Loan Agreement Between Individuals

What is loan agreement between individuals?

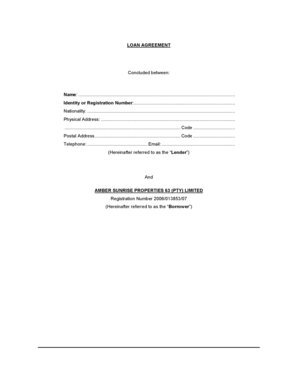

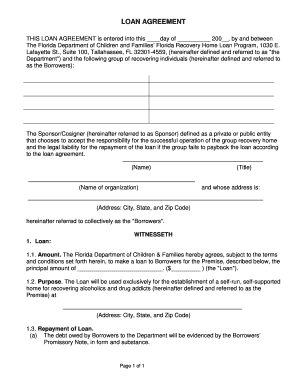

A loan agreement between individuals is a legally binding contract that outlines the terms and conditions of a loan made between two or more individuals. It specifies the loan amount, interest rate, repayment schedule, and any other relevant details. This agreement provides clarity and protects the rights and responsibilities of all parties involved.

What are the types of loan agreement between individuals?

There are different types of loan agreements between individuals, including: 1. Personal Loan Agreement: This type of agreement is used when one individual lends money to another individual for personal use, such as debt consolidation or home improvements. 2. Business Loan Agreement: This agreement is used for loans made between individuals for business purposes. It outlines the terms and conditions of the loan, repayment schedule, and any collateral involved. 3. Family Loan Agreement: In situations where a family member lends money to another family member, a family loan agreement is used. This agreement helps maintain transparency and avoid potential conflicts within the family.

How to complete loan agreement between individuals

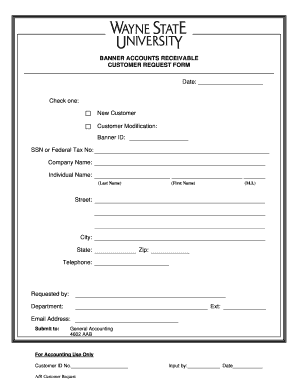

Completing a loan agreement between individuals can be done by following these steps: 1. Discuss and negotiate: The parties involved should communicate and agree upon the loan amount, interest rate, repayment terms, and any other relevant details. 2. Document the agreement: Use a template or create a written document that clearly outlines all the terms and conditions of the loan. 3. Include necessary clauses: Consider including clauses related to late payment charges, default consequences, and dispute resolution. 4. Review and sign: Each party should carefully review the agreement and sign it to demonstrate their acceptance and commitment. 5. Retain copies: It is essential for each party to keep a copy of the signed loan agreement for future reference or dispute resolution.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.