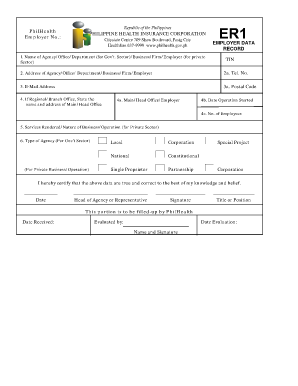

Employer Form - Page 2

What is Employer Form?

An Employer Form is a document that is used by employers to collect or update information about their employees. It typically includes details such as the employee's name, contact information, social security number, tax withholding information, and employment status. The Employer Form helps employers maintain accurate records and comply with various legal and regulatory requirements.

What are the types of Employer Form?

There are several types of Employer Forms that employers may use, depending on their specific needs and requirements. Some common types of Employer Forms include: 1. W-4 Form: This form is used to gather employee information for tax withholding purposes. 2. I-9 Form: This form is used to verify the employment eligibility of new hires. 3. W-2 Form: This form is used to report employee wages and taxes withheld to the Internal Revenue Service (IRS). 4. 1099 Form: This form is used to report income received by independent contractors or freelancers. These are just a few examples of the various types of Employer Forms that exist.

How to complete Employer Form

Completing an Employer Form can vary depending on the specific form and requirements. However, here are some general steps to help guide you through the process: 1. Ensure you have the necessary information: Gather all the relevant information needed to complete the Employer Form, such as your personal details, employment history, and tax information. 2. Read the instructions: Carefully read through the instructions provided with the Employer Form to understand what information is required and how to fill out the form correctly. 3. Provide accurate information: Fill out the Employer Form accurately and truthfully. Make sure to double-check the information before submitting. 4. Sign and date the form: If required, sign and date the Employer Form to confirm that the information provided is true and accurate. 5. Submit the form: Follow the instructions provided with the Employer Form to submit it to the appropriate recipient, such as your employer or the relevant government agency.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.