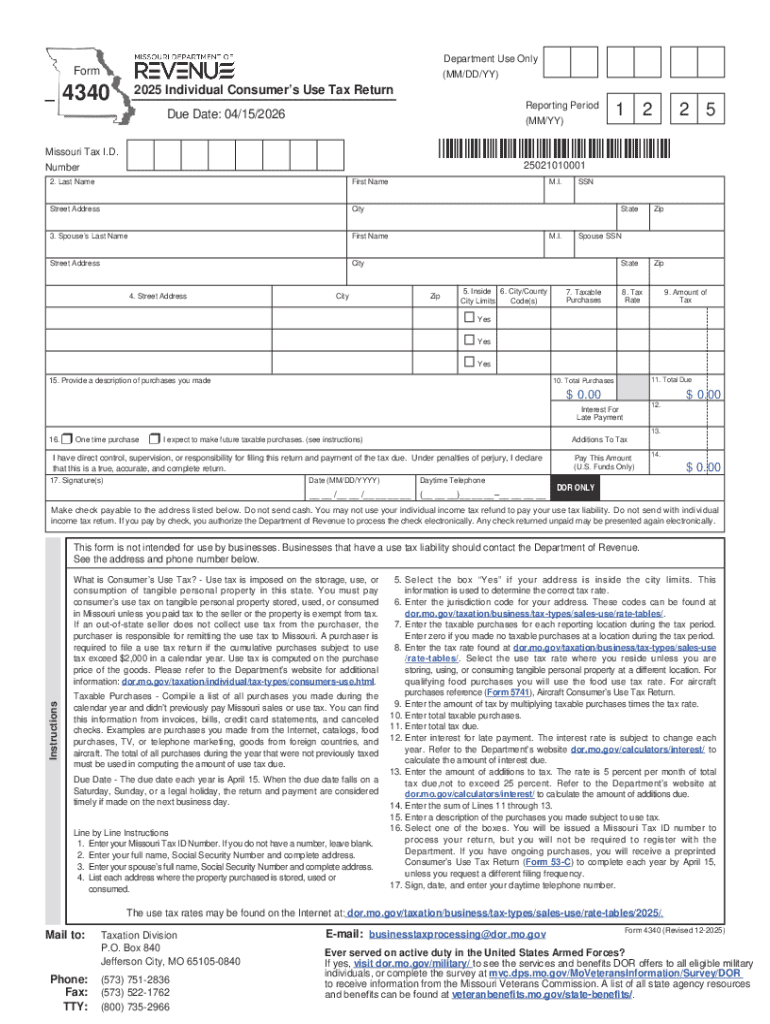

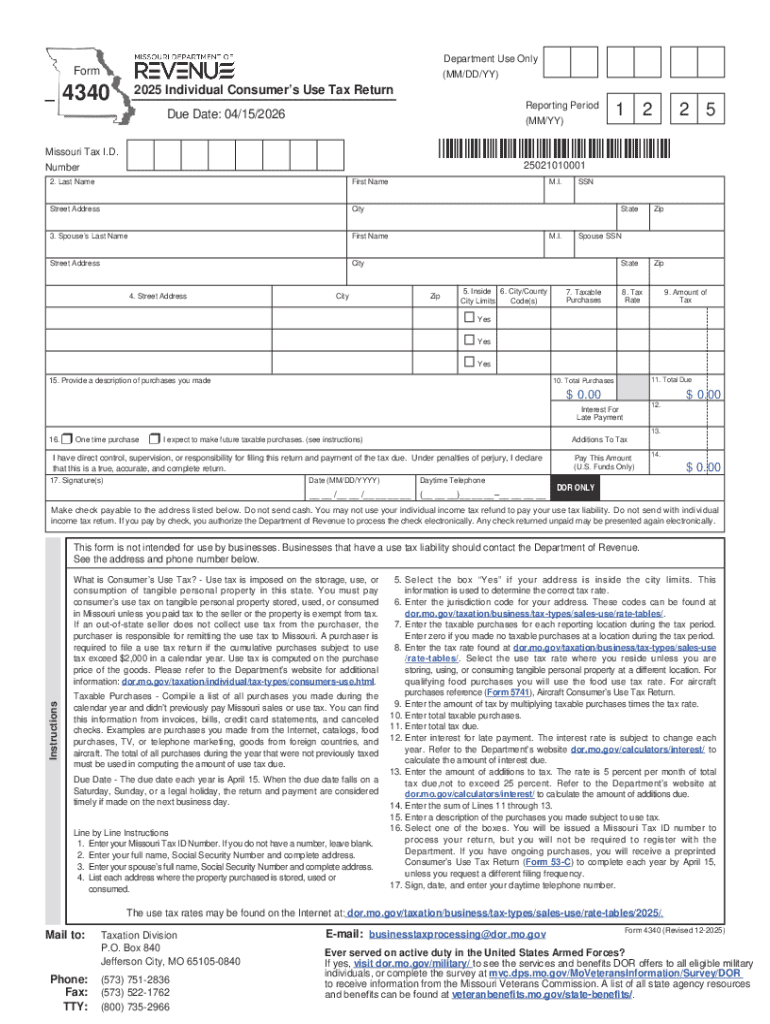

How to fill out 4340 - 2021 individual

Who needs 4340 - 2021 individual?

4340 - 2021 Individual Form: Your Comprehensive How-to Guide

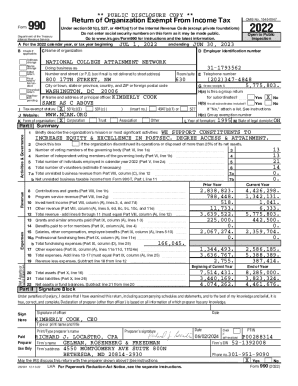

Understanding the 4340 - 2021 individual form

The 4340 - 2021 individual form is a crucial document in the realm of tax filing. Designed specifically for individuals, this form allows taxpayers to report their income, claim deductions, and explore a variety of credits applicable for the fiscal year. Utilizing this form is not merely a bureaucratic requirement but a significant step in ensuring that your tax obligations are met accurately and efficiently.

Importance of the 4340 - 2021 individual form cannot be overstated. It serves as the primary vehicle for individuals to communicate their financial situation to the IRS, which is essential for avoiding penalties and ensuring compliance. Failing to fill this form correctly could lead to complications, including audits or unexpected tax liabilities.

Who should use the 4340 form? Primarily, individuals who have taxable income above the threshold set by the IRS, those who are self-employed, and individuals seeking to claim refunds through deductions or credits must utilize this form. It’s vital for anyone navigating the complexities of the U.S. tax system.

Key features of the 4340 - 2021 individual form

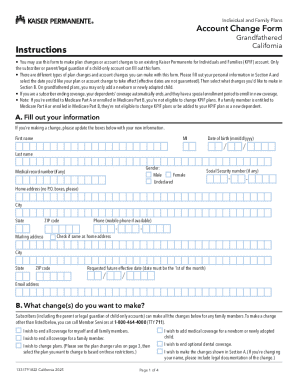

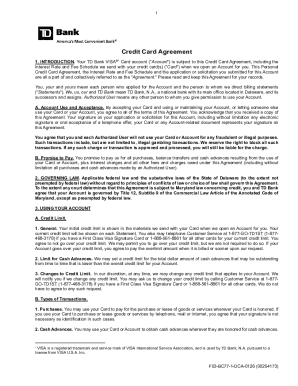

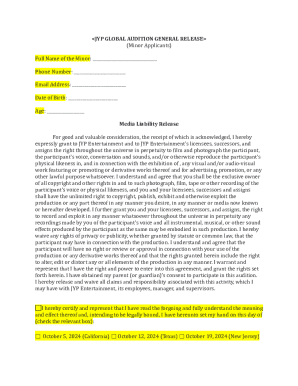

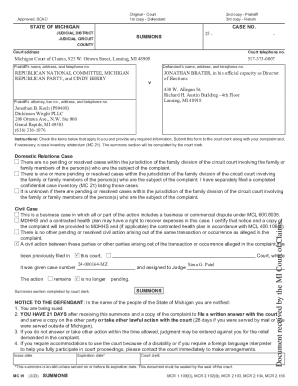

The 4340 - 2021 individual form comprises multiple sections that cater to different financial aspects. The key sections include Personal Information, Adjusted Gross Income, and Deductions and Credits. Each section has its distinct purpose and requires specific information to be accurately filled in.

Sections of the form explained

1. **Personal Information**: This section captures basic details such as your name, address, and Social Security number. Ensuring these details are accurate is crucial for the IRS to process your submission efficiently.

2. **Adjusted Gross Income (AGI)**: Your AGI is a central element in determining your tax liability. It encompasses all income sources while considering applicable adjustments. Providing the correct AGI is fundamental as it directly influences deductions and tax credits eligibility.

3. **Deductions and Credits**: This part allows taxpayers to itemize deductions or opt for the standard deduction, helping to reduce taxable income. Understanding which credits you qualify for can significantly decrease your tax bill.

It’s also important to be aware of common errors to avoid while filling out this form. These may include miscalculating figures, neglecting to sign the form, or entering incorrect personal information, all of which can lead to delays or problems with your tax filing.

Step-by-step instructions for completing the 4340 form

Completing the 4340 - 2021 individual form is a structured process. To ensure accuracy and compliance, follow these organized steps:

Tips for editing and modifying the 4340 form with pdfFiller

Editing and modifying your 4340 - 2021 individual form has never been easier with pdfFiller. Utilizing the editing tools provided by pdfFiller not only streamlines the process but also enhances your overall experience when managing your documents.

Making real-time changes to your form is efficient; errors can be corrected instantly, and you can save multiple versions if necessary to track changes or explore various scenarios. Adjusting text, adding images, or rearranging sections can be done with a few clicks.

Adding eSignatures is also simplified with pdfFiller. Users can easily sign their forms electronically, alleviating the need for printing, signing, and scanning, thus making the entire process smoother and more eco-friendly.

Collaborative features of pdfFiller for the 4340 form

PdfFiller shines in its collaborative features. Inviting team members for feedback on your completed 4340 form allows for a communal approach to tax filing. This feature can be particularly useful for individuals who work in teams, such as freelancers or small business owners.

Tracking changes and comments helps maintain version control, ensuring that all edits are documented and visible. Secure sharing options protect your sensitive financial data while allowing others to review or contribute to your form.

Managing your 4340 form documents

Once you've completed your 4340 - 2021 individual form, understanding how to manage your documents is essential. PdfFiller offers various options for saving your completed form securely within the platform.

Organizing forms for future reference can streamline your tax preparation for subsequent years. Utilize folders and tags to categorize your forms systematically. Additionally, accessing your forms anywhere is a breeze with pdfFiller’s cloud-based solution, enabling you to pull up your documents from any device with internet access.

Frequently asked questions about the 4340 - 2021 individual form

When dealing with tax forms, questions often arise. If you make a mistake when completing the 4340 form, it’s essential to correct it promptly. Depending on the nature of the error, you may need to amend your submission. A clear understanding of how to amend your form after submission is vital.

Be aware of deadlines and important dates associated with the 4340 form to ensure compliance with tax regulations. Setting personal reminders for these critical dates can prevent unnecessary stress and late submissions.

Additional tools and resources

Engaging with interactive tax calculators can provide insight into your estimated tax liability based on the information you input. This can also help in preparing for different financial scenarios.

Familiarizing yourself with related forms and understanding their functions can offer a more comprehensive approach to your tax filing process. Lastly, having direct links for state-specific requirements readily accessible can aid in ensuring compliance across different jurisdictions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my form 53-c - consumeramp039s directly from Gmail?

How do I make edits in form 53-c - consumeramp039s without leaving Chrome?

How do I edit form 53-c - consumeramp039s straight from my smartphone?

What is 4340 - 2021 individual?

Who is required to file 4340 - 2021 individual?

How to fill out 4340 - 2021 individual?

What is the purpose of 4340 - 2021 individual?

What information must be reported on 4340 - 2021 individual?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.