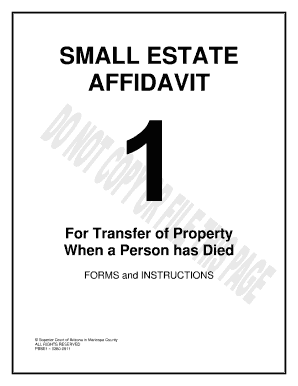

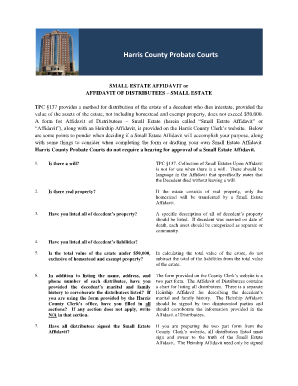

Small Estate Affidavit

What is Small Estate Affidavit?

A Small Estate Affidavit is a legal document that allows for the efficient transfer of property to heirs when a person passes away without leaving a will. It is a simplified probate process that can be used when the value of the estate falls below a certain threshold, which varies by state. The Small Estate Affidavit can help streamline the transfer of assets without the need for a lengthy and costly probate process.

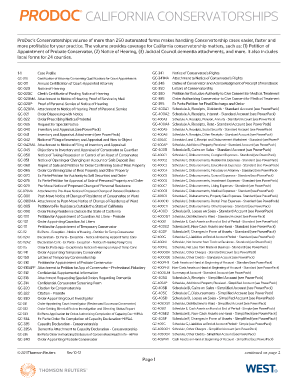

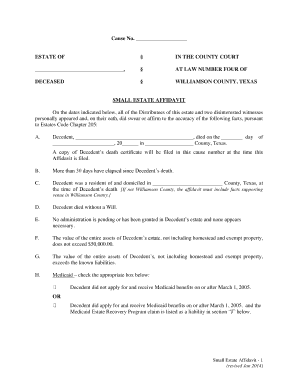

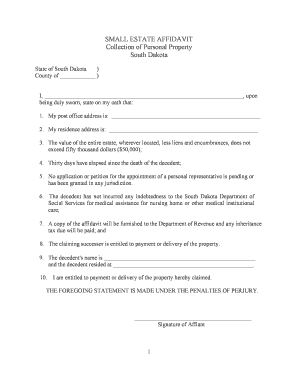

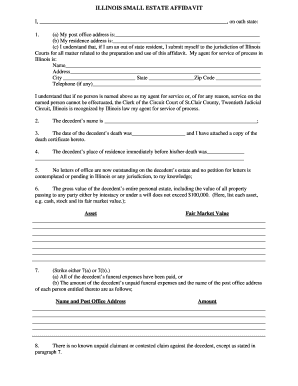

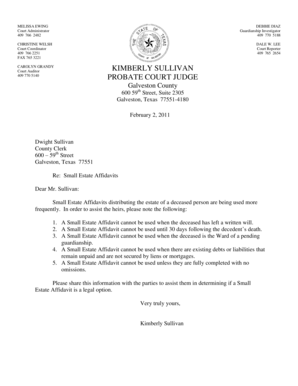

What are the types of Small Estate Affidavit?

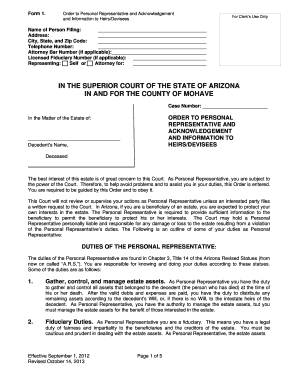

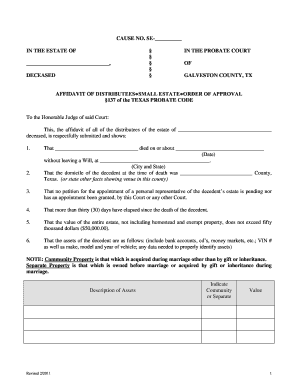

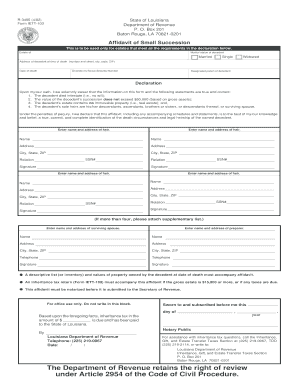

There are different types of Small Estate Affidavits available, depending on the state in which the deceased person resided. These include:

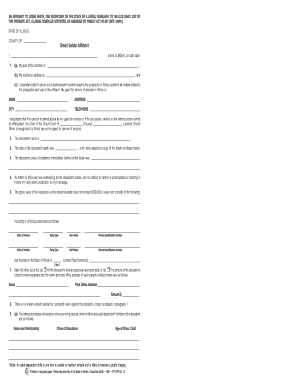

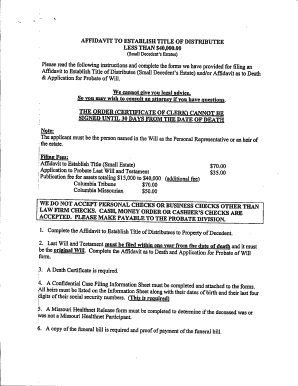

How to complete Small Estate Affidavit

Completing a Small Estate Affidavit requires attention to detail and adherence to state-specific instructions. Here is a general guide on how to complete a Small Estate Affidavit:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.