Direct Debit Vs Standing Order

What is direct debit vs standing order?

Direct debit and standing order are two common methods of making regular payments. Both involve setting up an arrangement with a bank or financial institution to automatically transfer funds from one account to another. However, there are key differences between the two.

What are the types of direct debit vs standing order?

There are several types of direct debit and standing order arrangements that cater to different needs:

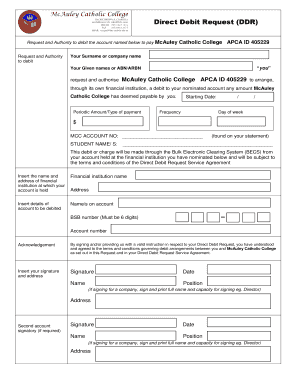

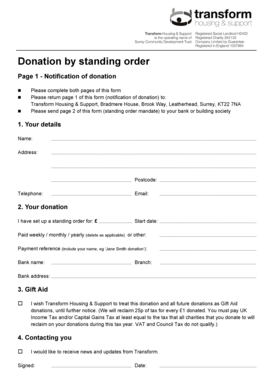

Direct Debit: With this type of arrangement, the payee (the person or company receiving the payment) is authorized to automatically withdraw funds from the payer's (the person making the payment) account. This can be for recurring payments of fixed or variable amounts, such as monthly utility bills or subscriptions.

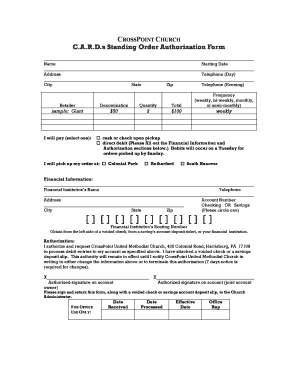

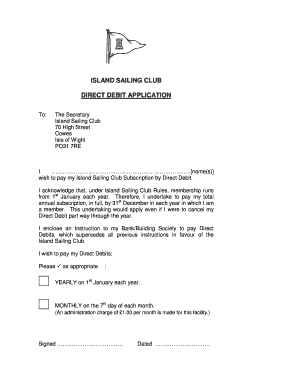

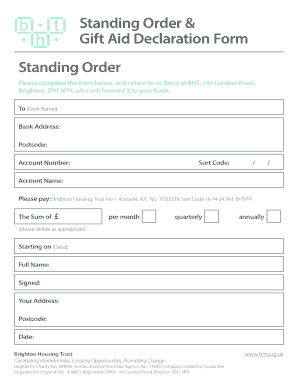

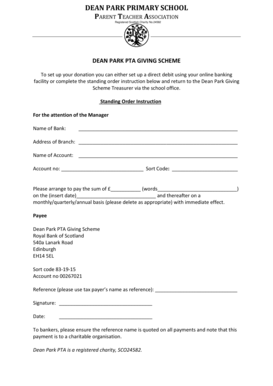

Standing Order: Unlike direct debit, a standing order is initiated by the payer. The payer sets up a regular payment to be made from their account to the payee's account on a specified date. This is often used for fixed amounts, such as rent or loan repayments.

How to complete direct debit vs standing order

Here are the steps to complete a direct debit or standing order:

01

Contact your bank: Speak to your bank or financial institution to understand their specific process for setting up direct debits or standing orders.

02

Provide necessary details: Whether you're the payer or the payee, you'll need to provide relevant information such as bank account numbers, names, and payment amounts.

03

Authorize the arrangement: Sign any required forms or documents to authorize the direct debit or standing order.

04

Set payment frequency and dates: Specify how often the payment should be made (e.g., monthly, weekly) and the dates on which it should occur.

05

Monitor your payments: Keep a record of the payments made through direct debit or standing order and ensure they are deducted or received correctly.

06

Make changes when needed: If there are any changes to the payment amount, frequency, or bank account details, contact your bank to make the necessary adjustments.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out direct debit vs standing order

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

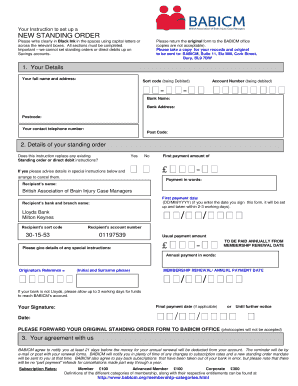

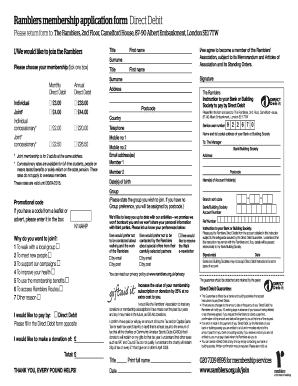

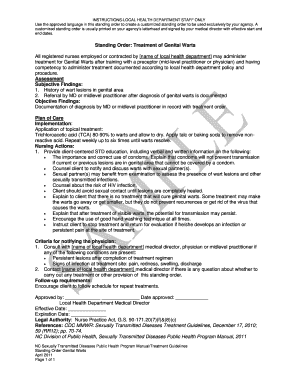

What does a customer need to set up a Direct Debit?

The only thing the customers need to do is to ensure that they have sufficient funds in their account. Here's an illustration explaining the bank-to-bank transfer in Direct Debit. The business owner initiates the payment after setting up Direct Debit for their customer.

How can I set up a Direct Debit?

How to set up a Direct Debit Step 1 - Contact the organisation you wish to pay. Get in touch with them and ask to set up a Direct Debit. Step 2 - Complete the Direct Debit Instruction. You'll need to provide: Step 3 - Check the advance notice details. Step 4 - Relax.

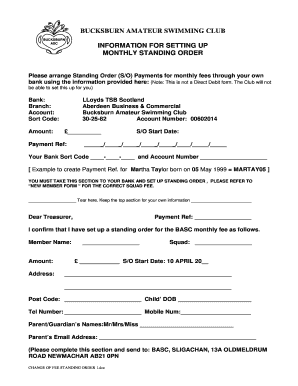

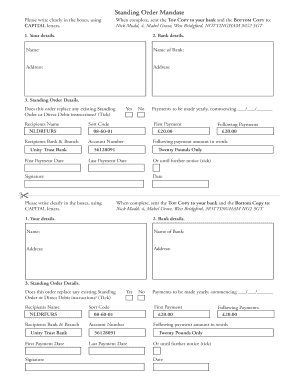

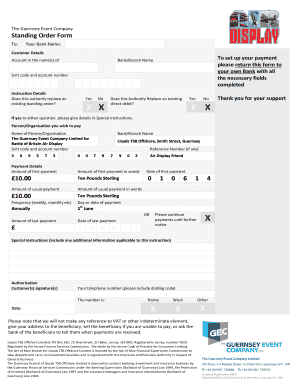

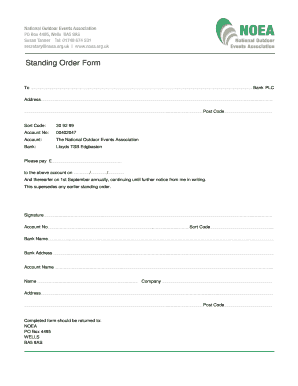

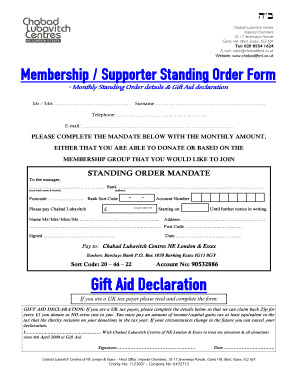

How do I create a standing order form?

The first step in setting up a standing order requires the payer to contact their bank to request it. With some banks and building societies, a standing order can be set up online or over the phone. With others, the payer needs to complete a standing order form on paper and give it to their bank.

What is a standing order document?

A standing order is a regular payment of the same amount that's paid on a specified date. It allows the bank to take money regularly from your account to pay another account. You can use a standing order for many payment types, including: Transferring money between your accounts.

How do I set up a standing order?

A standing order mandate is a form with your own and the payee's bank details, as well as the amount, date of payments and occurrence. Once you fill in the mandate, you can send it to your bank to set up the standing order on your behalf. You can visit your nearest branch to set up a standing order.

Can you set up a Direct Debit yourself?

A Direct Debit is an instruction from you to your bank that authorises a company to take an agreed amount of money from your account. You won't be able to create a new Direct Debit yourself. You'll need to contact the company you want to pay and they'll arrange for you to complete a Direct Debit instruction.