What is private placement memorandum requirements?

Private placement memorandum requirements refer to the rules and regulations that must be followed when creating a private placement memorandum (PPM). A PPM is a legal document that outlines the terms and conditions of a private placement offering of securities. These requirements vary depending on the jurisdiction and the type of securities being offered. They typically include information on the company's background, the securities being offered, the risks involved, and any applicable legal disclosures.

What are the types of private placement memorandum requirements?

There are several types of private placement memorandum requirements that need to be considered when creating a PPM. Some common types include:

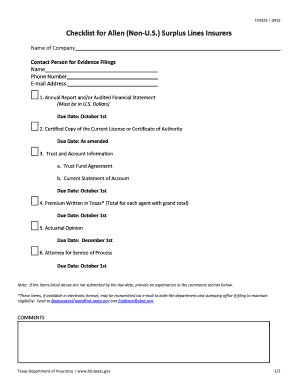

Disclosure requirements: This includes disclosing information about the company, its management team, financial statements, and any potential risks.

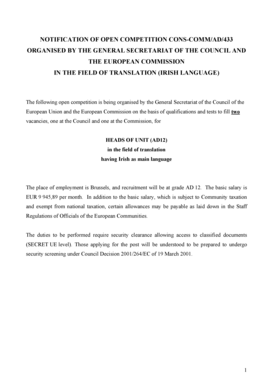

Legal requirements: This includes complying with securities laws and regulations, ensuring that all necessary documents are filed with the appropriate regulatory authorities.

Content requirements: This includes including specific information such as the use of proceeds, the terms of the offering, and any applicable investment restrictions.

Formatting requirements: This includes presenting the information in a clear, organized, and professional manner, with all necessary sections and disclosures.

Distribution requirements: This includes ensuring that the PPM is distributed to potential investors in a timely and appropriate manner, and that any necessary acknowledgments or agreements are obtained.

How to complete private placement memorandum requirements

Completing private placement memorandum requirements can be a complex process, but with the right approach, it can be done effectively. Here are some steps to help you complete the requirements:

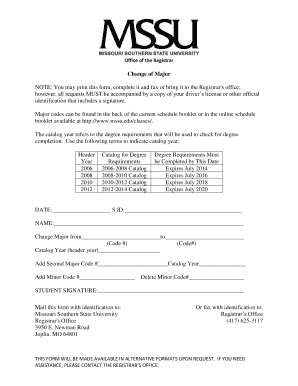

01

Gather all the necessary information: Collect all the relevant details about your company, the securities being offered, and any applicable regulations or legal requirements.

02

Create the PPM document: Use a reliable document editing tool like pdfFiller to create a well-structured and professional-looking PPM document. pdfFiller offers unlimited fillable templates and powerful editing tools to simplify the process.

03

Include all required sections and disclosures: Make sure to include all the necessary sections and disclosures as per the applicable requirements. This may include information about company background, risk factors, financial statements, and legal disclosures.

04

Review and revise: Carefully review the completed PPM document for any errors or omissions. Revise and make any necessary changes to ensure accuracy and compliance.

05

Distribute to potential investors: Share the completed PPM document with potential investors in accordance with the distribution requirements. Ensure that any necessary acknowledgments or agreements are obtained.

06

Seek legal advice if needed: If you are unsure about any aspect of completing the requirements, it is advisable to seek legal advice from an experienced professional to ensure compliance and mitigate legal risks.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.