Payment Agreement Contract For Car

What is payment agreement contract for car?

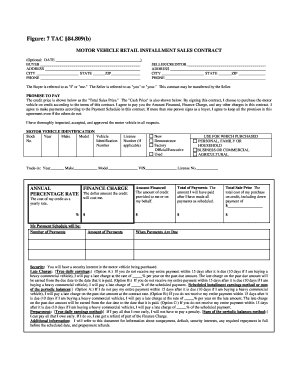

A payment agreement contract for a car is a legally binding document that outlines the terms and conditions of a car purchase. It specifies the agreed-upon price, payment schedule, and any other relevant details. This contract helps protect both the buyer and the seller by ensuring that both parties understand their obligations and rights throughout the transaction process.

What are the types of payment agreement contract for car?

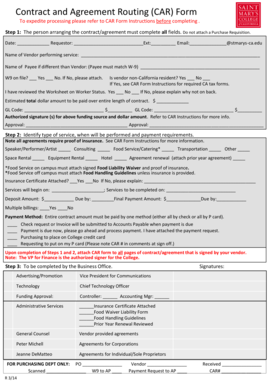

There are several types of payment agreement contracts for cars. Some common types include: - Installment Agreement: This contract allows the buyer to pay for the car in regular installments over a predetermined period. - Lease Agreement: This contract is for buyers who want to lease the car instead of purchasing it outright. It outlines the lease terms, including monthly payments and mileage restrictions. - Hire Purchase Agreement: This contract is similar to an installment agreement but typically allows the buyer to take possession of the car before completing the full payment. - Balloon Payment Agreement: In this type of contract, the buyer pays lower monthly installments but has a larger lump-sum payment due at the end of the agreement.

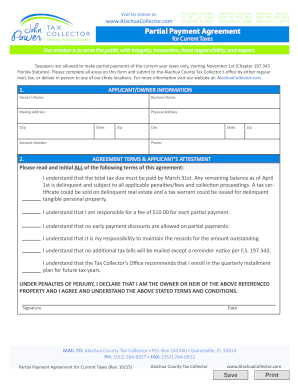

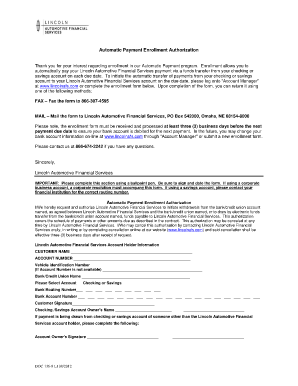

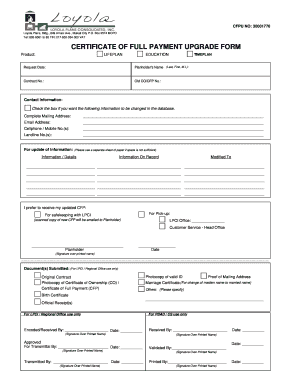

How to complete payment agreement contract for car

Completing a payment agreement contract for a car involves several steps: 1. Obtain the necessary documents: Gather all the necessary documentation, such as the car's title, registration, and VIN. 2. Determine the terms: Negotiate and agree upon the terms of the contract, including the purchase price, payment schedule, and any additional conditions. 3. Include detailed information: Clearly state the buyer's and seller's information, including their names, contact details, and addresses. 4. Specify the car details: Provide accurate details about the car, including its make, model, year, and any identifying features. 5. Outline payment terms: Clearly state the payment schedule, including the amount due, due dates, and any penalties for late payments. 6. Review and sign: Carefully review the entire contract, ensuring that all details are accurate and satisfactory. Then, sign the contract along with the seller.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.