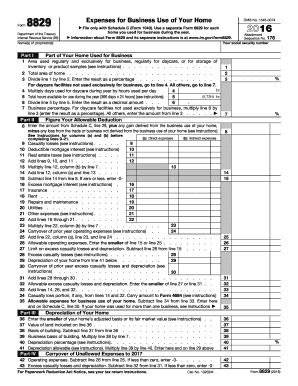

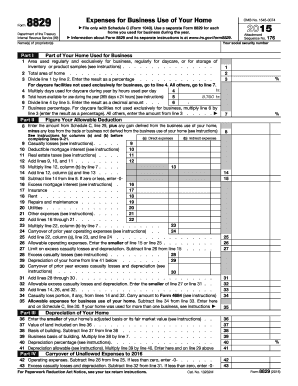

What is 8829 Form?

The 8829 Form is a document used by taxpayers who work from home and want to claim deductions for their home office expenses. It is specifically designed for individuals who are self-employed or work as a freelancer. By filling out this form correctly, individuals can deduct a portion of their home-related expenses from their income, potentially reducing their tax liability.

What are the types of 8829 Form?

There are two types of 8829 Forms: Form 8829 for regular home offices and Form 8829-S for home offices used for daycare services. The regular Form 8829 is used by individuals who work from home but do not provide daycare services, while Form 8829-S is for those who use their home office for daycare. It's important to determine which form is applicable to your situation before filling it out.

How to complete 8829 Form

Completing the 8829 Form may seem daunting at first, but with the right information and guidance, it can be a straightforward process. Here are the steps to complete the 8829 Form:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.