How to file the redesigned 1099-MISC tax form online

The number of US taxpayers who opt to file their tax returns electronically continues to grow each year. For all tax submissions, the total has already exceeded over 92%. Taxpayers can easily and securely complete forms in pdfFiller instead of filling out documents by hand and having to print and mail them over the course of many days.

This page is for informative purposes only and does not constitute tax or legal advice

What is the redesigned 1099-MISC tax form?

Because of the updates related to Form 1099-NEC, Form 1099-MISC has been revised. Specifically, the box numbers for reporting certain income have been rearranged. Start reporting your independent contractor income using the Form 1099-NEC to

report for the tax year 2020. If your company paid more than $600 to an independent

contractor, make sure to fill out the 1099-NEC. Pay attention to the contractor’s corporation type. C and S corporations (for the contractors) imply that you are not required to fill out a 1099-NEC.

If at least $600 was paid to the individual or LLC, please make sure to file a 1099-MISC:

Rents

Prizes and awards

Medical and health care payments

Crop insurance proceeds

Cash payments for fish (or other aquatic life) you purchase from anyone engaged in the trade or business of catching fish

Generally, the cash paid from a notional principal contract to an individual, partnership, or estate

Payments to an attorney

Any fishing boat proceeds

Here are the changes made in the current 1099-MISC form.

Direct sales of $5,000 or more that were made by a payer should now be written in box 7.

Report crop insurance proceeds in box 9.

Report Gross proceeds to an attorney in box 10.

Report section 409A deferrals in box 12.

Report nonqualified deferred compensation income in box 14.

State taxes withheld, state identification number, and amount of income earned in a state should now be reported in boxes 15, 16, and 17.

Dates: File Form 1099-MISC by March 1st, 2024, if you file on paper, or by March 31st, 2024, if you file electronically.

Take into consideration: Form 1099-MISC should only include the payments that are made in the course of your trade or business. Do not report your personal payments using this form!

Filling out the new 1099-NEC form online

Start reporting your independent contractor income using the Form 1099-NEC to report for the tax year 2024.

You should submit 1099-NEC in these cases:

A payment was made to someone who is not your employee.

A payment was made in the course of your trade or business.

Your company made a payment to an individual, partnership, estate, or corporation.

Your company paid more than $600 to an independent contractor.

Pay attention to the contractor’s corporation type. C and S contractor

corporations imply that you are not required to fill out 1099-NEC.

There are two copies of the 1099-NEC:

Copy A should be submitted to the IRS.

Copy B should be received by the contractor you worked with.

Make sure to send a copy of the form to the contractor!

Are you an independent contractor? You’re not required to file the 1099-NEC to the IRS,

but you should have your copy from the company you worked with!

Make sure that the form includes the following critical information:

Payer's data

Recipient's data

Nonemployee’s compensation amount

Federal income tax withheld

State information

Nonemployee compensation in box 1 should contain the total compensation for the past tax year.

Any federal income tax withheld is reported in box 4, although it's uncommon that this will

be the case unless you have received a backup withholding order for that person. If your

state has an income tax, include the total payment amount to that person for the year and

any state tax you withheld in box 5.

Before submitting Copy B to the contractor, make sure to get their consent.

Obtain it via email or any other way you’re planning to send the copy.

Pay taxes online

It’s more convenient to fill and e-file the 1099-MISC form online due to the fact that the IRS can only scan physical 1099-MISC forms obtained from a tax office. However, you may receive a penalty if you submit a form printed from an online copy. But all in all, paying taxes online has a number of benefits:

Ability to file from anywhere

Ensured accuracy

Time and money savings

Avoid added interest and penalties

Welcome to the pdfFiller forms catalog

Browse Versions and Schedules for All Relevant Forms

IRS Forms with Versions and Schedules

Edit professional templates, download them in any text format or send via pdfFiller’s advanced sharing tools. See also Top Forms by user votes.

1099-MISC form

Miscellaneous Income

W2 form

Wage and Tax Statement is used to report wages paid to employees and the taxes withheld from them

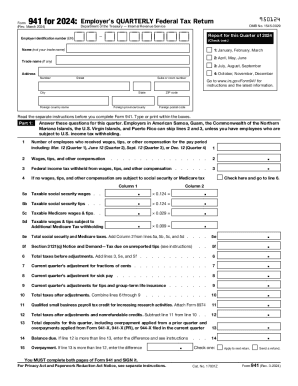

941 form

Don't use Form 941-V to make federal tax deposits. Use Form 941-V when making any payment with...

How to fill out other forms

Find the form you need, fill it out, and sign faster than ever before.

SSA SS-5 form

Application for a Social Security Card

Read guide

W2C form

Correct Wage and Tax Statements. For filing the corrected errors in W-2 forms

Read guide

CMS 1500 form

Health Insurance Claim Form

Read guide

How to fill out tax forms online

pdfFiller allows you to complete digital tax forms and file them directly with the IRS in minutes...

Read guide

All-in-one PDF software

A single pill for all your PDF headaches. Edit, fill out, eSign, and share – on any device.