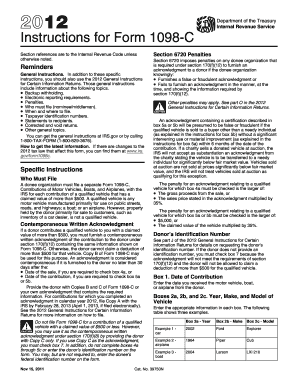

Form 1098-t Instructions - Page 2

What is form 1098-t instructions?

Form 1098-T instructions provide guidance on how to report educational expenses and scholarships on your tax return. It is a document provided by the IRS to help taxpayers accurately complete their taxes.

What are the types of form 1098-t instructions?

There are two types of form 1098-T instructions: the general instructions and the specific instructions for educational institutions. The general instructions provide an overview of the form and its requirements, while the specific instructions provide detailed guidance for educational institutions on how to complete the form accurately.

How to complete form 1098-t instructions

To complete form 1098-T instructions, follow these steps:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.