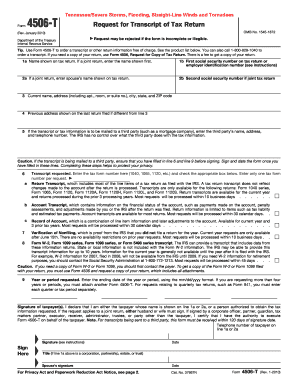

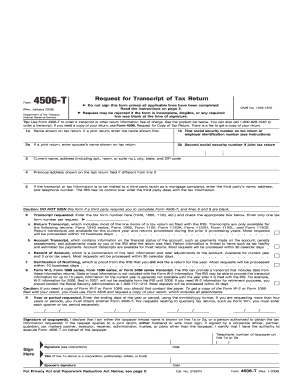

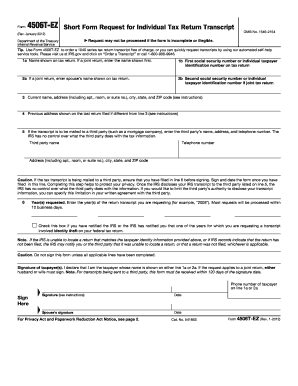

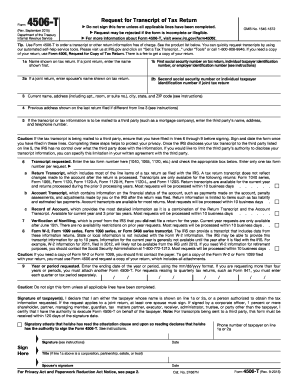

Irs Form 4506-t - Page 6

What is Irs Form 4506-t?

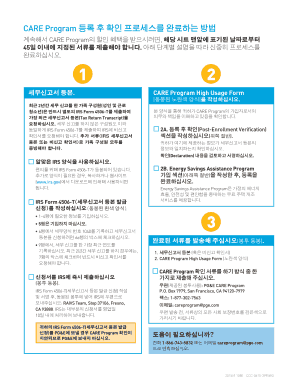

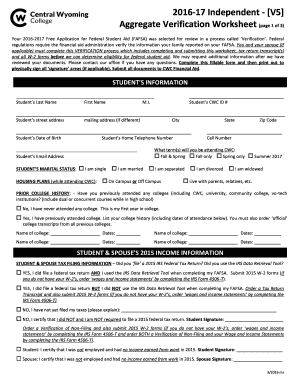

Irs Form 4506-t is a document used by taxpayers to request a transcript or copy of their tax return. This form is commonly used by individuals and businesses who need to provide proof of their income or tax filing history for various reasons. By filling out Form 4506-t, users can authorize the Internal Revenue Service (IRS) to release their tax information to a third party or themselves.

What are the types of Irs Form 4506-t?

There are different types of Irs Form 4506-t, designed to suit various needs. The most common types include:

How to complete Irs Form 4506-t

Completing Irs Form 4506-t is a straightforward process. Here are the steps to follow:

pdfFiller is a versatile online platform that empowers users to create, edit, and share documents online, including Irs Form 4506-t. With unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor you need to efficiently handle your document needs.