What is financial statement of a company?

A financial statement of a company is a formal record of the financial activities, performance, and position of the company. It provides valuable information about the company's revenues, expenses, assets, liabilities, and shareholders' equity. The financial statement helps stakeholders, such as investors, creditors, and analysts, to assess the financial health and performance of the company.

What are the types of financial statement of a company?

There are three main types of financial statements of a company:

Income Statement: This statement provides information about the company's revenues, expenses, and net income or loss for a specific period. It helps evaluate the profitability of the company.

Balance Sheet: This statement provides information about the company's assets, liabilities, and shareholders' equity at a specific point in time. It helps assess the company's financial position.

Cash Flow Statement: This statement provides information about the cash inflows and outflows of the company during a specific period. It helps analyze the company's cash management and liquidity.

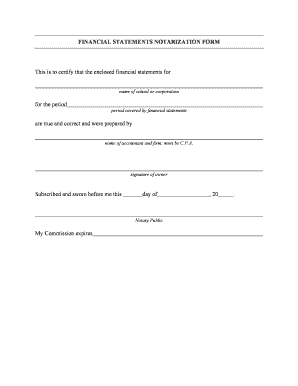

How to complete financial statement of a company

Completing the financial statement of a company requires careful consideration and accurate reporting. Here are the steps to complete a financial statement:

01

Gather all relevant financial information, such as accounting records, bank statements, and receipts.

02

Prepare the income statement by listing all revenues and deducting all expenses to calculate the net income or loss.

03

Prepare the balance sheet by listing all assets, liabilities, and shareholders' equity.

04

Prepare the cash flow statement by summarizing the cash inflows and outflows.

05

Review the financial statement for accuracy and ensure it adheres to accounting principles and standards.

06

Share the financial statement with relevant stakeholders, such as investors, creditors, and analysts.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.