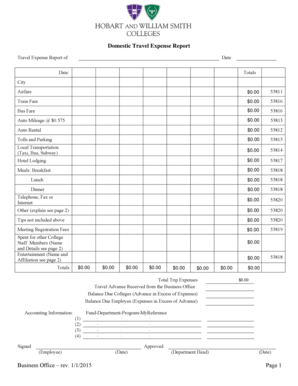

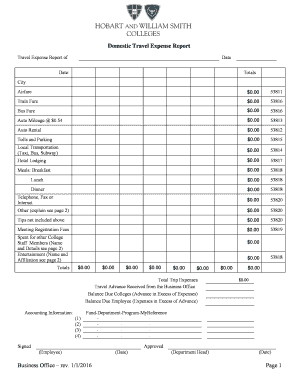

Domestic Travel Expense Report - Page 2

What is Domestic Travel Expense Report?

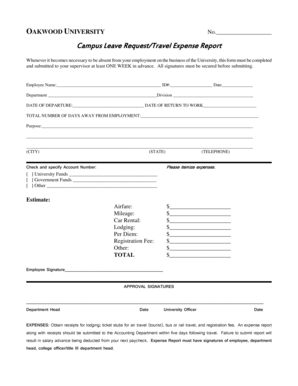

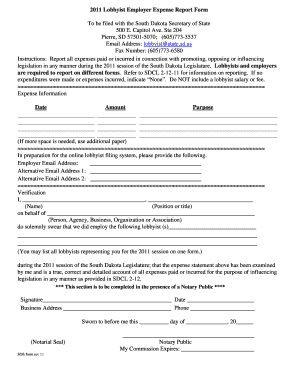

A Domestic Travel Expense Report is a document that helps individuals or organizations track and report their expenses related to domestic travel. It is usually used by employees, contractors, or freelancers who need to be reimbursed for their travel expenses.

What are the types of Domestic Travel Expense Report?

There are various types of Domestic Travel Expense Reports that may be used depending on the specific needs and policies of an organization. Some common types include: 1. Employee Travel Expense Report 2. Contractor Travel Expense Report 3. Freelancer Travel Expense Report 4. Business Travel Expense Report These different types cater to the unique requirements and guidelines set by each organization.

How to complete Domestic Travel Expense Report

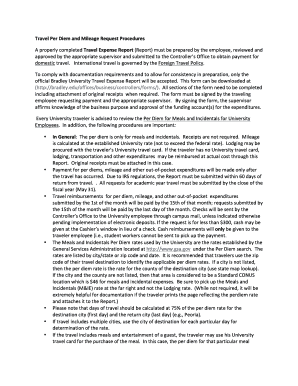

Completing a Domestic Travel Expense Report can be done with the following steps:

pdfFiller is an excellent tool that empowers users to easily create, edit, and share their Domestic Travel Expense Reports online. With unlimited fillable templates and powerful editing tools, pdfFiller eliminates the hassle of manual paperwork and streamlines the process of completing expense reports. By using pdfFiller, users can efficiently manage their travel expenses and ensure accurate reimbursement.