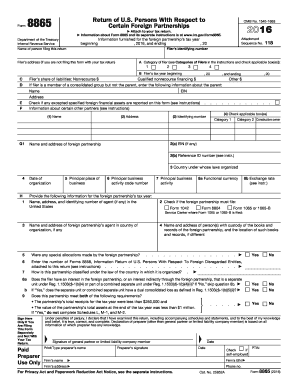

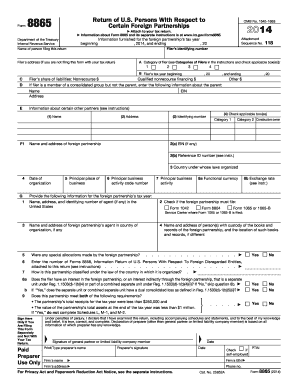

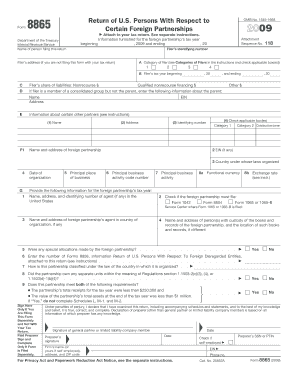

What is 8865 Form?

The 8865 Form, also known as the Foreign Partner's Information Statement of Section 6038 Partnership, is a crucial document used by taxpayers who have interests in foreign partnerships. It helps the Internal Revenue Service (IRS) gather information about these partnerships and monitor compliance with US tax laws. By filling out the 8865 Form accurately, taxpayers ensure that they meet their reporting obligations and avoid potential penalties or legal complications.

What are the types of 8865 Form?

There are several types of 8865 Form, each designed to address specific situations and partnerships. These include:

Form 8865 Schedule A - This form is used to report activities of foreign partnerships engaged in a U.S. trade or business.

Form 8865 Schedule G - Taxpayers use this form to provide information about control and certain transactions of controlled foreign partnerships.

Form 8865 Schedule H - This form is used to disclose information regarding income, deductions, and charitable contributions of certain foreign partnerships.

Form 8865 Schedule I - Taxpayers complete this form to report interests in foreign partnerships that have controlled foreign corporations as partners.

Form 8865 Schedule K - This form is used to report a partner's share of income, deductions, and credits from foreign partnerships.

Form 8865 Schedule L - Taxpayers use this form to report information about the balance sheet accounts of certain foreign partnerships.

How to complete 8865 Form

Completing the 8865 Form can seem daunting, but with the right guidance, it can be a straightforward process. Here are the steps to complete the 8865 Form:

01

Gather all necessary information about the foreign partnership, including its address, employer identification number (EIN), and financial details.

02

Identify the specific type of 8865 Form that applies to your situation. Refer to the list mentioned earlier to determine the correct form to use.

03

Follow the instructions provided with the chosen form. Pay close attention to each section and ensure accurate and precise reporting.

04

Provide all required information about the partnership's activities, financials, and any relevant transactions as requested in the form.

05

Double-check the completed form for any errors or omissions. It's crucial to review everything thoroughly to avoid potential issues later.

06

Submit the form to the IRS before the designated deadline. Consider using a reliable and secure online platform like pdfFiller to conveniently fill out, edit, and submit your 8865 Form.

07

Retain a copy of the filled-out form for your records. It's essential to keep a record of your submissions to demonstrate compliance, if necessary.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.