Budget Forms

What is budget forms?

Budget forms are documents used to outline and track income and expenses for a specific period of time. These forms are essential tools in financial planning and can be used by individuals, organizations, and businesses to manage their finances effectively.

What are the types of budget forms?

There are several types of budget forms available, each designed for different purposes. Some common types include:

Personal budget forms: These forms are used by individuals to track their personal income, expenses, and savings.

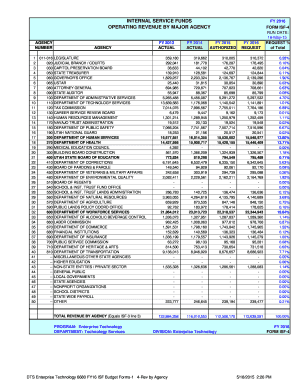

Business budget forms: These forms are used by businesses to monitor and control their financial activities and make informed decisions.

Project budget forms: These forms are used to estimate and manage the costs associated with specific projects or initiatives.

Event budget forms: These forms are used to plan and track the expenses and revenues for events, such as weddings, conferences, or fundraisers.

How to complete budget forms

Completing budget forms is a straightforward process. Here are some steps to guide you:

01

Gather all relevant financial information, including income statements, bills, receipts, and bank statements.

02

Determine your income sources and input the amounts in the appropriate section of the form.

03

List all your expenses, categorize them (such as housing, transportation, groceries), and enter the amounts in the respective fields.

04

Calculate the difference between your income and expenses to determine your net savings or deficit.

05

Review your budget form regularly and make adjustments as necessary to ensure financial stability and achieve your financial goals.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out budget forms

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What are the basic steps in creating a budget?

Basic steps to making a budget Step 1: Gather information. Step 2: Record all of your sources of income. Step 3: Create a list of monthly expenses. Step 4: Break your expenses into categories. Step 5: Total your monthly income and expenses. Step 6: Make adjustments and cut spending. Step 7: Review your budget monthly.

What are the 7 types of budgeting?

The 7 different types of budgeting used by companies are strategic plan budget, cash budget, master budget, labor budget, capital budget, financial budget, operating budget.

What are the 9 steps of the budget process?

9 Steps to Building a Budget Step 1: Schedule a Time to Start. Step 2: Get a Grip on Your Income. Step 3: Figure Out Your Expenses. Step 4: Track Your Spending. Step 5: Assess the Month. Step 6: Pick Out What to Cut. Step 7: Categorize Your Budget. Step 8: Start Spending – and Keep Recording!

What are the 7 steps in creating a budget?

7 Steps to a Budget Made Easy Step 1: Set Realistic Goals. Step 2: Identify your Income and Expenses. Step 3: Separate Needs and Wants. Step 4: Design Your Budget. Step 5: Put Your Plan Into Action. Step 6: Seasonal Expenses. Step 7: Look Ahead.

What are budget forms?

A budget worksheet is a simple spreadsheet or chart where you can record your income, expenses and savings. Using a worksheet to track your finances offers several benefits: It tracks income and expenses in one convenient place.

What are the 6 budgeting basics?

Six Basics of Building Your Budget Calculate Your Income. Categorize Your Expenses. Evaluate Your Spending. Follow the 50/30/20 Rule. Track Your Purchases.