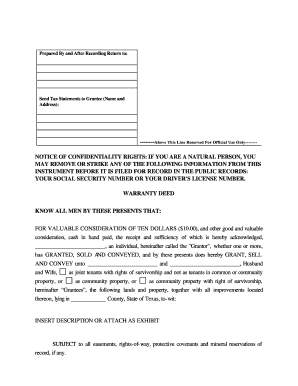

What is warranty deed texas?

A warranty deed in Texas is a legal document that transfers ownership of real estate from one person to another. It provides a guarantee, or warranty, that the seller has clear title to the property and has the right to sell it.

What are the types of warranty deed texas?

In Texas, there are two main types of warranty deeds: general warranty deed and special warranty deed. A general warranty deed provides the highest level of protection to the buyer, as it guarantees that the seller will defend against any claims to the property's title, even if they arose before the seller acquired it. On the other hand, a special warranty deed only guarantees that the seller hasn't done anything to negatively affect the property's title during their ownership.

How to complete warranty deed texas

Completing a warranty deed in Texas involves several steps:

pdfFiller empowers users to create, edit, and share documents online. With unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.