2290 Tax Form - Page 2

What is 2290 tax form?

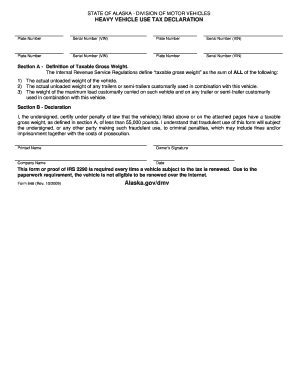

The 2290 tax form, also known as the Heavy Vehicle Use Tax form, is a tax return form used by owners or operators of heavy vehicles with a taxable gross weight of 55,000 pounds or more. This form is filed annually with the Internal Revenue Service (IRS) to report and pay the taxes due on these vehicles.

What are the types of 2290 tax form?

There is only one type of 2290 tax form, which is the Form 2290 for Heavy Vehicle Use Tax. However, there are different categories or types of vehicles that the form covers. These include trucks, truck tractors, and buses, among others.

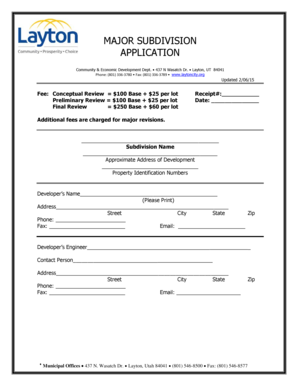

How to complete 2290 tax form

Completing the 2290 tax form is a straightforward process. Here are the steps to follow:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.