Credit Card Calculator Interest

What is credit card calculator interest?

Credit card calculator interest refers to the method used to calculate the interest charges on a credit card balance. It helps cardholders understand how much they will need to pay in interest based on their outstanding balance and the interest rate. By using a credit card calculator, users can estimate their future payments and plan their finances accordingly.

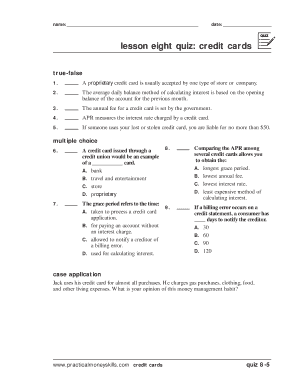

What are the types of credit card calculator interest?

There are various types of credit card calculator interest, including:

Simple Interest: This type calculates the interest based only on the principal balance.

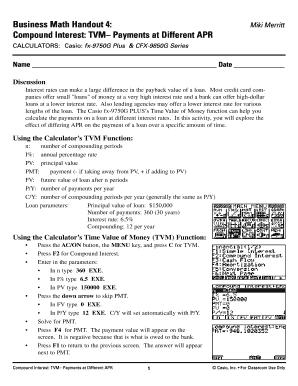

Compound Interest: This type takes into account the accumulated interest over time, resulting in a higher overall interest payment.

Introductory Rate: Some credit cards offer a promotional low or 0% interest rate for a certain period. This type of calculator helps users understand their payments during the introductory period.

Balance Transfer: This type calculates the potential savings when transferring a credit card balance to a card with a lower interest rate.

How to complete credit card calculator interest

Follow these steps to complete credit card calculator interest:

01

Gather the necessary information: You will need your credit card balance, interest rate, and the time period you want to calculate the interest for.

02

Input the information into the calculator: Enter the values into the designated fields of the calculator.

03

Click 'Calculate' or 'Calculate Interest': Depending on the calculator, there may be a specific button to initiate the calculation.

04

Review the results: The calculator will display the estimated interest charges based on the information provided.

05

Plan your payments: Use the calculated interest to plan your repayments and understand the impact of different payment amounts.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How much is 24 APR monthly?

If you have a credit card with a 24% APR, that's the rate you're charged over 12 months, which comes out to 2% per month. Since months vary in length, credit cards break down APR even further into a daily periodic rate (DPR). It's the APR divided by 365, which would be 0.065% per day for a card with 24% APR.

What is 25 APR on a credit card?

Nominal APR (or simply APR) Supposing your credit card has a 25% APR and you carry a $100 balance for a year, you would owe $125 by year's end.

How do I calculate the interest on my credit card?

Step 1: Find your current APR and current balance in your credit card statement. Step 2: Divide your current APR by 12 (for the twelve months of the year) to find your monthly periodic rate. Step 3: Multiply that number with the amount of your current balance.

How do I calculate interest?

Here's the simple interest formula: Interest = P x R x T. P = Principal amount (the beginning balance). R = Interest rate (usually per year, expressed as a decimal). T = Number of time periods (generally one-year time periods).

What is the formula to calculate interest on a credit card?

Step 1: Find your current APR and current balance in your credit card statement. Step 2: Divide your current APR by 12 (for the twelve months of the year) to find your monthly periodic rate. Step 3: Multiply that number with the amount of your current balance.

How do you calculate 24.99 interest?

A 24.99% APR means that the credit card's balance will increase by approximately 24.99% over the course of a year if the cardholder carries a balance the whole time. For example, if the APR is 24.99% and you carry a $1,000 balance for a year, you would owe around $246.48 in interest by the end of that year.

Related templates