NY DTF DTF-17-I 2010 free printable template

Show details

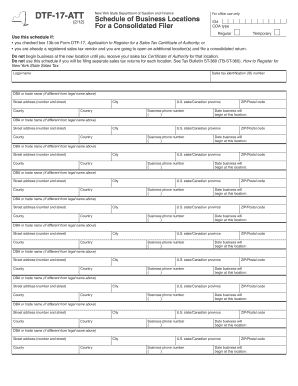

New York State Department of Taxation and Finance Instructions for Form DTF-17 DTF-17-I Application to Register for a Sales Tax Certificate of Authority Online registration Line instructions You can submit your application online. Lines 12a and 12b If you are a franchisee mark an X in the Yes box and enter the name and address of your franchisor. and want to file a separate return for each you must obtain a separate box to indicate whether you will file one return for all locations or a...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NY DTF DTF-17-I

Edit your NY DTF DTF-17-I form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NY DTF DTF-17-I form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing NY DTF DTF-17-I online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit NY DTF DTF-17-I. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Dealing with documents is simple using pdfFiller. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NY DTF DTF-17-I Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NY DTF DTF-17-I

How to fill out NY DTF DTF-17-I

01

Obtain the NY DTF DTF-17-I form from the New York State Department of Taxation and Finance website or your local tax office.

02

Read the instructions provided on the form carefully to ensure you understand each section.

03

Fill in your personal information at the top of the form, including your name, address, and taxpayer identification number.

04

Complete the tax period section, indicating the year or period for which you are filing.

05

Provide details about your income sources, deductions, and credits as required on the form.

06

Review all entries for accuracy and completeness to avoid processing delays.

07

Sign and date the form at the designated area before submission.

08

Submit the completed form via mail or online, as directed in the form instructions.

Who needs NY DTF DTF-17-I?

01

Individuals and businesses filing their New York State tax returns who have specific tax situations as indicated by the form.

02

Taxpayers who are required to report certain income types or claim particular credits or deductions related to their tax liability.

03

People seeking to amend their previous tax returns by using this form.

Instructions and Help about NY DTF DTF-17-I

Fill

form

: Try Risk Free

People Also Ask about

Does a NYS certificate of Authority expire?

Renewal of Sales Tax Certificate of Authority Renewal is mandatory for all registered sales tax vendors. If you fail to renew your certificate before the expiration date on your letter, it will be illegal for you to conduct any business subject to New York State sales and use tax law.

What is the difference between a certificate of Authority and a resale certificate in New York?

Expiration of a New York Resale certificate While a resale certificate itself doesn't expire, a certificate of authority is valid for a maximum of three years and is “renewable at the discretion of the Department of Taxation and Finance."

How long is a certificate of Authority good for in NY?

Expiration of a New York Resale certificate While a resale certificate itself doesn't expire, a certificate of authority is valid for a maximum of three years and is “renewable at the discretion of the Department of Taxation and Finance."

How do I get a certificate of Authority for New York State?

To apply for a Certificate of Authority use New York Business Express. Your application will be processed and, if approved, we'll mail your Certificate of Authority to you. You cannot legally make any taxable sales until you have received your Certificate of Authority.

What is a NYS certificate of Authority?

The Certificate of Authority gives you the right to collect tax on your taxable sales and to issue and accept most New York State sales tax exemption certificates. Generally, the seller collects the tax from the purchaser and remits it to New York State.

How long does it take to get sales tax certificate NYS?

This can be done online through the state's Business Wizard portal and should be completed 20 or more days before you begin making taxable sales in New York. Complete Form DTF-17, Application to Register for a Sales Tax Certificate of Authority, and the certificate will be mailed to you within five business days.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify NY DTF DTF-17-I without leaving Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your NY DTF DTF-17-I into a dynamic fillable form that you can manage and eSign from anywhere.

How do I complete NY DTF DTF-17-I online?

Easy online NY DTF DTF-17-I completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

How do I fill out the NY DTF DTF-17-I form on my smartphone?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign NY DTF DTF-17-I and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

What is NY DTF DTF-17-I?

NY DTF DTF-17-I is a form used for reporting New York State tax information, specifically related to the New York State tax credits.

Who is required to file NY DTF DTF-17-I?

Individuals or businesses that qualify for certain New York State tax credits and are required to report their eligibility and calculations must file NY DTF DTF-17-I.

How to fill out NY DTF DTF-17-I?

To fill out NY DTF DTF-17-I, individuals need to provide their personal information, calculate the applicable tax credits, and report any relevant financial data as outlined in the form instructions.

What is the purpose of NY DTF DTF-17-I?

The purpose of NY DTF DTF-17-I is to help taxpayers report their eligibility for specific tax credits and to provide the necessary information for the state to process these credits.

What information must be reported on NY DTF DTF-17-I?

The information that must be reported on NY DTF DTF-17-I includes taxpayer identification details, tax credit eligibility, calculations, and any supporting financial information as specified in the form.

Fill out your NY DTF DTF-17-I online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NY DTF DTF-17-I is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.