What is Charitable Donation Tracker?

Charitable Donation Tracker is a tool that helps individuals and organizations keep track of their charitable donations. It allows users to easily record and monitor their donations, ensuring they have a clear record of their giving.

What are the types of Charitable Donation Tracker?

There are several types of Charitable Donation Tracker available, including:

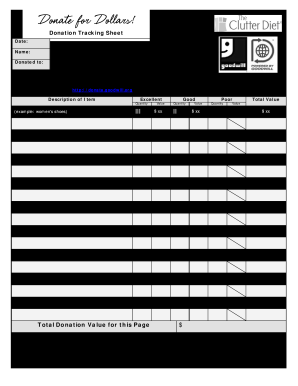

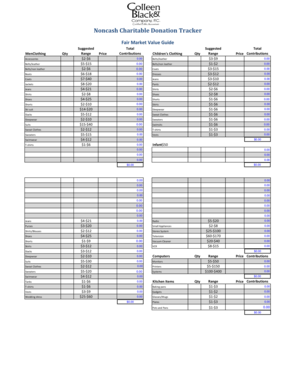

Spreadsheet-based trackers: These are simple trackers that allow users to manually enter their donation details into a spreadsheet. While they may require more effort to maintain, they offer flexibility and customization options.

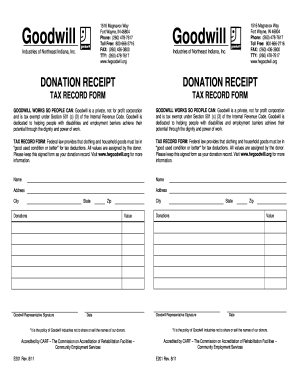

Online platforms: These are web-based platforms that offer a dedicated interface for tracking charitable donations. They often provide additional features like donation receipts, reporting tools, and integration with other financial management systems.

Mobile applications: These apps allow users to track their donations on their smartphones or tablets. They offer convenience and real-time updates, making it easier to stay organized and keep track of donations on the go.

How to complete Charitable Donation Tracker

Completing a Charitable Donation Tracker is a straightforward process. Follow these steps:

01

Choose the type of Charitable Donation Tracker that best suits your needs. Consider factors such as ease of use, features, and compatibility with your devices or systems.

02

Sign up or download the chosen tracker and create an account if necessary.

03

Familiarize yourself with the interface and features of the tracker. Take advantage of any tutorials or help guides provided.

04

Start recording your charitable donations by entering the necessary details, such as donation amount, date, recipient organization, and any additional notes.

05

Regularly update your tracker with new donations and review the existing records to ensure accuracy.

06

Utilize any additional features offered by the tracker, such as generating donation reports or exporting data for tax purposes.

07

Keep a backup of your donation records in a secure location, either digitally or in physical form.

By using pdfFiller, you can further simplify the process of completing a Charitable Donation Tracker. With its unlimited fillable templates and powerful editing tools, pdfFiller empowers users to effortlessly create, edit, and share their donation tracking documents online. Say goodbye to manual data entry and enjoy the convenience of a comprehensive PDF editor.