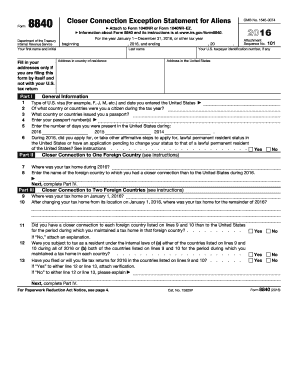

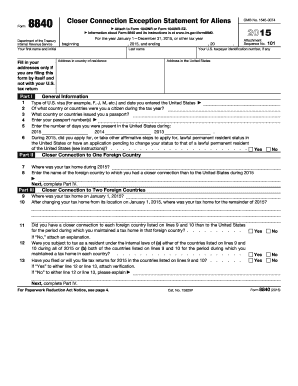

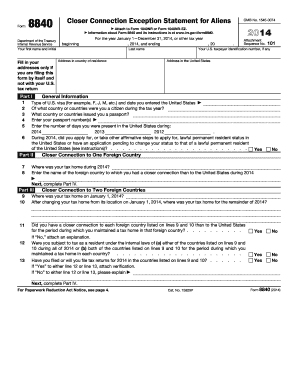

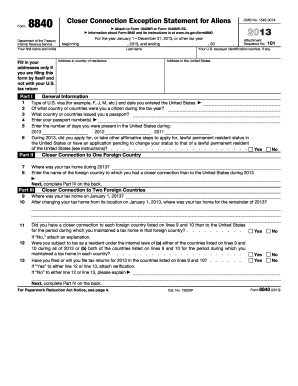

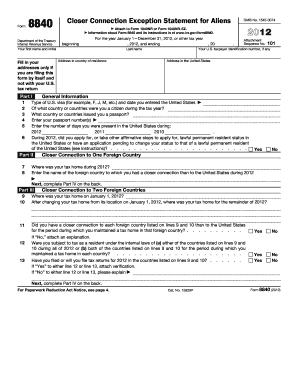

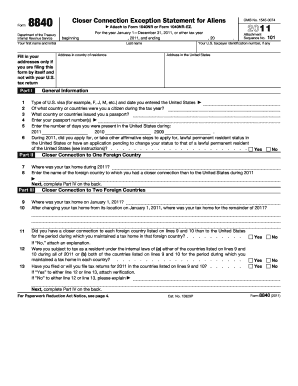

8840 Form

What is 8840 Form?

The 8840 Form, also known as the Closer Connection Exception Statement for Aliens, is a document required by the Internal Revenue Service (IRS). It is used by individuals who are non-residents for tax purposes and need to prove that they have a closer connection to a foreign country than to the United States.

What are the types of 8840 Form?

There is only one type of 8840 Form, which is the Closer Connection Exception Statement for Aliens form.

How to complete 8840 Form

Completing the 8840 Form is a straightforward process. Here is a step-by-step guide:

pdfFiller is a powerful online platform that enables users to create, edit, and share documents with ease. With unlimited fillable templates and robust editing tools, pdfFiller is the ultimate PDF editor for getting your documents done efficiently and professionally.