Vehicle Mileage Log Book

What is vehicle mileage log book?

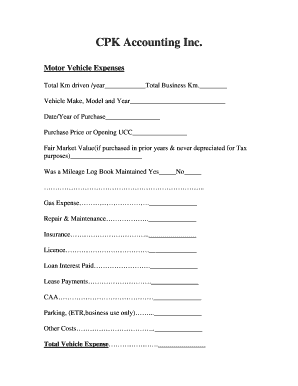

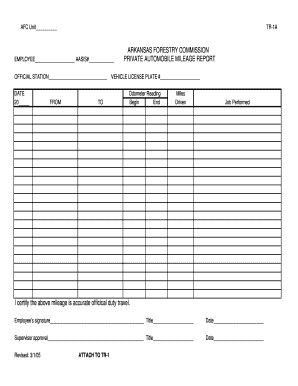

A vehicle mileage log book is a document used to track and record the number of miles driven by a vehicle. It helps individuals and businesses keep a detailed record of their travel expenses, which can be used for tax purposes or reimbursement.

What are the types of vehicle mileage log book?

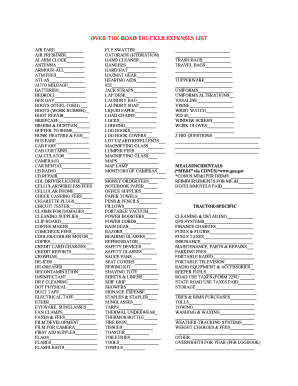

There are several types of vehicle mileage log books available, depending on the specific needs of the user. Some common types include:

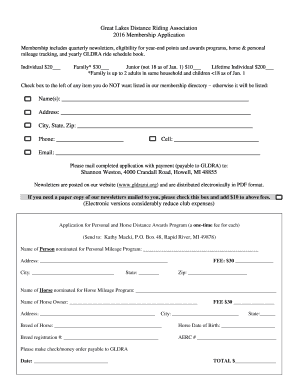

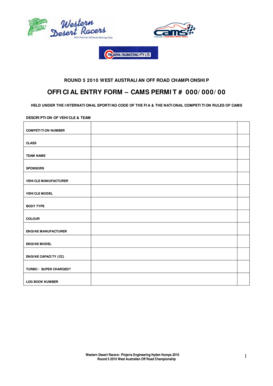

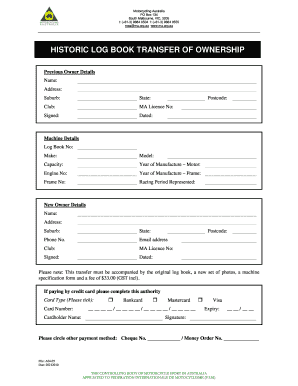

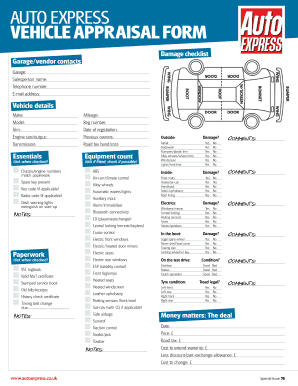

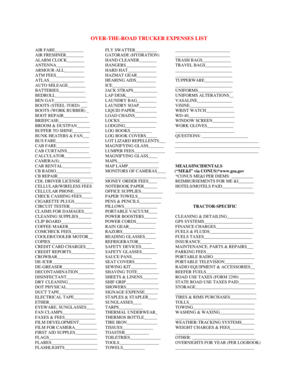

Printed log books: These are pre-designed log books that can be purchased from office supply stores. They often include spaces for recording dates, destinations, starting and ending odometer readings, and the purpose of the trip.

Electronic log books: These are software or mobile applications that can be installed on a device such as a smartphone or tablet. They allow users to record mileage electronically and provide additional features such as automatic GPS tracking.

Custom log books: These are log books designed specifically for the unique needs of a user or business. They can be customized with company logos, fields, and formats to suit individual requirements.

How to complete vehicle mileage log book

Completing a vehicle mileage log book is a straightforward process. Here are the steps involved:

01

Start by entering the date of the trip.

02

Record the starting and ending odometer readings for the trip.

03

Indicate the purpose of the trip, whether it's for business, personal, or any other specific reason.

04

If the trip includes multiple stops, note down each destination and the corresponding mileage.

05

At the end of each trip, calculate the total miles driven and record it in the appropriate field.

06

Review and verify the accuracy of the recorded information before finalizing the log book entry.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out vehicle mileage log book

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

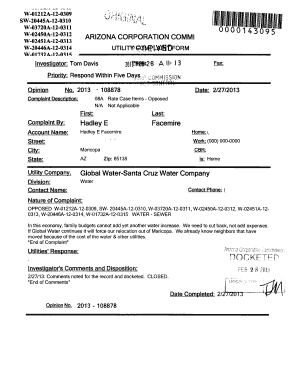

How do you prove mileage to HMRC?

According to HMRC, your mileage log should include: The date of your journey. If it is a personal or business-related journey. The start and end addresses, including postcodes. The total number of miles driven for the journey.

How do you manually track mileage?

If you're tracking manually, you'll need to reference your vehicle's odometer and track both the starting and finishing addresses of your trip. You'll do a quick calculation and then enter your mileage into your logbook.

How do you record mileage logs?

What to record in your mileage log book Each journey's date. The purpose (business or personal) The origin and destination addresses of your journey including postcodes, as well as the total number of miles driven. Any additional information your employer might require, for example, odometer readings.

How do you document mileage on a car?

How do you keep a mileage log? Keep a separate bank account or credit card for business expenses. This can be a great way to keep personal and driving expenses separated. Record mileage on paper or in a spreadsheet. Use a mile-tracking app. Use your Uber or Lyft app to track mileage deductions (not recommended).

How do you keep track of mileage?

Tips for keeping track of mileage Use your odometer. Depending on the age of your vehicle, you either have a mechanical or digital odometer. Download a mile tracker app. Another option is to download a mile tracker app. Google Maps, Apple Maps, or Waze.

How do you log mileage?

At the start of each trip, record the odometer reading and list the purpose, starting location, ending location, and date of the trip. At the conclusion of the trip, the final odometer must be recorded and then subtracted from the initial reading to find the total mileage for the trip.

Related templates