What is retirement withdrawal strategies?

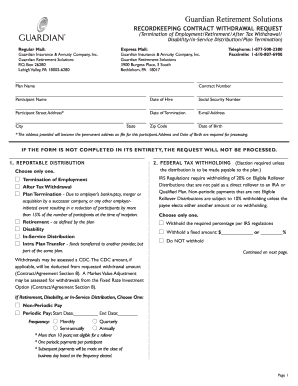

Retirement withdrawal strategies refer to the various approaches that individuals can use to withdraw funds from their retirement accounts during their retirement years. These strategies are important because they help individuals determine the most efficient and sustainable way to access their retirement savings while considering factors such as taxes, investment returns, and longevity.

What are the types of retirement withdrawal strategies?

There are several types of retirement withdrawal strategies that individuals can consider. These include:

Fixed Percentage Withdrawal: This strategy involves withdrawing a fixed percentage of your retirement savings each year. This provides a predictable income stream but does not adjust for market performance or inflation.

Systematic Withdrawal: With this strategy, individuals withdraw a fixed amount from their retirement savings at regular intervals, such as monthly or annually. The amount remains constant regardless of market conditions, which may impact the sustainability of the income stream.

Age-Based Withdrawal: This strategy involves withdrawing funds from retirement accounts based on specific age milestones, such as taking a certain percentage at age 65 and increasing the percentage at later ages. This approach considers life expectancy and adjusts the withdrawal rate accordingly.

How to complete retirement withdrawal strategies

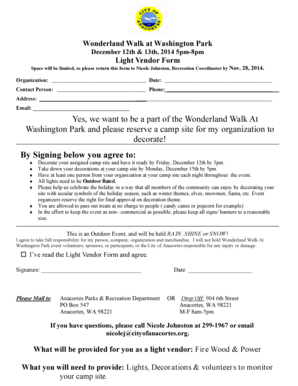

Completing retirement withdrawal strategies requires careful planning and consideration of various factors. Here are steps to help you complete your retirement withdrawal strategies:

01

Assess your retirement savings: Begin by evaluating your current retirement savings and any other sources of income you may have during retirement. This will help you determine how much you can afford to withdraw each year.

02

Estimate your expenses: Calculate your expected expenses during retirement, considering both essential and discretionary spending. This will give you an idea of the income you will need to sustain your desired lifestyle.

03

Consider your risk tolerance: Understand your risk tolerance and make informed decisions about how to allocate your investments. This will impact the withdrawal strategy you choose.

04

Seek professional guidance: Consult with a financial advisor or retirement planner who can provide personalized advice and guide you through the process of completing your retirement withdrawal strategies.

05

Monitor and adjust: Regularly review your retirement withdrawal strategies and make adjustments as needed. Market conditions, inflation, and changes in your personal circumstances may necessitate modifications to your strategy.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.