How To Write A Payment Contract

What is how to write a payment contract?

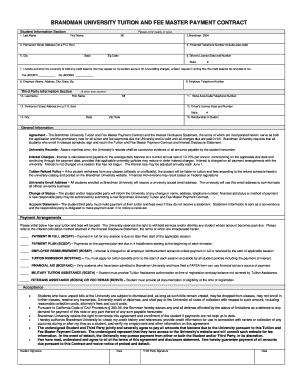

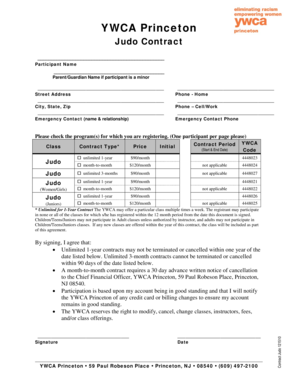

A payment contract is a legally binding agreement between two parties that outlines the terms and conditions for payment of goods or services. It is essential to clearly outline the payment schedule, payment methods, and consequences for non-payment or late payment in the contract. By creating a payment contract, you can ensure that both parties are aware of their obligations and can avoid any potential disputes or misunderstandings.

What are the types of how to write a payment contract?

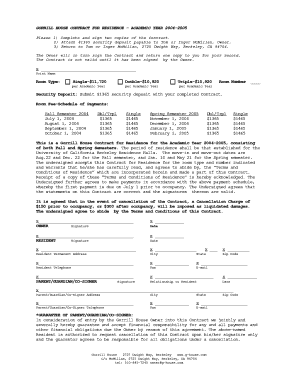

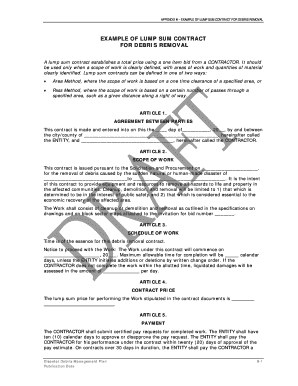

There are several types of payment contracts that you can write depending on the nature of the transaction. Some common types include: 1. Lump Sum Payment Contract: This type of contract requires a one-time fixed payment for the goods or services provided. 2. Installment Payment Contract: In this type of contract, the payment is divided into multiple installments, usually with specific due dates and amounts. 3. Retainer Payment Contract: This contract is commonly used in professional services such as legal or consulting, where a retainer fee is paid upfront to secure services throughout a specific period. 4. Milestone Payment Contract: This type of contract specifies that payments will be made upon the completion of specific milestones or deliverables.

How to complete how to write a payment contract

To complete a payment contract, follow these steps: 1. Identify the parties involved: Clearly state the names and contact information of both the payer and payee. 2. Define the payment terms: Specify the payment amount, due dates, and acceptable methods of payment. 3. Include late payment penalties or interest rates: Outline the consequences for non-payment or late payment, such as additional fees or interest. 4. Outline dispute resolution procedures: Include provisions for resolving any disputes that may arise regarding the payment contract. 5. Review and sign the contract: Both parties should carefully review the contract and sign it to demonstrate their agreement.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.