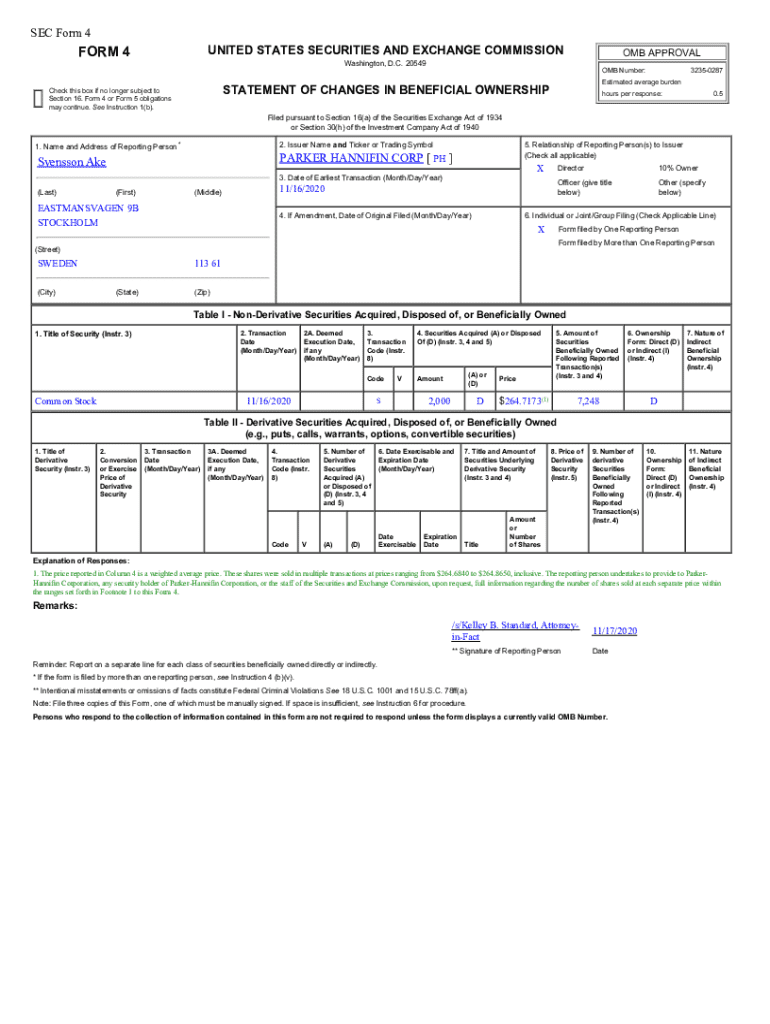

Get the free These shares were sold in multiple transactions at prices ranging from $264

Get, Create, Make and Sign formse shares were sold

Editing formse shares were sold online

Uncompromising security for your PDF editing and eSignature needs

How to fill out formse shares were sold

How to fill out formse shares were sold

Who needs formse shares were sold?

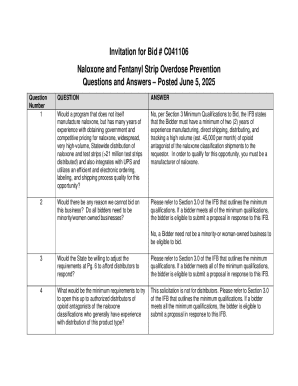

Understanding the Formse Shares Were Sold Form: A Comprehensive Guide

Understanding the Formse shares were sold form

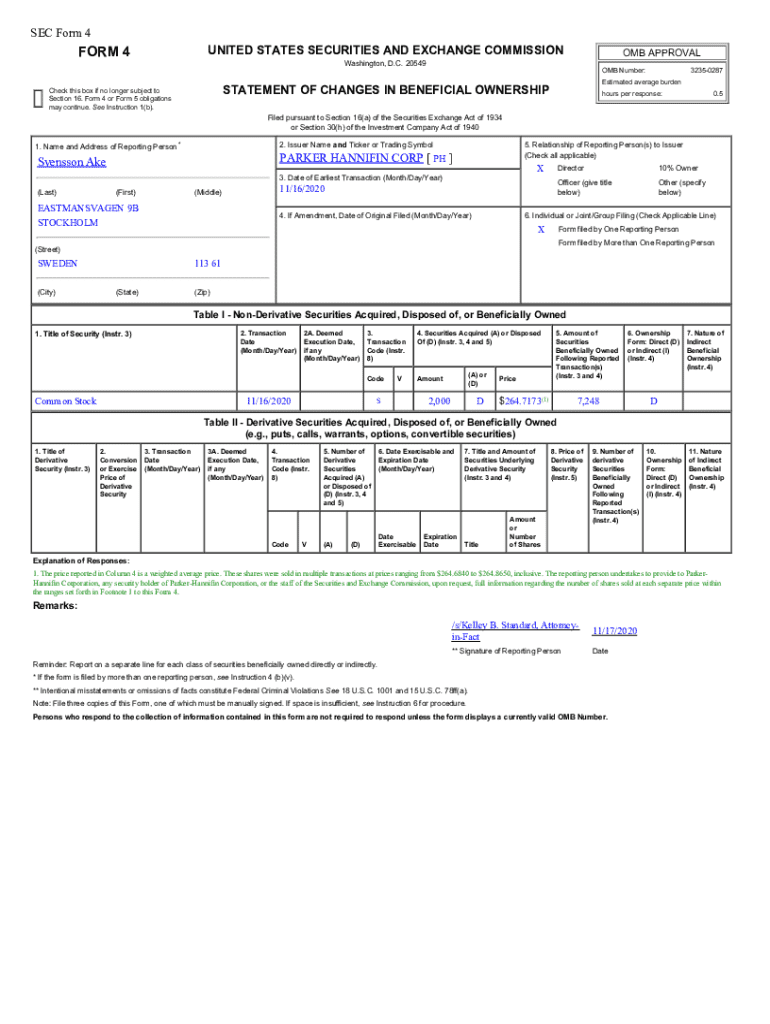

The Formse Shares Were Sold Form serves as an essential document in the realm of financial transactions. This form is specifically designed to record the sale of shares in a company, ensuring that both buyers and sellers maintain transparent and accurate records. The primary purpose of the form is to report capital gains or losses from the sale of stocks, a critical aspect that affects both personal finances and tax obligations.

Understanding this form is vital as it not only facilitates proper tax reporting but also safeguards the interests of the parties involved in the transaction. By documenting the details clearly, individuals can avoid potential disputes and ensure compliance with regulatory requirements.

Individuals and entities alike may find the need to use this form, particularly during periods of active trading or asset reallocation. Common scenarios include personal investments, corporate asset divestitures, or even estate settlements where shares are sold as part of an inheritance. It's crucial for anyone engaged in such transactions to be familiar with the nuances of the Formse Shares Were Sold Form.

The role of Formse in document management

Formse plays a significant role in document management, particularly in financial contexts like the Formse Shares Were Sold Form. As a comprehensive platform, Formse enhances the efficiency of form completion and documentation processes. Utilizing a cloud-based system, it provides accessibility from any location, allowing users to manage their forms effectively as they navigate the complexities of share transactions.

The advantages of a streamlined form completion process are manifold. Users benefit from features such as integration with various financial tools, allowing for seamless data importation. Additionally, Formse enables collaboration among teams, simplifying the process of collecting information from multiple stakeholders involved in a transaction. This is particularly valuable in corporate scenarios where multiple approvals and changes must be tracked.

Detailed breakdown of the Formse shares were sold form structure

At its core, the Formse Shares Were Sold Form comprises several key sections that provide a comprehensive snapshot of the transaction. The initial part of the form collects identification details of the seller, which are crucial for establishing the identity and legitimacy of the transaction. It is imperative to fill this section accurately to prevent any misunderstandings or legal complications.

Next, users must detail the transaction specifics, including:

Finally, the form includes reporting requirements that guide how the transaction should be reported to relevant authorities, ensuring compliance with tax laws.

Understanding common terms associated with the form, such as 'capital gains' and 'cost basis,' plays a critical role in accurately reporting financial outcomes from the sale. Capital gains refer to the profit made when shares are sold at a higher price than they were purchased, while cost basis is the original value of the shares purchased, adjusted for factors like stock splits or dividends.

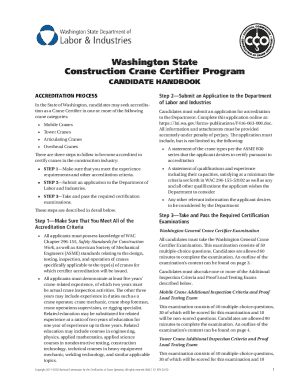

Step-by-step instructions for filling out the form

Filling out the Formse Shares Were Sold Form accurately is crucial for compliance and record-keeping. Start by gathering all necessary documentation and information concerning the shares sold. This includes purchase documents, sale agreements, and any related financial records.

Here’s a structured approach to filling out the form:

Tips for electronic submission of the form

Utilizing pdfFiller for electronic submission of the Formse Shares Were Sold Form introduces numerous advantages. The platform allows for quick completion and ease of access, saving you time and effort. One notable benefit is the ability to include eSignatures, which streamline the submission process while ensuring all parties have authenticated their consent.

Real-time collaboration features are also invaluable, particularly when multiple stakeholders need to contribute information or approve the form. For teams managing transactions together, pdfFiller offers tracking capabilities to monitor changes and maintain version control.

To manage your forms effectively within pdfFiller, organizing your documents is critical. Create a system that allows for easy access and retrieval, grouping related documents by transaction, date, or any other relevant classification.

Common mistakes to avoid

Filling out the Formse Shares Were Sold Form can seem straightforward, but there are several common pitfalls to be aware of. One frequent error involves misreporting sales documentation, where individuals may not keep accurate records of their share transactions, leading to discrepancies in reporting.

Another common mistake is incorrect calculation of gains or losses. This is often the result of not accounting for additional costs related to share acquisition or failing to use the correct date for valuation.

If errors occur post-submission, it's essential to know how to amend your submission effectively. Most jurisdictions allow for amendments if they are promptly filed. Keeping accurate records and documentation facilitates this correction process and can help mitigate potential penalties.

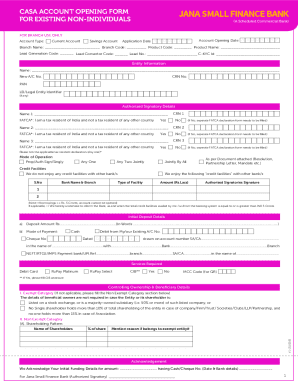

Understanding tax implications

Reporting sold shares carries tax obligations that are largely dictated by the nature of the gains realized from the transaction. The capital gains tax is a critical consideration, varying based on the length of time the asset was held before selling. Short-term capital gains, which are applied to assets held for less than one year, are taxed at ordinary income rates, while long-term capital gains enjoy preferential tax rates.

Another aspect to consider is the concept of wash sales, which occurs when an individual sells a security at a loss and repurchases the same or substantially identical security within 30 days. This can complicate reporting and may negate a tax deduction on the loss incurred, making it vital to keep track of all transactions meticulously.

Additional considerations

State-specific requirements can change the landscape of reporting sold shares. Regulations may differ significantly from one state to another, and it is crucial for users to familiarize themselves with their local laws to ensure compliance. For example, several states impose their tax rates on capital gains; thus, individuals must understand their obligations based on where they reside.

For further information, users should refer to IRS guidelines regarding tax obligations related to share sales. Additionally, resources available through pdfFiller can be pivotal in streamlining future documentation needs, guiding users through various forms with ease.

Enhanced features of pdfFiller for managing Formse shares were sold form

The tools provided by pdfFiller offer extensive capabilities aimed at enhancing the user experience for managing the Formse Shares Were Sold Form. Collaborative tools stand out, particularly in team settings where document sharing and the ability to track changes in real time can significantly reduce miscommunication and errors.

Security features are also robust, ensuring that sensitive financial information is protected throughout the documentation process. Advanced data protection measures offer peace of mind for users who manage a multitude of financial documents online.

Moreover, pdfFiller integrates seamlessly with other applications, providing flexibility and efficiency. This synergy enables users to connect their existing financial solutions and enhances the overall functionality, making document creation and management a more cohesive experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in formse shares were sold?

How can I fill out formse shares were sold on an iOS device?

How do I complete formse shares were sold on an Android device?

What is formse shares were sold?

Who is required to file formse shares were sold?

How to fill out formse shares were sold?

What is the purpose of formse shares were sold?

What information must be reported on formse shares were sold?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.