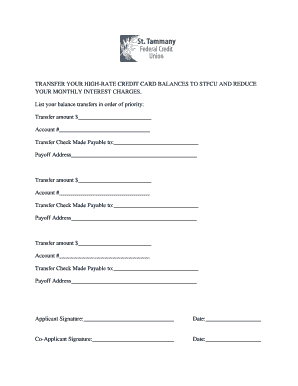

Credit Card Payoff Plan

What is a credit card payoff plan?

A credit card payoff plan is a strategic approach to systematically paying off credit card debt. It involves creating a budget, setting financial goals, and prioritizing payments to reduce and eliminate outstanding credit card balances.

What are the types of credit card payoff plan?

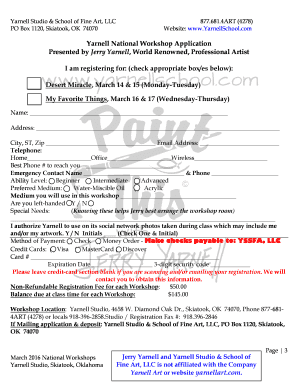

There are several types of credit card payoff plans that individuals can choose from based on their financial situation and preferences. Some common types include:

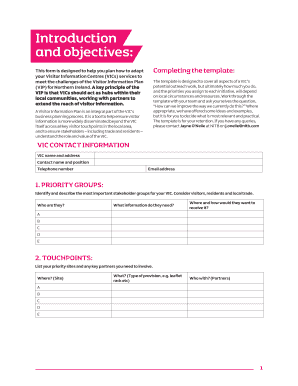

How to complete a credit card payoff plan

Completing a credit card payoff plan requires discipline, commitment, and effective financial management. Here are some steps to help you successfully complete your credit card payoff plan:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor you need to get your documents done.