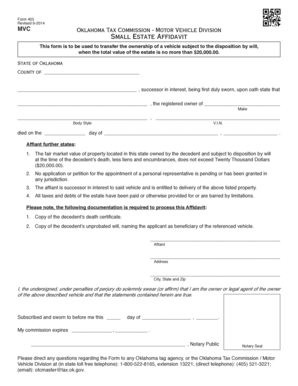

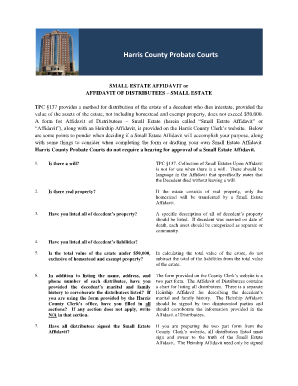

Small Estate Affidavit Form

What is Small Estate Affidavit Form?

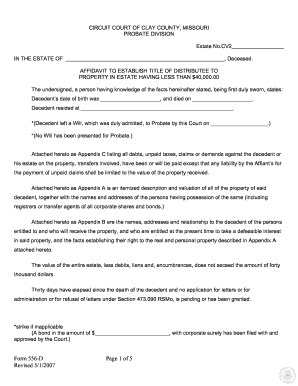

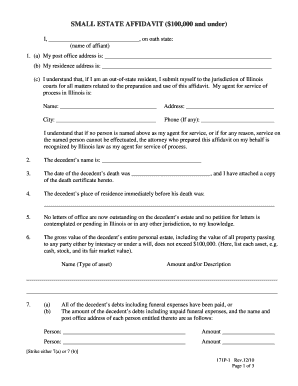

The Small Estate Affidavit Form is a legal document used to transfer the assets of a deceased person to their rightful heirs without the need for a lengthy probate process. It is typically used when the estate is of small value and there is no will.

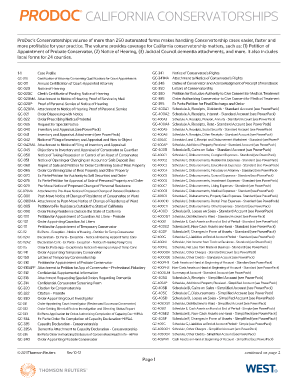

What are the types of Small Estate Affidavit Form?

There are several types of Small Estate Affidavit Forms, each designed for specific situations. These include:

Small Estate Affidavit Form for Personal Property

Small Estate Affidavit Form for Real Estate

Small Estate Affidavit Form for Vehicles

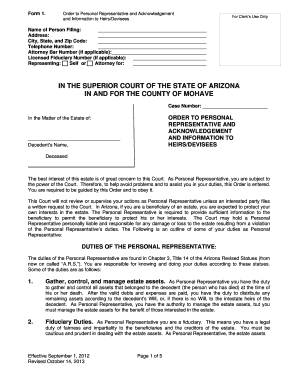

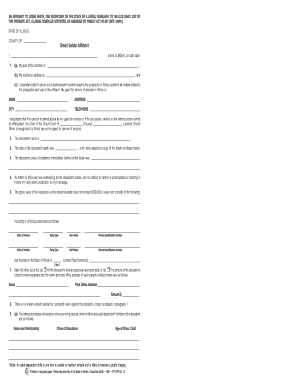

How to complete Small Estate Affidavit Form

Completing the Small Estate Affidavit Form is a straightforward process. Here are the steps to follow:

01

Begin by providing the necessary information about the deceased person, such as their full name, date of birth, and date of death.

02

Next, list the assets of the deceased person that need to be transferred. This may include personal property, real estate, vehicles, or any other assets.

03

Indicate the estimated value of each asset listed.

04

Identify the rightful heirs who are entitled to receive the assets. Provide their names, addresses, and relationship to the deceased person.

05

If required, include any supporting documentation, such as a death certificate or a copy of the will (if applicable).

06

Sign the form in the presence of a notary public, who will notarize your signature.

07

Submit the completed form to the appropriate authority, usually the probate court or the county clerk's office.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

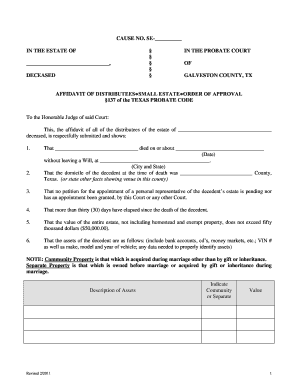

How much does an estate have to be worth to go to probate in California?

In California, if your assets are valued at $150,000 or more and they are not directed to beneficiaries through either a trust plan, beneficiary designation, or a surviving spouse, those assets are required to go through the probate process upon your incapacity or death.

How do I file a small estate affidavit in Hawaii?

How to File (4 steps) Step 1 – Make a List of Assets. Step 2 – Download and Prepare Affidavit. Step 3 – Get Affidavit Notarized. Step 4 – File with Appropriate Local Court.

How much does it cost to file a small estate affidavit in California?

Use the Court Locator and find the probate court where the decedent was a resident. The State filing fee is $435.

Can you settle an estate without probate in California?

For decedents who died prior to April 1, 2022 the California Probate Code provides that probate estates of $166,250 or less do not need to be probated. Deaths on or after April 1, 2022 the threshold amount is $184,500. If the estate consists of assets in excess of the prescribed amount a probate is necessary.

How much is a small estate in California?

Maximum Value of Small Estate: $166,250→$184,500 To use the affidavit for small estates under Probate Code §13100, the value of an estate must be no larger than $184,500. (For deaths prior to April 1, 2022, the maximum value of an estate that could use the small estate affidavit was $166,250.)

How much does it cost to file a small estate affidavit in Arizona?

Cost Of The Small Estate Affidavit Procedure The clerks filing fee for this procedure is usually about $350.

Related templates