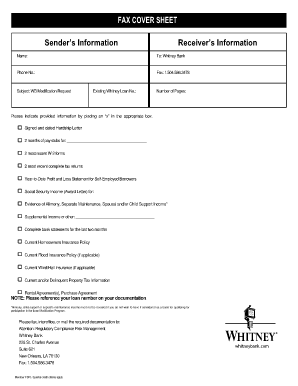

Basic Personal Financial Statement Form

What is Basic Personal Financial Statement Form?

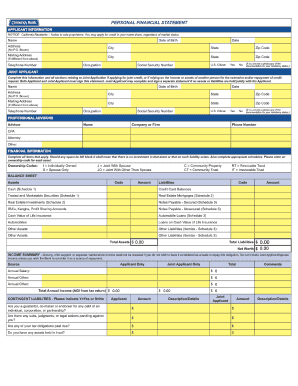

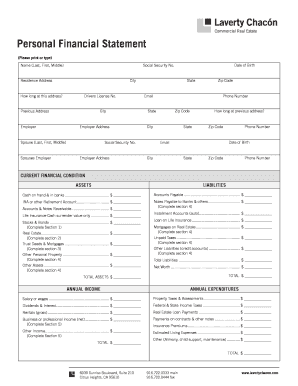

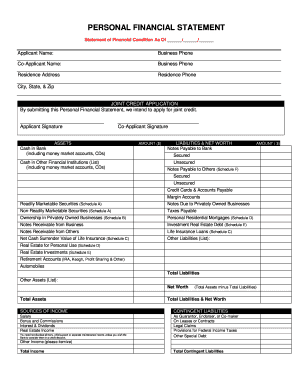

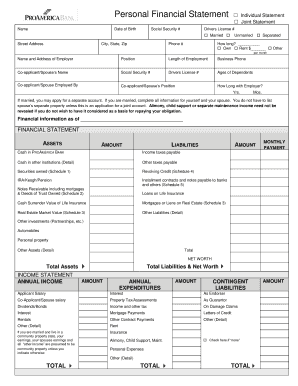

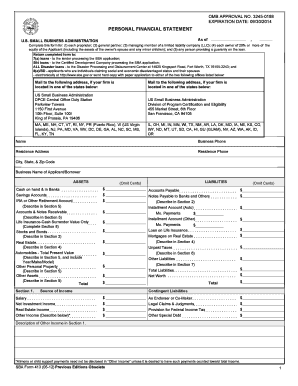

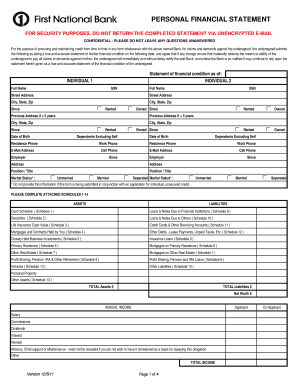

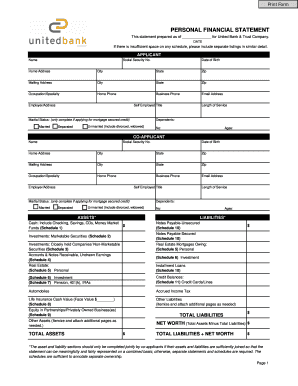

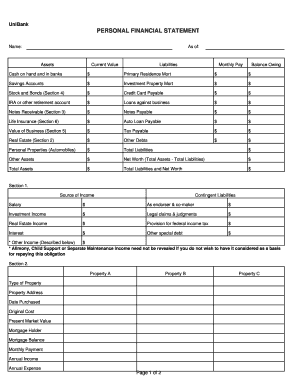

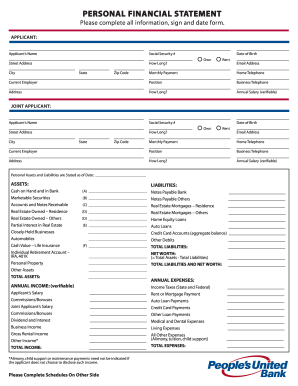

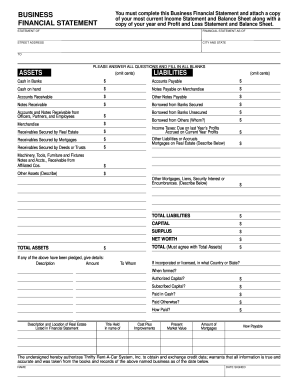

A Basic Personal Financial Statement Form is a document that provides a snapshot of an individual's financial situation. It includes information about their assets, liabilities, and net worth. This form is commonly used by individuals and businesses to assess their financial health and make informed decisions about budgeting, investing, and managing money.

What are the types of Basic Personal Financial Statement Form?

There are several types of Basic Personal Financial Statement Forms available, each catering to specific needs and requirements. Some common types include:

How to complete Basic Personal Financial Statement Form?

Completing a Basic Personal Financial Statement Form can seem daunting, but with pdfFiller's powerful tools, it becomes a breeze. Here is a step-by-step guide to help you:

With pdfFiller's intuitive interface and powerful features, completing a Basic Personal Financial Statement Form has never been easier. Sign up today and take control of your financial future!