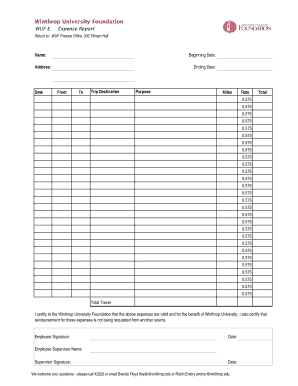

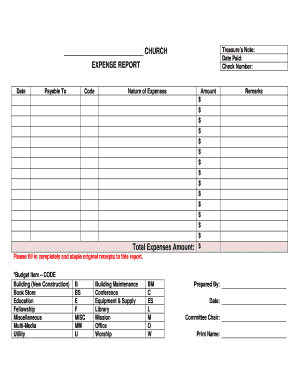

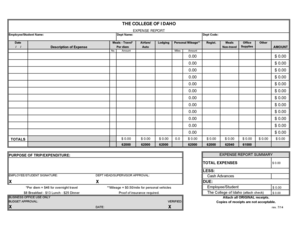

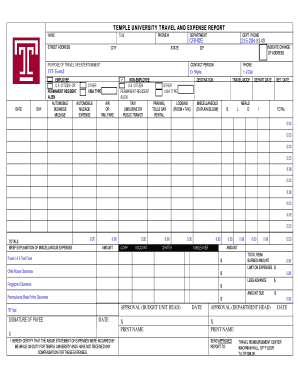

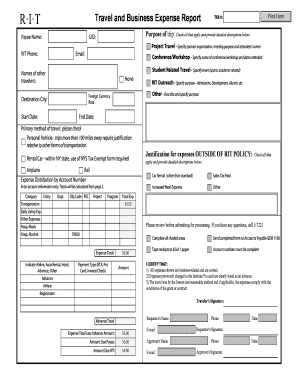

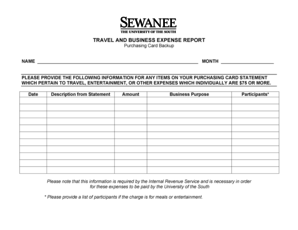

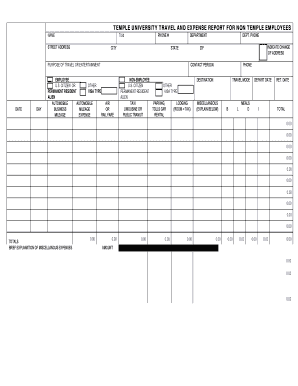

What is Travel Business Expense Report?

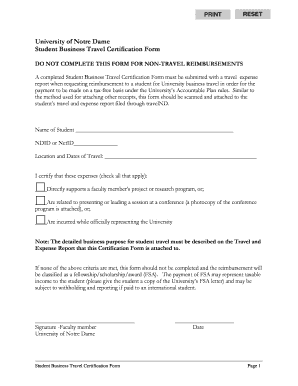

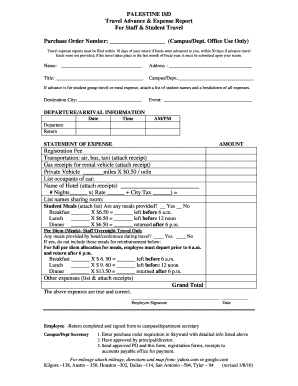

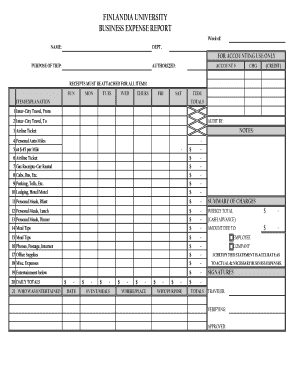

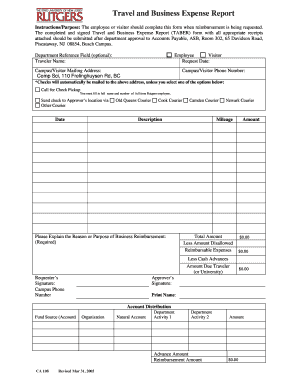

A Travel Business Expense Report is a document that records and summarizes travel expenses incurred by an individual or employee during a business trip. It serves as a tool for tracking and documenting all the costs associated with travel, such as accommodation, transportation, meals, and other incidental expenses. This report is often required by companies to ensure appropriate reimbursement and to maintain accurate financial records.

What are the types of Travel Business Expense Report?

There are several types of Travel Business Expense Reports, each designed to cater to specific needs and travel arrangements. Some common types include:

Individual Expense Report: This type of report is used by individuals who are responsible for their own travel expenses and need to be reimbursed by their company.

Corporate Expense Report: This report is used by employees who make travel arrangements through a company or travel agency. It consolidates expenses for multiple individuals and serves as a comprehensive record for reimbursement.

Project Expense Report: When employees work on specific projects that require travel, this report is used to track expenses related to that project. It helps in analyzing project costs and budgeting for future similar projects.

How to complete Travel Business Expense Report?

Completing a Travel Business Expense Report may seem daunting, but with the following steps, it becomes a simple and organized process:

01

Gather all receipts and supporting documents for your travel expenses.

02

Ensure you have the necessary information, such as dates, purpose of the trip, and location.

03

Categorize your expenses into different categories, such as transportation, accommodation, meals, and others.

04

Enter each expense item in the respective category and provide a brief description if required.

05

Calculate the total amount for each category and the overall total.

06

Review the report for accuracy and completeness.

07

Submit the report to the relevant department for approval and reimbursement.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.