What is Blank Mileage Log?

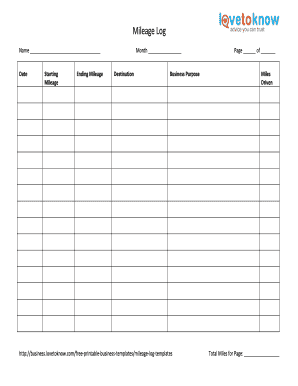

A Blank Mileage Log is a document used to track and record the mileage of a vehicle for various purposes. It provides a detailed account of the distance traveled and is commonly used by individuals, businesses, and organizations to keep a record of their vehicle usage.

What are the types of Blank Mileage Log?

There are several types of Blank Mileage Logs available, depending on the specific needs and preferences of users. Some common types include:

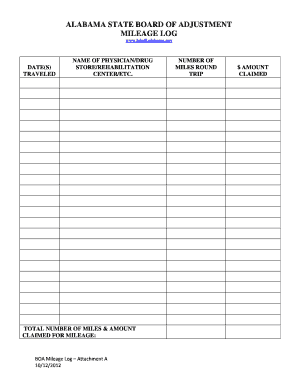

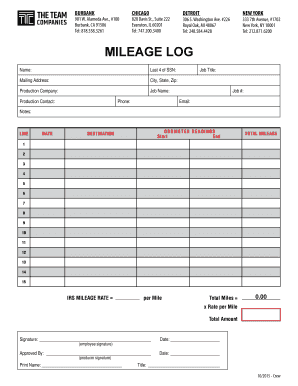

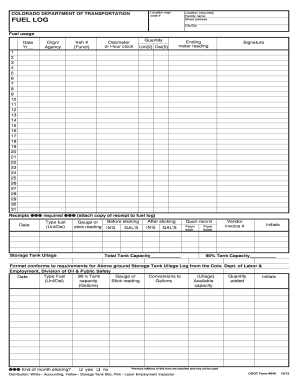

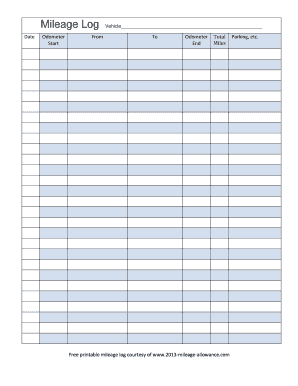

Basic Mileage Log: This type of log includes fields for recording the date, starting and ending odometer readings, total miles driven, and purpose of the trip.

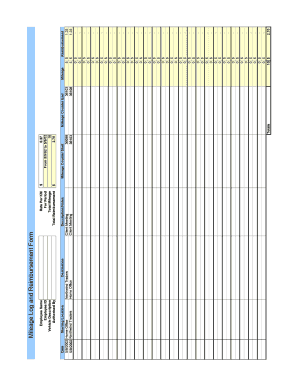

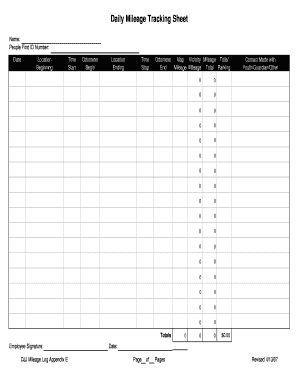

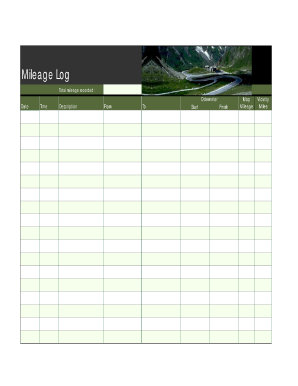

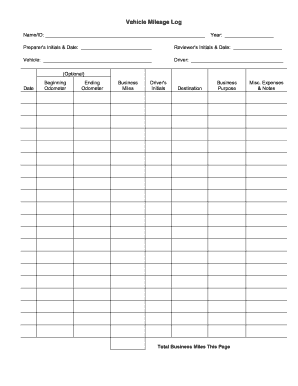

Detailed Mileage Log: In addition to the basic fields, this type of log includes additional fields for recording the starting and ending locations, time of departure and arrival, and any additional notes or comments.

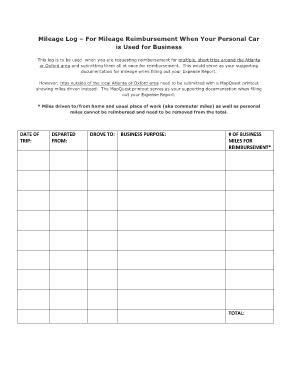

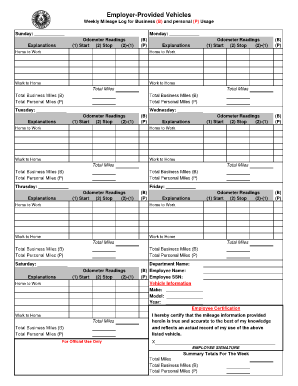

Business Mileage Log: Specifically designed for business use, this type of log includes fields for recording the business purpose of the trip, client or project details, and any reimbursable expenses.

Personal Mileage Log: This type of log is used for personal or non-business-related mileage tracking. It typically includes fields for recording the date, starting and ending locations, purpose of the trip, and any additional notes.

How to complete Blank Mileage Log

Completing a Blank Mileage Log is a simple and straightforward process. Here's a step-by-step guide to help you:

01

Begin by entering the date of the trip in the designated field.

02

Record the starting and ending odometer readings for the trip.

03

Calculate the total miles driven by subtracting the starting mileage from the ending mileage.

04

Specify the purpose of the trip, whether it's for personal use, business-related, or any other specific reason.

05

If applicable, provide additional details such as the starting and ending locations, departure and arrival times, and any relevant notes or comments.

06

Review the completed log for accuracy and make any necessary adjustments.

07

Save the completed log for future reference.

By using a Blank Mileage Log, you can efficiently track your vehicle usage and maintain accurate records. With the help of pdfFiller, you can conveniently create, edit, and share your Blank Mileage Log online. pdfFiller offers unlimited fillable templates and powerful editing tools, making it the perfect PDF editor to get your documents done.