Credit Card Minimum Payment Formula - Page 2

What is credit card minimum payment formula?

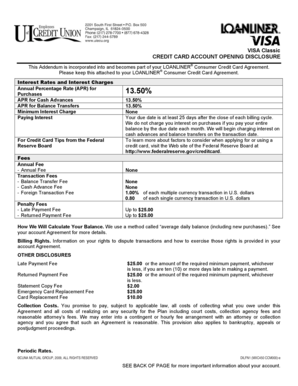

The credit card minimum payment formula is a calculation method used by credit card companies to determine the minimum amount that cardholders must pay each month. The formula typically includes a percentage of the outstanding balance, as well as any interest and fees accrued.

What are the types of credit card minimum payment formula?

There are different types of credit card minimum payment formulas used by various credit card companies. Some common types include:

Flat percentage of the outstanding balance

Fixed dollar amount

Percentage of the outstanding balance plus interest and fees

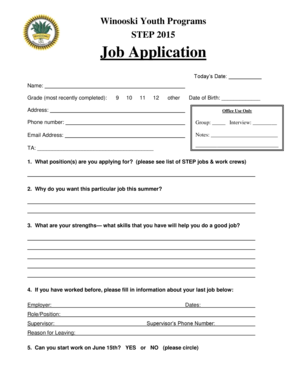

How to complete credit card minimum payment formula

Completing the credit card minimum payment formula is relatively straightforward. Here are the steps involved:

01

Obtain your credit card statement

02

Identify the minimum payment calculation method used by your credit card company

03

Gather the necessary information, such as the outstanding balance, interest rate, and any applicable fees

04

Apply the formula to calculate the minimum payment amount

05

Pay the calculated minimum payment amount

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out credit card minimum payment formula

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How is total amount due calculated?

What is Total Amount Due and how it is calculated? Total Amount Due is the amount due for payment as on the statement date. It includes your opening balance, new purchases, fees & finance charges if any, minus your last payment or any other due credits.

What does it mean by total minimum payment due?

When your receive your credit card bill, there are typically three amounts you can pay: the minimum due, the statement balance and the current balance. The minimum payment is the smallest amount of money that you have to pay each month to keep your account in good standing.

What is the minimum payment on a $10000 credit card?

High Interest Amounts. Let's say you have a 10,000 balance with a 19.9% interest rate. Your minimum payment is 3% of your $10,000 balance, so it's right around $300. If you only pay the minimum payment, it'll take your 15 years to pay it off completely, and it'll cost you $21,080.

What is the minimum payment on a $5000 credit card?

The minimum payment on a $5,000 credit card balance is at least $50, plus any fees, interest, and past-due amounts, if applicable.What is the minimum payment on a $5,000 credit card balance? IssuerStandard Minimum PaymentUSAA$50U.S. Bank$50Wells Fargo$507 more rows

How much should I spend on a 5000 credit card?

If you have a $5,000 credit limit and spend $1,000 on your credit card each month, that's a utilization rate of 20%. Experts generally recommend keeping your utilization rate under 30%, ideally closer to 10% if you can.

How do I calculate my minimum credit card payment?

Methods of Calculating 1 So, for example, 1% of your balance plus the interest that has accrued. Let's say your balance is $1,000 and your annual percentage rate (APR) is 24%. Your minimum payment would be 1%—$10—plus your monthly finance charge—$20—for a total minimum payment of $30.