How To Write A Payment Contract

What is how to write a payment contract?

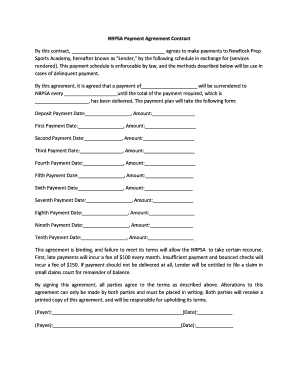

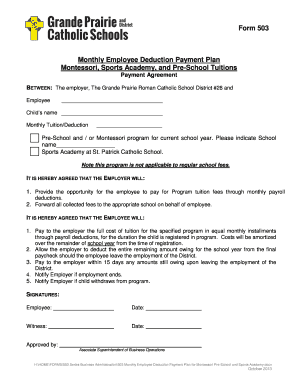

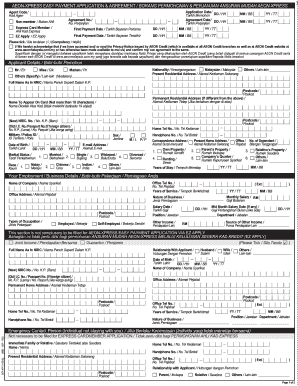

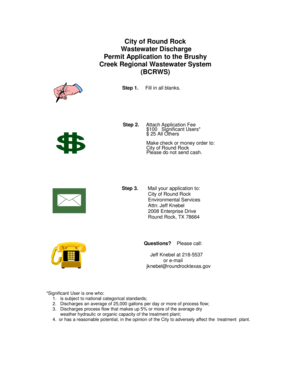

A payment contract is a legally binding agreement between two parties that outlines the terms and conditions of a payment arrangement. It is used to establish the agreed-upon payment terms, such as the amount of money to be paid, the due dates, and any penalties or interest for late payments.

What are the types of how to write a payment contract?

There are several types of payment contracts that can be written depending on the nature of the agreement. Here are some common types: 1. Installment Payment Contract: This type of contract allows for payment in regular installments over a specified period of time. 2. Lump Sum Payment Contract: This contract requires a one-time payment of the full amount owed. 3. Deferred Payment Contract: With this type of contract, the payment is postponed to a later date or spread out over a longer period of time.

How to complete how to write a payment contract

When completing a payment contract, follow these steps: 1. Include the names and contact details of both parties involved. 2. Clearly state the payment amount and the due dates for each payment. 3. Outline any penalties or interest for late payments. 4. Include any additional terms and conditions, such as the consequences for non-payment. 5. Both parties should review the contract carefully and make any necessary revisions before signing.

pdfFiller is a powerful online tool that empowers users to easily create, edit, and share payment contracts and other important documents. With unlimited fillable templates and robust editing tools, pdfFiller is the ultimate PDF editor that users need to efficiently manage their document requirements.