Payment Agreement Letter

What is payment agreement letter?

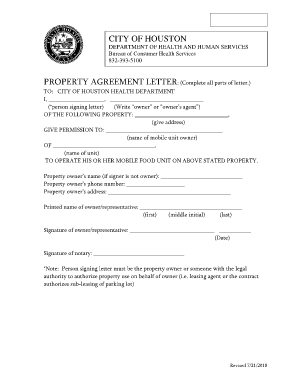

A payment agreement letter is a legal document that outlines the terms and conditions of a financial arrangement between two parties. It is used to formalize an agreement and provide a clear understanding of the payment schedule, interest rate (if applicable), and any applicable fees or penalties. This letter helps protect both parties involved and ensures that they are on the same page regarding the payment agreement.

What are the types of payment agreement letter?

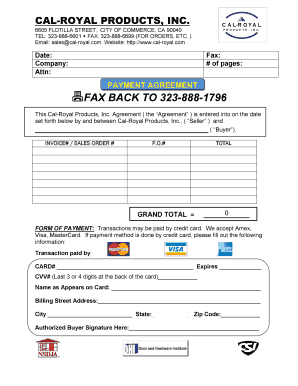

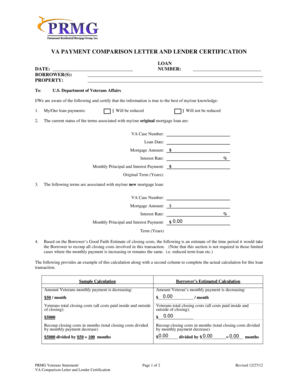

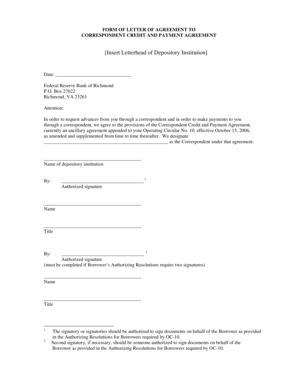

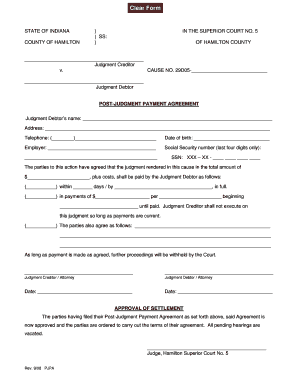

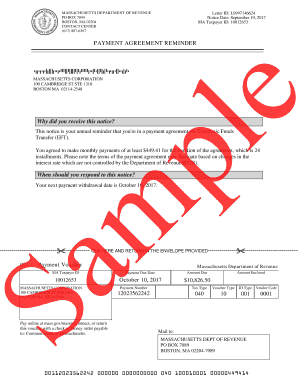

There are different types of payment agreement letters, depending on the purpose and nature of the financial arrangement. Some common types include: 1. Installment Payment Agreement Letter: This type of agreement outlines a series of equal payments that the debtor agrees to make over a set period of time. 2. Promissory Note: A promissory note is a written agreement in which one party promises to pay another party a specific amount of money by a certain date or on-demand. It serves as a legally binding document and can be used as evidence in case of disputes. 3. Loan Agreement Letter: This type of letter outlines the terms and conditions of a loan, including the principal amount, interest rate, repayment schedule, and any other terms agreed upon by the lender and borrower. 4. Settlement Agreement Letter: A settlement agreement letter is used when parties involved in a dispute reach a mutually agreed-upon resolution and decide to settle the matter outside of court. The letter outlines the agreed payment terms to fulfill the settlement.

How to complete payment agreement letter

Completing a payment agreement letter is a straightforward process. Here are the steps to follow: 1. Header: Start by including your contact information and the date at the top of the letter. 2. Recipient's Information: Include the recipient's contact information, including their name, title, company name (if applicable), and address. 3. Introduction: Begin the letter with a polite salutation and clearly state the purpose of the letter. 4. Terms and Conditions: Outline the payment terms and conditions, including the amount owed, payment schedule, interest rate (if applicable), and any other pertinent details. 5. Signature Block: Provide space for both parties to sign and date the agreement. 6. Proofread: Review the letter for any errors or ambiguity and ensure that both parties have a clear understanding of the agreement. Remember, it is always a good idea to seek legal advice or consult an attorney to ensure that the payment agreement letter is legally binding and complies with relevant laws and regulations.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.