Form 1065 Extension - Page 2

What is form 1065 extension?

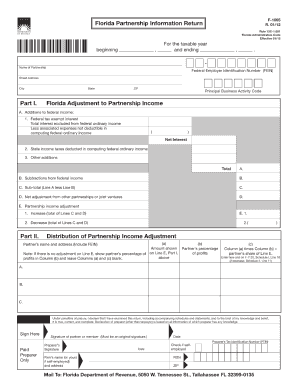

A form 1065 extension is a request to the Internal Revenue Service (IRS) for additional time to file a partnership tax return. It allows partnerships to extend their filing deadline beyond the original due date.

What are the types of form 1065 extension?

There are two types of form 1065 extensions:

Automatic extension:

Partnerships qualify for an automatic extension if they meet specific requirements and submit Form 7004 before the original due date.

Additional extension:

If partnerships need more time beyond the automatic extension period, they can request an additional extension by providing a reasonable explanation for the delay in filing.

How to complete form 1065 extension

Completing form 1065 extension is simple and straightforward. Here are the steps to follow:

01

Gather required information:

02

Collect all necessary details about the partnership, including the Employer Identification Number (EIN), name, address, and contact information.

03

Fill out Form 7004:

04

Enter the partnership's information accurately in the designated fields of Form Include the reason for the extension, if applying for an additional extension.

05

Review and submit:

06

Double-check all the information provided on the form to ensure accuracy. Then, submit the completed form to the IRS before the original due date.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

Can you extend a partnership return?

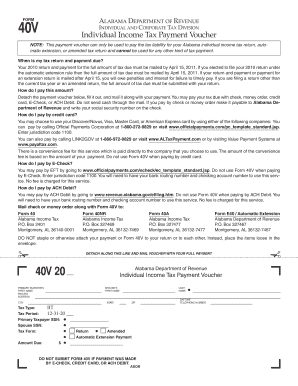

The due date for a calendar-year partnership's 2021 return is March 15, 2022. If you think you may need more time to prepare your return, you should file for an extension using Form 7004. The due date for your partnership return will be extended until September 15, 2021.

Can I file form 4868 electronically?

You can file Form 4868 electronically by accessing IRS e-file using your tax software or by using a tax professional who uses e-file. 3. You can file a paper Form 4868 and enclose payment of your estimate of tax due (optional). IRS e-file is the IRS's electronic filing program.

How do I electronically file 7004?

How to E-file IRS Form 7004 Online? Enter Business Details. Select Business entity & Form. Select the tax year. Enter tax payment details. Transmit your form to the IRS.

How do I extend my tax deadline 2022?

To request an extension to file your federal taxes after April 18, 2022, print and mail Form 4868, Application for Automatic Extension of Time To File U.S. Individual Income Tax Return. We can't process extension requests filed electronically after April 18, 2022. Find out where to mail your form.

Can I file form 7004 online?

Form 7004 can be e-filed through the Modernized e-File (MeF) platform. All the returns shown on Form 7004 are eligible for an automatic extension of time to file from the due date of the return.

What happens if you miss the tax deadline 2022?

After this time, you'll forfeit your tax refund. Your 2021 tax return was due on April 18, 2022, so you have three years from that date to request a refund. If you don't file your 2021 return by the April tax deadline in 2025, you'll lose your tax refund. The U.S. Treasury will own your money.