What is mileage log for taxes pdf?

A mileage log for taxes pdf is a document that records the distances traveled for business purposes in order to claim tax deductions. It is an important record for self-employed individuals or employees who use their personal vehicles for work-related tasks. The mileage log provides evidence of the mileage driven and helps calculate the deductible expenses for tax purposes.

What are the types of mileage log for taxes pdf?

There are several types of mileage logs for taxes pdf that individuals can use based on their preferences and needs. Some commonly used types include:

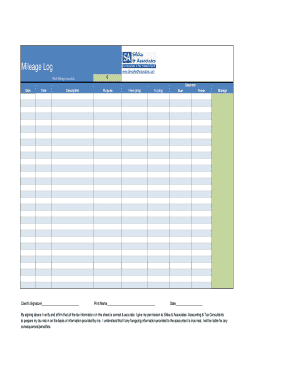

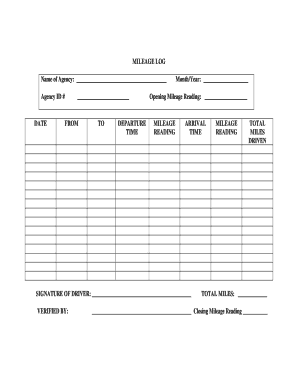

Standard Mileage Log: This type of log records the date, starting and ending locations, purpose of the trip, and the mileage traveled for each business-related journey.

Detailed Mileage Log: This log includes all the information from the standard log, as well as additional details such as tolls, parking fees, and other expenses incurred during the trip.

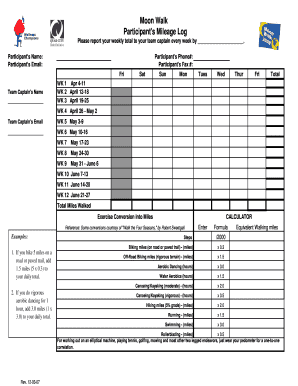

Electronic Mileage Log: Instead of manual recording, this type of log allows users to track their mileage digitally using smartphone apps or mileage tracking software. It automates the process and provides accurate records.

GPS Mileage Log: This log utilizes GPS technology to track and record the mileage automatically. It eliminates the need for manual record-keeping and ensures accurate mileage reporting.

How to complete mileage log for taxes pdf

Completing a mileage log for taxes pdf is a straightforward process. Here are the steps to follow:

01

Start by downloading a mileage log template or using PDF editor software like pdfFiller to create a blank log.

02

Fill in the necessary details, such as your name, business name, and the tax year for which the log is being prepared.

03

For each business trip, record the date, starting location, ending location, purpose of the trip, and the mileage driven.

04

If using a detailed log, also keep track of any additional expenses incurred during the trip.

05

Regularly review and update the log to ensure accurate and up-to-date records.

06

Save the completed mileage log for future reference and tax filing purposes.

By using pdfFiller, users can conveniently create, edit, and share their mileage logs online. With unlimited fillable templates and powerful editing tools, pdfFiller eliminates the hassle of manual paperwork and ensures efficient documentation. It is the ultimate PDF editor that users can rely on to get their documents done quickly and easily.