Mileage Reimbursement Template

What is mileage reimbursement template?

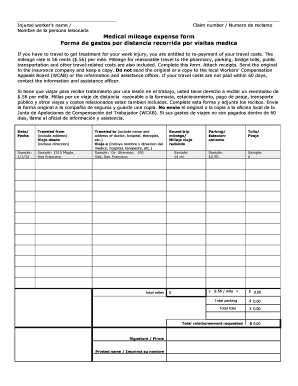

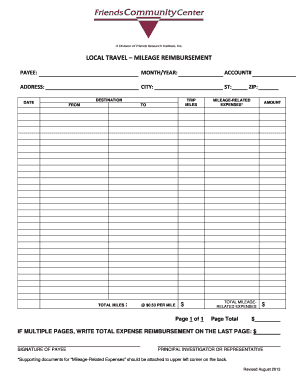

A mileage reimbursement template is a document that helps individuals or businesses calculate and track expenses related to mileage reimbursement. It provides a structured format to record information such as the starting and ending locations, total miles traveled, and reimbursement rates.

What are the types of mileage reimbursement template?

There are several types of mileage reimbursement templates available, including:

Standard mileage reimbursement template - This template is commonly used to calculate mileage reimbursement based on the standard mileage rate set by the IRS.

Actual expense reimbursement template - This template allows individuals or businesses to track and calculate mileage reimbursement based on the actual expenses incurred, such as gas, maintenance, and insurance.

Business-specific reimbursement template - Some organizations may create customized mileage reimbursement templates to meet their specific needs and requirements.

How to complete mileage reimbursement template

Completing a mileage reimbursement template is a straightforward process. Here are the steps to follow:

01

Fill in the starting and ending locations of your trip.

02

Record the total miles traveled during the trip.

03

Enter the reimbursement rate or use the standard mileage rate set by the IRS.

04

Calculate the reimbursement amount by multiplying the total miles by the reimbursement rate.

05

Include any additional expenses, if applicable.

06

Review the template for accuracy and completeness.

07

Save or print the completed template for record-keeping purposes.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out mileage reimbursement template

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How do you make a mileage sheet?

According to the IRS, you must include the following in your mileage log template: The mileage driven for each business-related trip. The date of each trip. The destination and purpose of your trip. The total mileage you've driven for the year.

Do I need a mileage log for tax purposes?

It is a myth that the IRS requires you to record your odometer at the beginning and end of your trips. There's currently nothing in the law that requires you to log odometer readings except for the beginning and the end of each year, and when you start using a new vehicle.

What information do I need to claim mileage on my taxes?

You can calculate your driving deduction by adding up your actual expenses or by multiplying the miles you drive by the IRS's standard mileage rate. The per-mile rate for the first half of 2022 is 58.5 cents per mile and for the second half of 2022 it's 62.5 cents per mile.

Is it better to claim mileage or gas on taxes?

Turns out, the actual car expense method would give you a far greater deduction. If you use the standard mileage method, you could have written off $2,725. But if you deducted your actual car expenses, that number goes all the way up to $3,380. That's an extra $655 in tax write-offs from your car.

Where do I enter mileage on my tax return?

Self-employed individuals will report their mileage on the Schedule C form. In addition to providing the number of miles driven during the tax year, you'll also need to answer a few questions about the vehicle, including when it was placed into service for business.

How do you document mileage for taxes?

How do you keep a mileage log? Keep a separate bank account or credit card for business expenses. This can be a great way to keep personal and driving expenses separated. Record mileage on paper or in a spreadsheet. Use a mile-tracking app. Use your Uber or Lyft app to track mileage deductions (not recommended).

Related templates