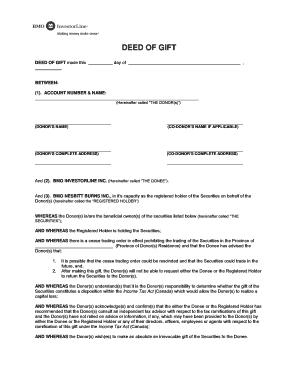

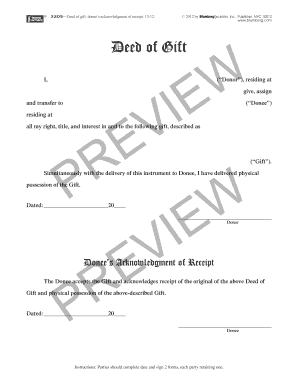

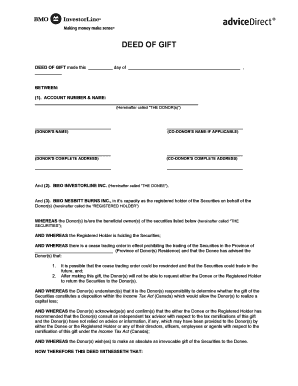

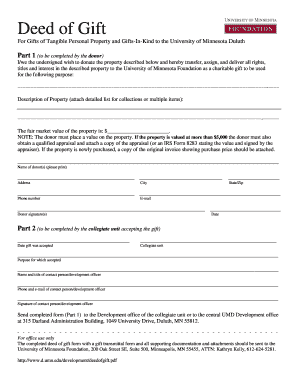

What is Deed Of Gift Form?

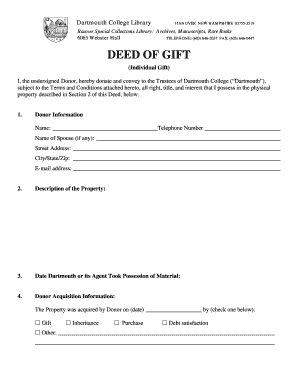

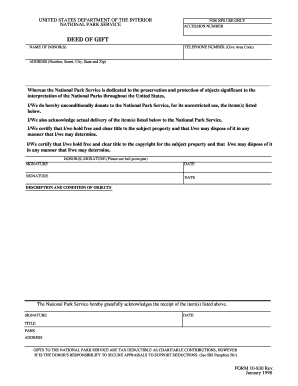

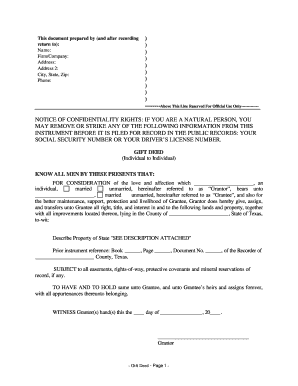

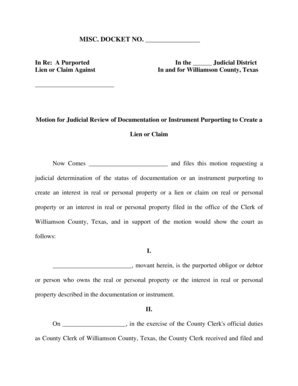

A Deed of Gift Form is a legal document that transfers ownership of a tangible or intangible asset from one party, known as the donor, to another party, called the donee. It is a way to legally record and document the voluntary transfer of property without any financial exchange. This form is commonly used when individuals want to gift property, such as a vehicle, real estate, artwork, or other valuables, to another person or organization.

What are the types of Deed Of Gift Form?

There are several types of Deed of Gift Forms that can be used, depending on the specific circumstances and requirements of the gift. Some common types include:

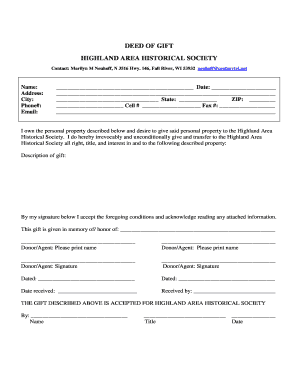

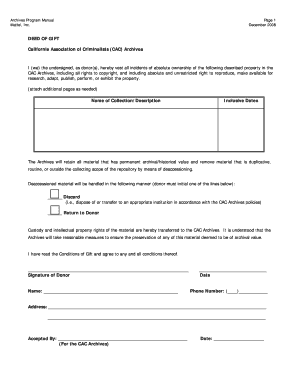

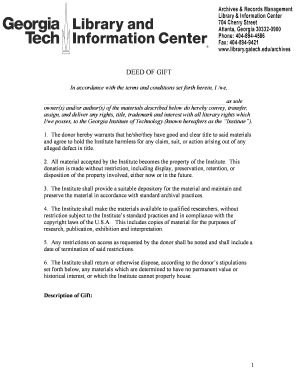

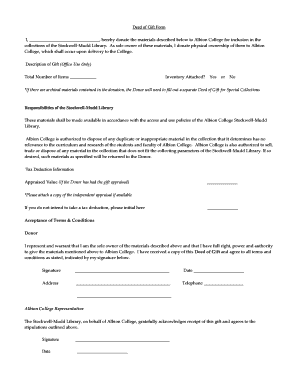

Personal Property Deed of Gift: This form is used to transfer ownership of personal items such as jewelry, artwork, antiques, or collectibles.

Real Estate Deed of Gift: This form is used when a donor wishes to gift a property, such as a house, land, or building, to another person or organization.

Automobile Deed of Gift: This form is specifically designed for transferring ownership of a vehicle from one party to another as a gift.

Intellectual Property Deed of Gift: This form is used for transferring ownership of intellectual property rights, such as patents, copyrights, or trademarks, from one party to another.

Financial Asset Deed of Gift: This form is used for gifting financial assets like stocks, bonds, or mutual funds from one party to another.

How to complete Deed Of Gift Form

Completing a Deed of Gift Form is a relatively straightforward process. Here are the general steps to follow:

01

Begin by obtaining a Deed of Gift Form that is appropriate for the type of gift you wish to make. You can find templates online or consult an attorney for assistance.

02

Fill out the donor's information, including name, address, and contact details.

03

Provide the details of the donee, such as their name, address, and relationship to the donor.

04

Clearly describe the gift being transferred, including any relevant details such as make, model, or identification numbers.

05

Include any terms or conditions associated with the gift, such as restrictions on use or future transfer.

06

Sign and date the Deed of Gift Form in the presence of a notary public or witnesses, if required by your jurisdiction.

07

Make copies of the completed form for your records and provide a copy to the donee for their reference.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.