Printable Bill Pay Checklist

What is a printable bill pay checklist?

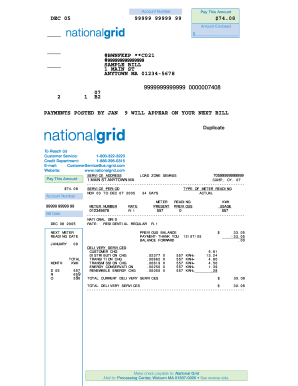

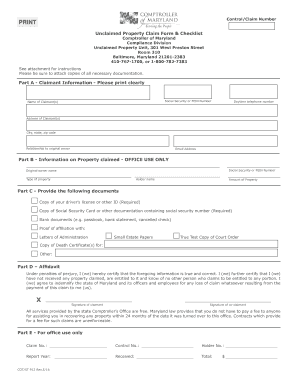

A printable bill pay checklist is a helpful tool that assists you in organizing and keeping track of your bills. It allows you to list and prioritize your expenses, ensuring that you never miss a payment. By using a printable bill pay checklist, you can stay on top of your financial obligations and avoid late fees or penalties. It is a convenient way to manage your bills efficiently and effectively.

What are the types of printable bill pay checklist?

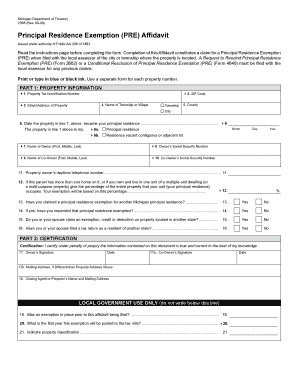

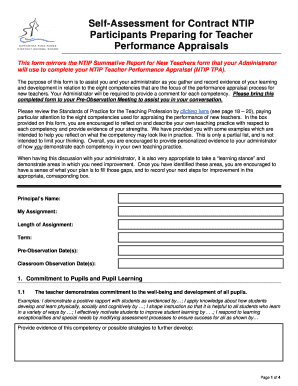

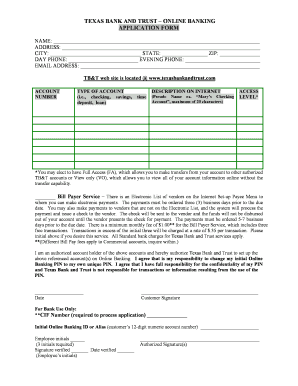

There are various types of printable bill pay checklists available to cater to different needs and preferences. Some common types include: 1. Monthly bill pay checklist: This checklist helps you keep track of your monthly bills, such as rent/mortgage, utilities, credit card payments, etc. 2. Annual bill pay checklist: This checklist allows you to plan and schedule your yearly expenses, such as insurance premiums, subscriptions, and memberships. 3. Budget bill pay checklist: This checklist helps you align your bill payments with your budget and financial goals, ensuring that you allocate the right amount of funds for each expense. 4. Business bill pay checklist: Designed for small business owners, this checklist helps keep track of business-related bills, invoices, and due dates. These are just a few examples, and you can customize your printable bill pay checklist based on your specific needs and requirements.

How to complete a printable bill pay checklist?

Completing a printable bill pay checklist is a straightforward process that can be done in a few simple steps: 1. Gather your bills: Collect all your bills, invoices, and payment reminders. 2. List your expenses: Write down each bill or expense you need to pay, along with its due date and amount. 3. Prioritize your payments: Determine which bills need to be paid first based on their due dates and importance. 4. Mark paid bills: As you make payments, check off or mark the bills as paid to keep a record. 5. Review and update regularly: Regularly review and update your checklist to reflect any changes in your bills or expenses. By following these steps, you can effectively manage your bill payments and stay organized throughout the process.

pdfFiller is an excellent tool that empowers users to create, edit, and share documents online. With its unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor you need to get your documents done easily and efficiently. Whether you're creating a printable bill pay checklist or any other document, pdfFiller offers a seamless and user-friendly experience.