Can I Get A Child Benefit Form From The Post Office - Page 2

What is can i get a child benefit form from the post office?

If you are wondering where to obtain a child benefit form, one of the options available is from the post office. The child benefit form can be collected in person at your local post office branch. This allows you the convenience of obtaining the form in a physical format.

What are the types of can i get a child benefit form from the post office?

When it comes to child benefit forms, the post office offers different types to cater to various situations. These include:

New child benefit form for first-time applicants

Renewal child benefit form for existing recipients

Additional child benefit form for families with multiple children

How to complete can i get a child benefit form from the post office

Completing a child benefit form obtained from the post office is a straightforward process. Here are the steps to follow:

01

Start by reading the instructions carefully to understand the requirements

02

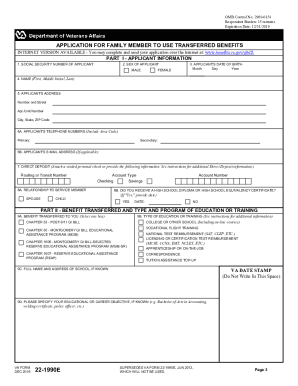

Provide accurate personal information, ensuring it matches official documents

03

Fill in all the relevant sections regarding your child and their details

04

Double-check the form for any mistakes or missing information

05

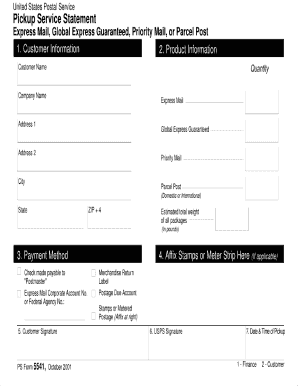

Submit the completed form to the appropriate authority or address as instructed

pdfFiller is an excellent solution for creating, editing, and sharing documents online. With its unlimited fillable templates and powerful editing tools, pdfFiller offers everything you need to efficiently handle your PDF documents.

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How do you qualify for child tax benefit?

You must live with the child, and the child must be under 18 years of age. You must be the person primarily responsible for the care and upbringing of the child. If a child does not live with you all the time, see If you share custody of a child. You must be a resident of Canada for tax purposes.

Can I claim Child Benefit if I live outside the UK?

If you and your partner live in different countries you may qualify for Child Benefit or its equivalent in both. The country the child lives in will usually pay the benefit. If the benefit is more in the other country, that country will pay you extra.

What documents do I need to send for Child Benefit UK?

What documents will I need to claim Child Benefit? You must give evidence of your child, for example, a birth or adoption certificate. You should also give your national insurance number. If you do not have a national insurance number, send in the claim form anyway to save delays.

How do I get a copy of my Child Benefit letter UK?

Claimants can request a child benefit entitlement letter from HMRC by contacting them directly or via their Personal Tax Account. HMRC state that DWP have advised them that evidence of child benefit should only be sought from the claimant where there is doubt.

How much does each child get for Child Benefit?

Updated for 2022-2023 The maximum benefit per child under 6 is $6,997 per year ($583.08 per month). The maximum benefit per child for children aged 6 to 17 is $5,903 per year ($491.91 per month).

How much is the Canada Child Benefit 2022?

For the 2022–23 benefit year, families most in need can receive up to $6,997 per child under the age of six and $5,903 per child aged six through 17. The Canada Child Benefit was introduced in 2016 and is a key component of the Government of Canada's Affordability Plan.