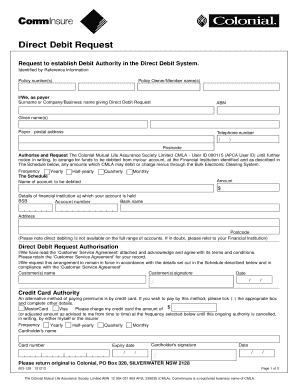

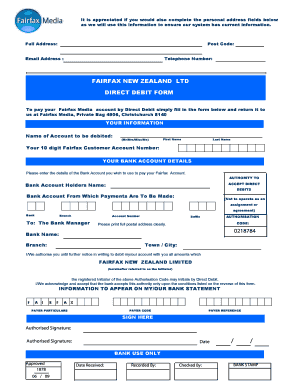

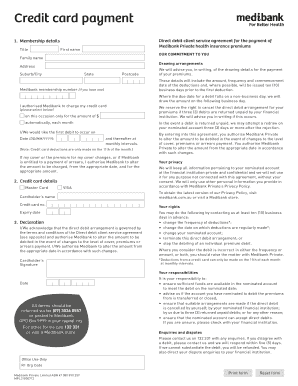

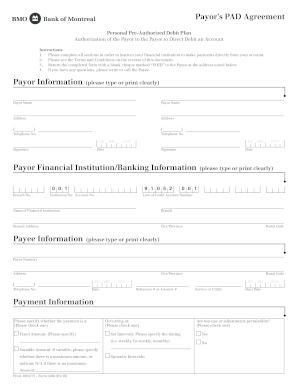

Direct Debit Request Form - Page 2

What is Direct Debit Request Form?

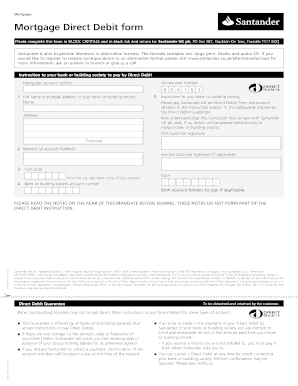

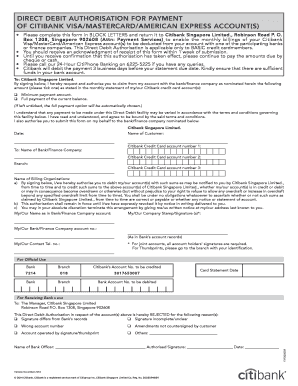

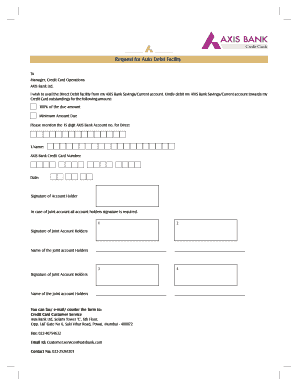

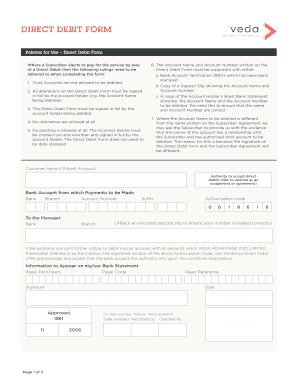

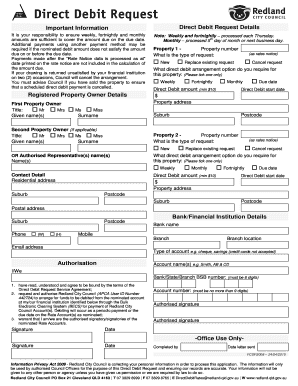

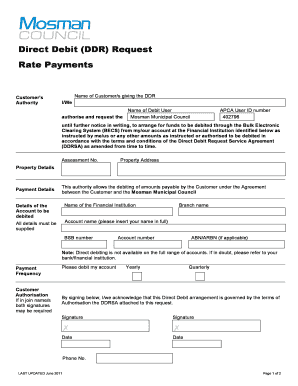

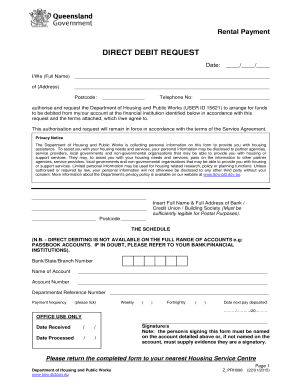

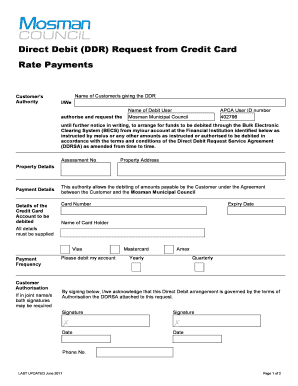

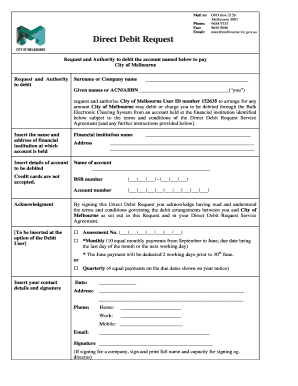

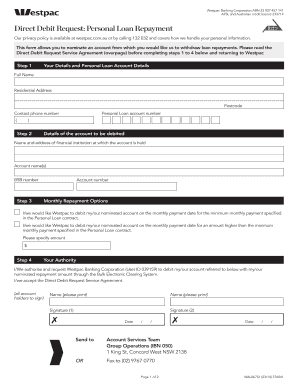

The Direct Debit Request Form is a document that allows individuals or organizations to authorize automatic deductions from a bank account. It provides a convenient and hassle-free way to make regular payments, such as utility bills, subscriptions, or loan repayments. By completing this form, users give permission to the payee to withdraw funds directly from their bank account on specified dates.

What are the types of Direct Debit Request Form?

There are various types of Direct Debit Request Forms available based on specific purposes. Some common types include:

How to complete Direct Debit Request Form

Completing a Direct Debit Request Form is straightforward and can be done in a few simple steps:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.